Despite the slowing market frenzy, home prices continue rising across all price points

Despite the slowing market frenzy, home prices continue rising across all price points

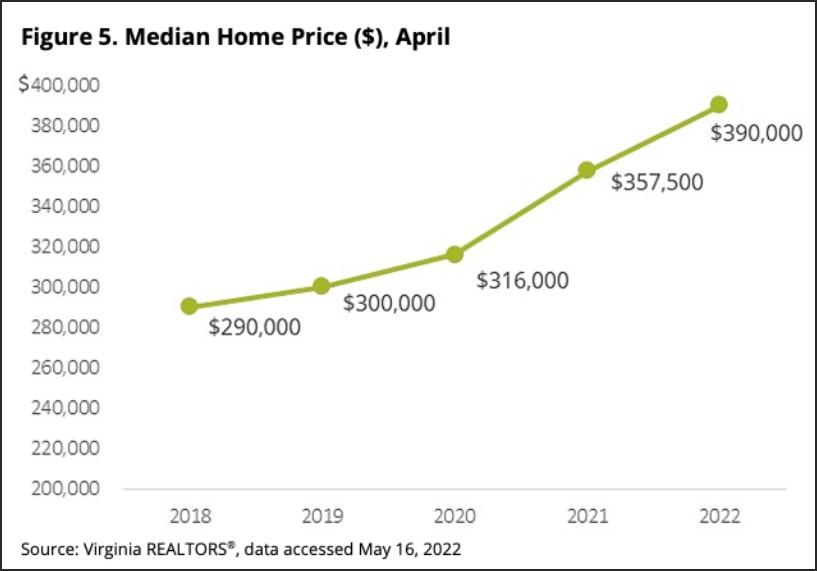

According to the April 2022 Virginia Home Sales Report released by Virginia REALTORS®, the statewide median home sales price was $390,000 in April. This is $100,000 higher than April of 2018, just four years ago. Compared to last year at this time, Virginia’s median sales price is up just over 9%, a gain of $32,500.

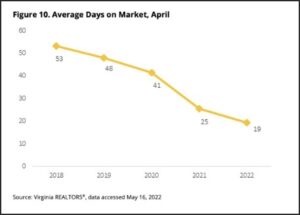

In Virginia, the steady upward trajectory of home prices has not been hindered by the slowdown in sales activity or the recent spike in mortgage rates. In April, homes sold for 3.4% higher than list price, on average. In all price segments, the average sold-to-list price ratio was at least 100%.

In Virginia, the steady upward trajectory of home prices has not been hindered by the slowdown in sales activity or the recent spike in mortgage rates. In April, homes sold for 3.4% higher than list price, on average. In all price segments, the average sold-to-list price ratio was at least 100%.

In total, there were 11,991 home sales in Virginia in April 2022, down 11.6% from a year ago. Sales have been down year-over-year for five consecutive months. This slowdown reflects the very busy 2021 market but is also indicative of buyers pulling back due to high home prices, elevated inflation, and rising mortgage rates.

In the coming months, Virginia could see a change in the speed of price growth. “As the Federal Reserve continues targeting inflation by raising rates, it is likely that mortgage rates will keep increasing over the coming months,” says Virginia REALTORS® 2022 President Denise Ramey. “In turn, housing demand will cool in the year ahead, slowing down price growth. However, higher mortgage rates and home prices will continue posing a challenge to buyers.”

In the coming months, Virginia could see a change in the speed of price growth. “As the Federal Reserve continues targeting inflation by raising rates, it is likely that mortgage rates will keep increasing over the coming months,” says Virginia REALTORS® 2022 President Denise Ramey. “In turn, housing demand will cool in the year ahead, slowing down price growth. However, higher mortgage rates and home prices will continue posing a challenge to buyers.”

Regarding the stability of Virginia’s housing market, Virginia REALTORS® Chief Economist Ryan Price says, “While higher mortgage rates and prices will have a dampening effect on housing demand in the months to come, underlying economic and demographic fundamentals—such as strong job growth and low unemployment rates—will support a stable housing market here in the commonwealth.”

The Virginia Home Sales Report is published by Virginia REALTORS®. Click here to view the full April 2022 Virginia Home Sales Report. This article has been republished with permission from The Roanoke Star.

Leave a Reply

You must be logged in to post a comment.