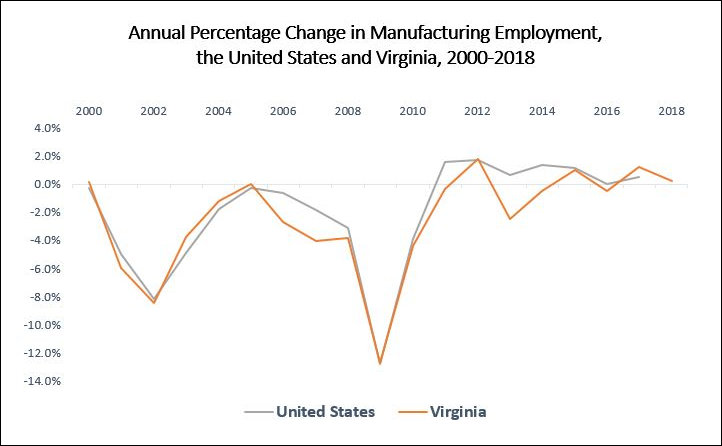

Virginia has lost nearly 136,000 manufacturing jobs since 2000, a 36% decrease, according to Kyaw Khine writing in the StatChat blog. The losses occurred mostly in the latter phases of the 2000 and 2007 recessions, but, far from making up the losses during the last eight years of economic expansion, manufacturing jobs have been treading water.

Further, Khine cites long-term industry projections by the Virginia Employment Commission that employment in Virginia’s manufacturing sector will decrease by another 5.7% between 2016 and 2026.

Khine’s numbers call into question the economic-development priorities of Virginia’s non-metropolitan areas which continue to invest resources in building a manufacturing base as well as the Northam administration’s well-intentioned goal of ensuring that no region gets left behind economically.

The phenomenon of “re-shoring” manufacturing capacity that had previously been outsourced to China and other countries may bring some manufacturing investment back into the United States, the availability of large supplies of inexpensive natural gas will spur investment in energy-intensive industries. But those two favorable trends likely will be swamped by the mega-trend to robotics, artificial intelligence and factory automation, which employ smaller numbers of highly trained work-technicians. Also, while it’s not politic to discuss such things, there may be issues with rural workforce quality — not just low education levels but a high incidence of substance abuse and other health issues. (To be clear, Khine does not draw these conclusions. I do.)

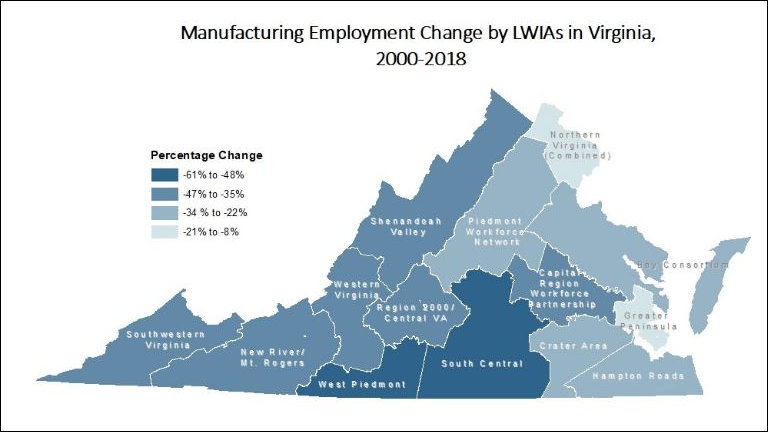

Textiles and apparels, once a dominant industry in Virginia, continued their precipitous fall — 83% for textile mills and 87% for apparel. This sector now totals for only 4,500 employment. Furniture employment was down 55%, metals down 57%, printing down 47%, petroleum and coal products down 46%. The losses have been most dramatic in the Martinsville-Danville (West Piedmont) workforce investment area and the South Central region.

Looking ahead, the VEC projects the greatest manufacturing losses in the New River, Lynchburg, South Central and Northern Virginia regions. The losses in Northern Virginia are no surprise, and not a thing to be particularly concerned about. High-wage high-tech and corporate HQ activities have push the cost of business and cost of living so high that lower value-added activities like light manufacturing have been displaced. But losses in local manufacturing jobs can be made up through an increase in retail- and service-sector jobs. The job losses downstate are more problematic. There is no obvious alternative source of jobs for small mill towns.

Bacon’s bottom line: The decline in factory jobs has been abundantly evident for the past couple of decades but leaders of rural communities double down on their commitment to recruit manufacturing along with the odd call center or back-office operation. Companies are still investing in rural Virginia, but the announcements are fewer and the job counts are smaller. Some recent examples from the Virginia Economic Development Partnership website:

- Smyth County: Scholle IPN Packaging, Inc. to create 42 new jobs.

- Caroline County: M.C. Dean, Inc. to create 100 new jobs.

- Rockbridge County: Dynovis, Inc. to create 44 new jobs.

- Frederick County: The Clorox Company to create 100 new jobs.

- Botetourt County: Pratt Industries, Inc. to create 50 new jobs.

That’s not bad for one month. Those announcement, creating a total 336 new jobs, beat a poke in the eye with a sharp stick. But, annualized, the deals account for just over 4,000 new jobs for all of non-metropolitan Virginia.

Virginia’s small communities have limited resources to waste, but they’re betting on a manufacturing renaissance that likely will never occur. With a few few exceptions such as Southwest Virginia’s cultural heritage trails, they have given precious little thought to any alternative model of development. Nor have they given much thought about how to shrink gracefully — maintaining the quality of government services for a smaller population and with fewer resources.

Virginia is a diverse state, and some parts of the Old Dominion have greater potential than others. The Northern Piedmont region, led by the Piedmont Environmental Council and the Journey Through Hallowed Ground, have several important advantages: proximity to the Washington metropolitan area, a rich historical heritage, and beautiful vistas. The region has attracted large numbers of wealth people who are willing to invest there. No other Virginia region can replicate the Northern Piedmont’s unique mix of resources.

But the Shenandoah Valley has farms, mountains, vistas, and history. The Tidewater counties along the Chesapeake Bay have access to river fronts and the Bay. Southwest Virginia has mountains, hiking, kayaking, and rock climbing, along with a unique cultural heritage. These assets can support retirement communities and a modest amount of tourism — admittedly, a pale substitute for tens of thousands of factory jobs, but industries that can provide some jobs and a more enduring economic base than a light manufacturing facility that may be gone in 10 years.

Rural America is hurting. But it’s not hurting everywhere. There are pockets of prosperity. What are other places doing that Virginians are not? What economic drivers might exist beyond manufacturing, call centers, small-scale tourism, and retirement communities? What other strategies might Virginians pursue? We don’t know because we haven’t bothered to look. But time is running out. If the VEC is right, the manufacturing jobs are not coming back.

Leave a Reply

You must be logged in to post a comment.