Yes, education was a big deal but how about inflation’s impact on fixed income retirees?

by Chris Saxman

Results of a newly released study by TargetSmart, “a Democratic political data and data services firm,” suggest that we should rethink the conventional wisdom and push back on the social media/cable news narratives about the 2021 election.

NOW before everyone hits the reply button that because this is a Democratic firm and they are just trying to improperly turn the 2021 narrative to benefit Democrats in the upcoming midterms — just stop.

The news here is WORSE for Democrats for the midterms, but kudos to TargetSmart for following the data. As the old saying goes — in order to solve a problem, you first have to admit you have a problem.

Today’s Richmond Times Dispatch ran a Bloomberg editorial which provides context: “Piecemeal reform won’t solve U.S. retirement crisis.”

Yet many Americans face the prospect of great financial strain and even poverty in old age, because they lack the resources to support themselves after they stop working.

A retirement crisis. The largest voting generation in history has to deal with almost double-digit inflation in lower turnout midterms. #WreckingBall

Social Security is the Third Rail of American politics for a reason.

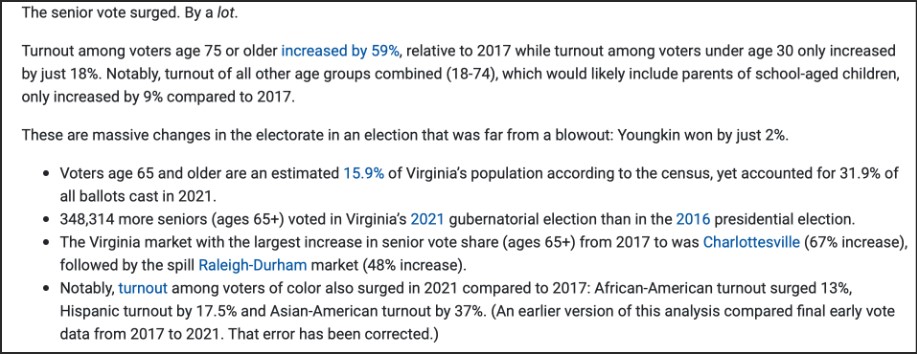

Here we go with the TargetSmart article link: “The authors of the study and article call it “the Silver Surge.” New Data Showing ‘Silver Surge’ of Senior Voters Raises Questions About Conventional Wisdom Facts from the article linked above:”>Did Education Sway the VA Election? Maybe, but Probably Not.”

The reality is much more complex. As is often the case, conventional wisdom is too often formed before all the facts are available.

The authors of the study and article call it “the Silver Surge.”

New Data Showing ‘Silver Surge’ of Senior Voters Raises Questions About Conventional Wisdom

Facts from the article linked above:

Massive changes to say the least. 350k MORE seniors voted in the 2021 gubernatorial cycle than the 2016 presidential cycle.

Glenn Youngkin’s data and political operation were top-notch targeting voters from the very recent presidential cycle to turnout, but they had to have reasons to show up. Sure, education was obviously in the mix; but was the Silver Surge the reported Critical Race Theory-based Parent Surge that was all over the cable news excuse makers? Probably not.

A far more plausible explanation is the that the rising cost of living (inflation) was bumping up against fixed income realities.

Remember that Youngkin ran ads on the grocery tax cut long before Terry McAuliffe handed his Republican opponent a piñata bat the NOVA Chamber Debate.

“Glenn, would you be a dear and hit me with this while I double/triple/ quadruple/quintuple down on telling parents they don’t matter in the education of their children?”

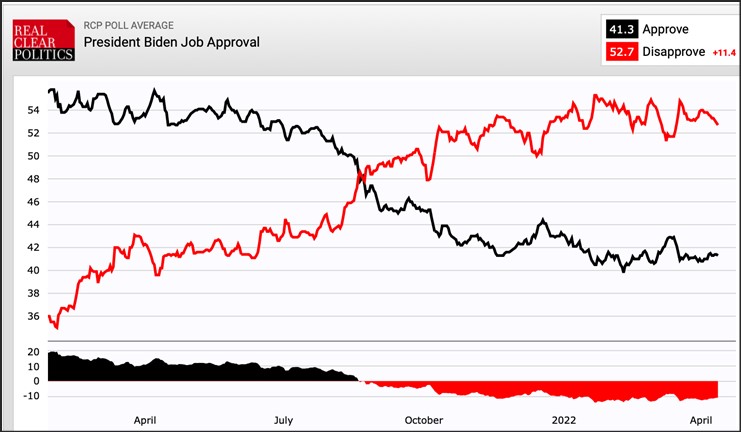

Look at these charts and note WHEN the uptick in negative economic sentiment/inflation/Joe Biden disapproval starts:

(Note – long before the NOVA debate.)

Inflation starts moving over a year ago in Q1 2021:

Biden’s approval numbers lag inflation but it caught up and accelerated with the botched Afghanistan withdrawal.

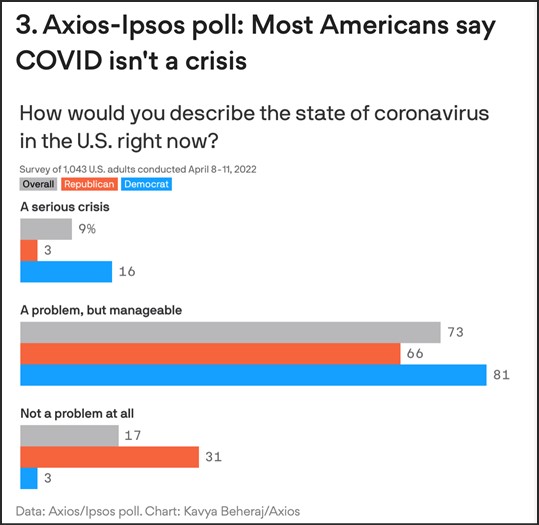

COVID?

Might be time for some new messaging there.

(Side question – does everything have to be called a crisis to get our attention? #Yes)

Start with removing masks on airplanes maybe? Airline prices jumped 10% last month. Busy summer travel (hot crowded airports and planes) and mask mandates are going to create very cranky passengers/customers/voters.

Even the shock of the Russian invasion of Ukraine is tapering.

Going to the grocery store and gas station are pretty much mandatory and those final tabs are really causing problems for people.

In 2021, education helped Virginia Republicans with a final push at the end, but the data suggest inflation was fueling a surge of seniors throughout the cycle.

The 2022 midterms will be settled in 209 days and that’s plenty of time for both parties to focus on solutions to both education and inflation. After all, come the fall voters will be talking about education – again.

For now – it’s inflation.

P.S. Education is #18 according to the recent Harvard/Harris poll.

Chris Saxman is executive director of Virginia FREE. This column is republished with permission from The Intersection.

Leave a Reply

You must be logged in to post a comment.