I called it correctly back in June: Conformity to federal tax reform produces a major boost in state revenue which the state’s leadership on both side of the aisle is strongly tempted to keep because the state remains strapped for cash.

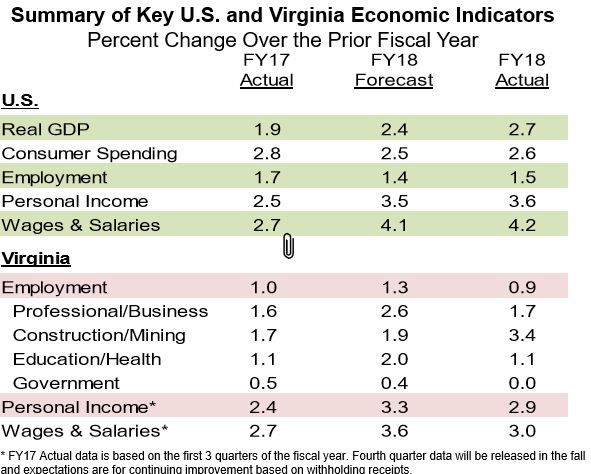

The signs of economic stress are all over Secretary of Finance Aubrey Layne’s August 17 presentation to the General Assembly’s money committees. At the end of perhaps the longest U.S. bull market in history, following a tax cut designed to stimulate growth and a major shift in regulatory climate, Virginia continues to under-perform the national economy. The employment growth figure of less than one percent stands out.

Yes, Virginia ended fiscal year 2018 on June 30 with $555 million more general fund revenue than projected in the budget – a 2.7 percent cushion. But Layne explained a large part of that came from $120 million in last-day deposits made earlier than normal because of the July 4 holiday timing. It also appears many taxpayers boosted their withholding because of uncertainty over whether or how Virginia would conform to federal tax reform.

The report shows Virginia missed its forecasts on corporate income, recordation, insurance premium and other smaller taxes tied to economic activity, and only exceeded the sales and use tax projection by one-tenth of one percent. Layne, always candid, mentioned the growing prevalence of sales and use tax exemptions as business incentives as one reason that revenue source can’t seem to grow.

The chart above shows the basic problem: Virginia missed its own forecasts on employment and wage growth, while at the same time the national forecasts – higher to begin with – were being beaten. The similar chart for the new fiscal year shows the same expected result – Virginia trailing the national averages into next year.

The overall general fund growth target for fiscal year 2019 is an anemic 1.4 percent. The first month of the new year, July, was down from last year.

