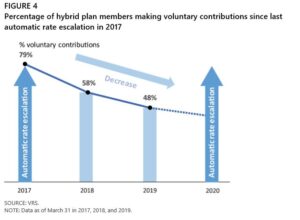

The percentage of state employees making voluntary contributions to their own retirement pot, contributions which are matched with free money, has continued its rapid decline over the past year. As of March 2019, fewer than half of state employees who should be investing in their own retirement are doing so, according to a Virginia Retirement System update Monday.

A year earlier, according to the comparable report given the Joint Legislative Audit and Review Commission and reported on Bacon’s Rebellion, 58 percent were contributing something and drawing in matching funds. A year before that it was 79 percent. Just how much money the 52 percent adding nothing this past year failed to invest, and how many matching dollars were therefore not captured, is not in the report.

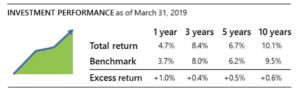

The full VRS presentation to JLARC is here and here is the JLARC staff’s own summary, both of them presented to the legislators Monday. In general, the pension system is reporting another good year, with a total return on all investments of 4.7 percent against its industry benchmarks of 3.7 percent. VRS underperformed benchmarks on its stock investments, however, both for the past year and the past three years. It uses March 31 as the end of its reporting periods.

The actuarial measure comparing its assets to the expected future demand for benefits continues to slightly improve, with the local retiree plan a hair under 90 percent “funded,” the state employee plan at 77 percent and the teacher plan at 75 percent. As reported in Tuesday’s Richmond Times-Dispatch, VRS may lower its assumed future returns from 7 to 6.5 percent, which would increase the state’s required employer contribution an additional $442 million, with additional funds demanded from localities.

It is those daunting future costs that caused the state to join the general stampede away from defined benefits and to defined contributions. The hybrid retirement plan depends on voluntary contributions and matching funds to achieve full benefits and is standard for VRS-covered employees hired since 2014. About 103,000 active employees participate. That is up from 85,000 a year ago. The total VRS customer base of active employees, retirees and beneficiaries is now 722,000.

The JLARC summary reports: “Employee turnover has contributed to the decline in the proportion of members making voluntary contributions. Over 59,000 new hybrid plan members have been added to the plan since the automatic escalation in 2017, and new employees tend not to initiate a voluntary contribution when they start employment.” Automatic escalation refers to an increase in the non-voluntary contribution part of the deal, which happens again in January with an increase to 4.0 percent.

Of those 48 percent who do add voluntary contributions, almost half do the minimum, one-half of one percent of their compensation. A very small group among the total 103,000 are making the maximum 4 percent voluntary contribution to draw the maximum state match.

Since March 31, all the major stock indexes have recently reached new all-time highs, of course. Investors sitting on the sidelines since 2016 have missed something. Yet an amazing number of people simply do not believe claims like the following, which is found in a footnote in the JLARC staff notes: “Hybrid plan members who make the maximum 4 percent in voluntary contributions would potentially receive retirement benefits greater than (defined benefit) Plan 1 or Plan 2 members.”

They never view the matching money as a tax-deferred raise, which it is, but a raise they cannot collect immediately. That is their loss and the Virginia taxpayers’ short-term gain. With years of educational efforts tried and ignored, JLARC indicates the only way to improve the situation is to make higher contributions mandatory. Switching back to a full defined benefit plan is not listed among the options.

The hybrid plan is only one of the four defined contribution plans managed by VRS on behalf of current or future retirees. Participants in the older defined benefit plans are allowed to supplement those with voluntary investments, sometimes drawing small state or local matching funds. That fund contains $3.2 billion. A similar defined contribution fund for university employees exceeds $1 billion. The fourth such plan, limited mainly to political appointees who might not last the five years until vesting, is tiny.

For those state university employees making defined contributions within VRS (several of the schools run their own plans), the agency has aggressively weeded out funds it considered poor performers or weakened by excessive fees. The Fidelity funds which were available have been entirely “deselected” (a nice word for dumped) as of the end of this year and the fund choices available through TIAA have been changed.

In contrast, VRS claims the investment choices it offers almost always meet or exceed their industry benchmarks.

Leave a Reply

You must be logged in to post a comment.