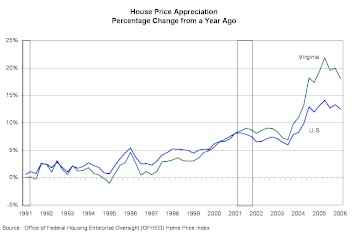

I’ve long maintained that real estate prices in Virginia are out of control and headed for a bust. Nothing makes my point clearer than this chart, created by Chmura Economics & Analytics and scheduled for publication tomorrow in VA Newswire.

The image is fuzzy because I had to shrink it to fit this blog format, but the divergence since 2001 between the green line (change in Virginia housing prices) and the blue line (change in U.S. housing prices) comes through clearly. The increase in Virginia housing prices has outpaced the increase for the U.S. by a wide and growing margin. The strongest price increases, according to Chmura, have been concentrated in Winchester, Northern Virginia and Hampton Roads.

What goes up must come down. When mortgage rates are rising and income is increasing at only five percent per year, it is impossible to sustain price increases of 20 percent or more per year, no matter how severe the local housing shortage. Inevitably, as speculative excess is wrung from the market, price increases will cool. The first big question is whether there is sufficient froth in the market to lead to an outright retreat in prices. The second big question is what will happen to local tax revenues and tax rates when property values fall and reassessments roll around. It won’t be pretty.

Leave a Reply

You must be logged in to post a comment.