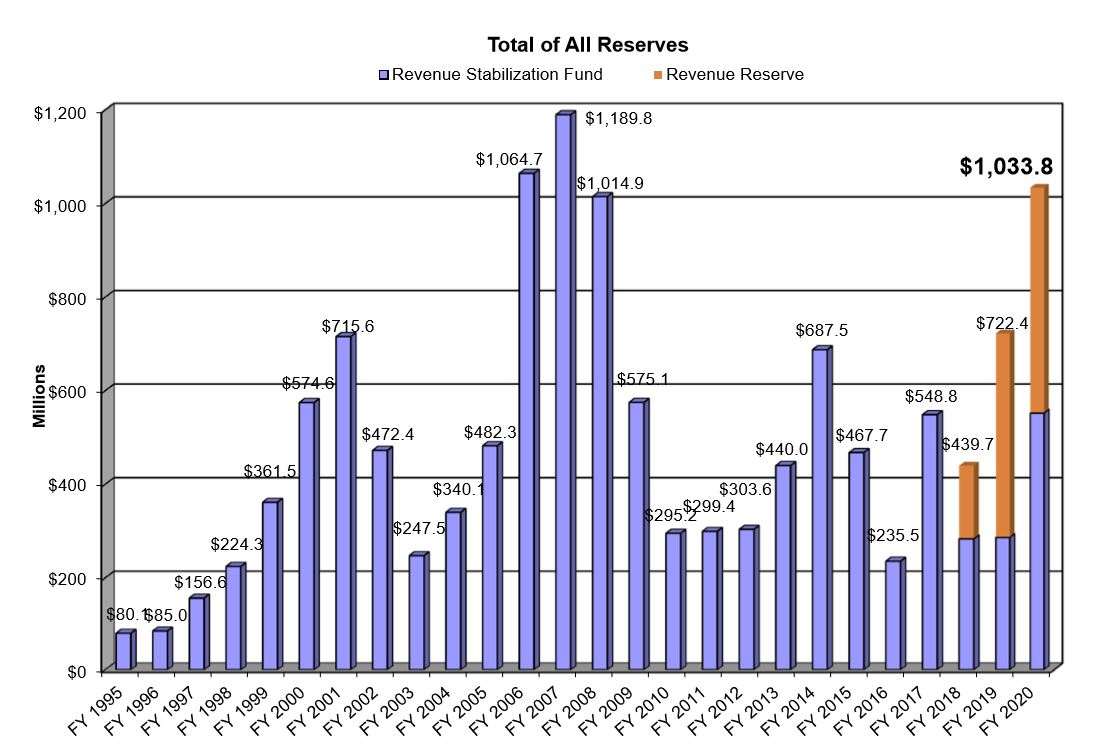

This continued weak economic performance explains why Virginia seems unable to refill its mandatory revenue stabilization fund, or rainy-day fund. There are no large surpluses to direct to that purpose, so only a trickle of money is flowing in. By law, Virginia also has dedicated portions of any surplus revenue to several other uses.

Virginia has avoided the wrath of the Wall Street rating firms over its small reserves by setting aside a second, non-mandatory revenue reserve with what would otherwise be operating cash. Only with the help of that will the reserves exceed $1 billion by 2020.

Much of this was overlooked because the discussion Friday promptly turned to tax policy and Governor Ralph Northam’s call for full conformity with the federal changes, projected to increase state tax revenues by $3.6 billion over five years. But the link between the two issues is strong.

At the end of his presentation Layne went through several risks facing the state, and these did not include the giant risk of an economic downturn or stock market crash (which came up in response to a question from Del. Scott Garrett, R-Lynchburg).

Virginia has apparently made some major economic development promises, a package of incentives large enough to lead Layne’s list of revenue risks should the deal be sealed and announced Is it Amazon? He was careful not to mention names, but such an open discussion was unprecedented. It must be a huge incentive promise.

Next he mentioned VRS, which of course needs to continue strong investment performance to meet future obligations but may come asking the General Assembly for increased employer contributions. He went on to talk about federal risks, expensive technology costs facing the state, and capital needs. Then he pointed to transportation funding, which remains flat despite the 2013 transportation tax package because gasoline prices remain low and more vehicles are moving away from that fuel. Only Hampton Roads and Northern Virginia, with their added regional taxes and greater acceptance of tolls, are seeing major construction activity, he said.

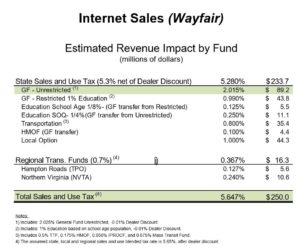

The U.S. Supreme Court’s recent decision in the Wayfair case opens the door for Virginia to demand that out-of-state sellers collect sales tax from Virginia buyers and remit that to Richmond. The estimate Friday was that might produce $250 million a year for Virginia, but that is shared several ways and only $89 million of it would be available to the general fund for appropriation. Layne reminded those talking of directing this revenue to school construction that much of it already goes to education.

Perhaps it will happen naturally, perhaps it is already happening, but somehow Virginia needs to see some real five plus percent year-over-year growth – one more reason to take a long, hard look at the state tax code to see what if any provisions might be impeding that and what changes might kick start things.

Leave a Reply

You must be logged in to post a comment.