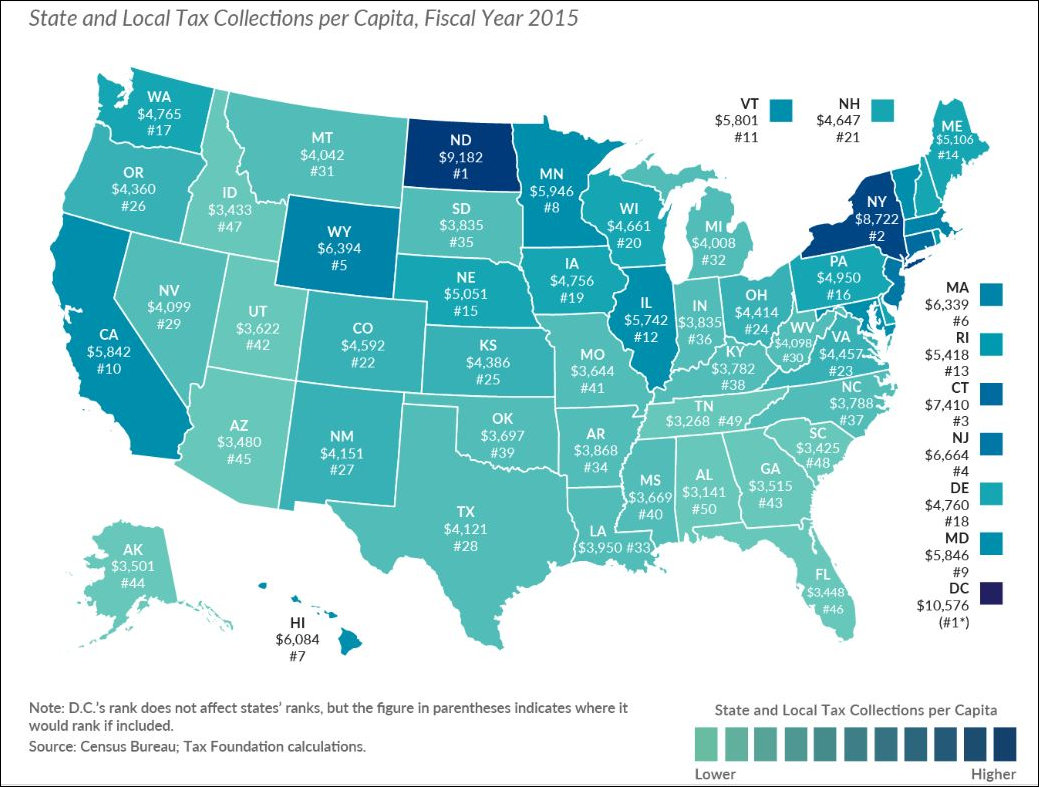

State and local tax collections per capita in Virginia amounted to $4,457 in fiscal 2015, ranking the Old Dominion as the 23rd highest taxed state in the country, according to the Tax Foundation. We are the most heavily taxed state in the Southeast.

If you believe state/local government should spend and tax more, this data gives you ammo. We have plenty of room to raise taxes. If you think state/local government spends and taxes too much… this data gives you ammo. We have plenty of room to cut taxes.

Leave a Reply

You must be logged in to post a comment.