Following up on Steve Haner’s discussion of Virginia’s handling of the new federal tax laws, I decided to do a “hypothetical” sample calculation. “Hypothetical” is in quotes, because this example is somewhat similar to my own household, where we are grandparents in retirement.

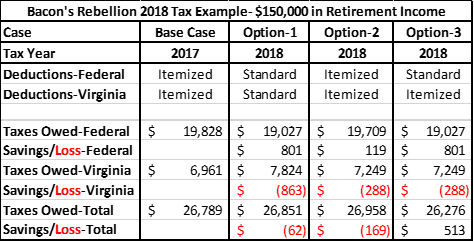

In this simplified example, the annual income is assumed to be $150,000 withdrawn from retirement savings. Itemized deductions total $28,500 including $7500 state income tax, $7500 property tax, and $13,500 mortgage interest and charitable donations. Thus the SALT (state and local taxes) exceed the new $10,000 federal limit.

Our hypothetical taxpayers are filing a Married-Joint tax return, and they are Age 65 or older. Due to being over Age 65, this couple benefits from a larger 2018 Federal Standard Deduction of $26,600 vs. the normal deduction of $24,000 for younger couples. In our example, the couple’s itemized deductions total $28,500 in 2017, but which is reduced to $23,500 in 2018 with the new SALT deduction limits. Thus the $26,600 Standard Deduction looks better, but only on the surface. As you will see below, the plot thickens in 2018 for many Virginians.

Using 2017 as a Base Case, let’s look at the tax payment options available to the couple in 2018:

Option-1 above is currently the best for our couple in 2018, but they are not very happy. Upon completion of their Federal FORM 1040 they are temporarily pleased see $801 tax savings, courtesy President Trump. However, upon filing their Virginia FORM 760, the couple owes Virginia an extra $863, courtesy whomever wants to take the credit for that. So the overall loss is $62 versus the 2017 Base Case.

Option-2 uses itemized deductions, and presents our retired couple with an interesting and rebellious alternative. If they are mad at Virginia, they could elect to itemize deductions, and pay more tax to the Feds, and less to the state. In my actual personal tax projection, right now I think Option-2 probably saves me a few bucks.

Option-3 is the most preferable option for our retired couple, but it requires the General Assembly to change the Virginia tax laws. Virginia tax law currently stipulates that a taxpayer who takes the Federal Standard deduction, cannot itemize taxes for Virginia purposes. It is this Virginia law that prevents our retired couple from taking the modest tax reduction that the new Federal tax law tries to achieve.

(Calculations based on a shareware 2018 Federal Tax estimator, and using 2017 Virginia tax calculator with adjustments for itemized/standard deductions.)

Bill Tracy, a retired engineer, lives in Northern Virginia.

Leave a Reply

You must be logged in to post a comment.