by James C. Sherlock

In general, I do not write enough about Virginia small businesses.

Small business is both the heart and soul of the Virginia economy.

I have no personal financial interest in Virginia’s community banks, but all of us need them to be healthy.

Because community banks disproportionately fund small business.

The Federal Reserve reported in its 2023 Report on Employer Firms: Findings from the 2022 Small Business Credit Survey

As pandemic-related funding programs ended, the data show an accompanying rise in the share of firms that sought traditional financing in the form of loans, lines of credit, or merchant cash advances. The share of these applicants that were fully approved rose year-over-year but lags prepandemic levels.

But the banking industry, trying to reestablish itself as the economy’s primary funding agent after the COVID federal money tsunami receded, is under stress not seen in 2022.

The Fed’s rapid rise in interest rates to combat inflation, driven by federal spending, has lowered the value of banks’ fixed rate collateral.

Community banks, not the source of the problem, are bearing the brunt of the reaction.

Depositors need to understand how important Virginia’s 42 community banks are to Virginia’s economy — and many of their own jobs.

Depositors, chasing safety, have been moving money into the money center banks — a half a trillion dollars alone since the collapse of Silicon Valley Bank. (J.P. Morgan analysis).

On March 12, in an attempt to slow those transfers, the Federal Reserve Board announced it would make available additional funding to banks, savings associations, credit unions, and other eligible depository institutions through creation of a new Bank Term Funding Program (BTFP).

This program offers loans of up to one year in length by valuing at par U.S. Treasuries, agency debt, mortgage-backed securities, and other qualifying assets used as collateral.

The Fed was seeking to stop a run on deposits in small and mid-sized banks by bolstering their capacity to safeguard deposits and ensure they could continue to provide money and credit to their customers.

It is too early to see if that works to calm depositor fears.

I offer some additional considerations to depositors in Virginia’s community banks.

- If your bank is FDIC-insured, your deposits are insured up to $250,000;

- The Federal Reserve, as noted earlier, is using its Exchange Stabilization Fund to provide backstop for the Bank Term Funding Program and thus community banks are beneficiaries, stabilizing asset values until the storm passes. The program will be extended if the storm does not pass in a year;

- Certificate of Deposit rates are typically far higher in community banks than those at money center banks;

- Money center bank deposits historically are far less likely to be lent to Virginia small businesses;

- Nearly half – about 1.5 million — of Virginia employees in the private workforce work for small businesses;

- Small businesses in the professional, scientific, and technical services sectors in 2022 had a total of 233,757 employees;

- Virginia has 6,143 small enterprises which are exporters. They account for 29% of the state’s $17.3 billion of revenue from total exports;

- There are only 299 small businesses operating in the utilities sector. Of these, 24 are businesses with fewer than 20 employees;

- Virginia’s community banks are local businesses run by local businesspeople and are in position to evaluate small business credit quality;

- That is why community banks make 60% of the small business loans and more than 80% of agricultural loans nationally;

- Most businesses with lower credit quality turn to online lenders and nonbank finance companies, not banks;

- Virginia’s 567,830 small businesses, of which 169,053 have employees, are in real trouble if community banks can’t lend; therefore, so are their employees. Other estimates of small business impact have higher figures;

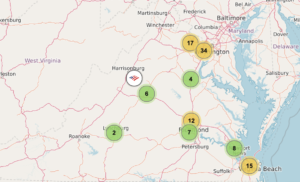

- Bank of America (see map above) is very unlikely to serve small communities. Citibank has six branches in Virginia — all in Northern Virginia.

Food for thought.

Community banks matter existentially to Virginia small businesses and small communities. They need to be supported.

That is the message.

Leave a Reply

You must be logged in to post a comment.