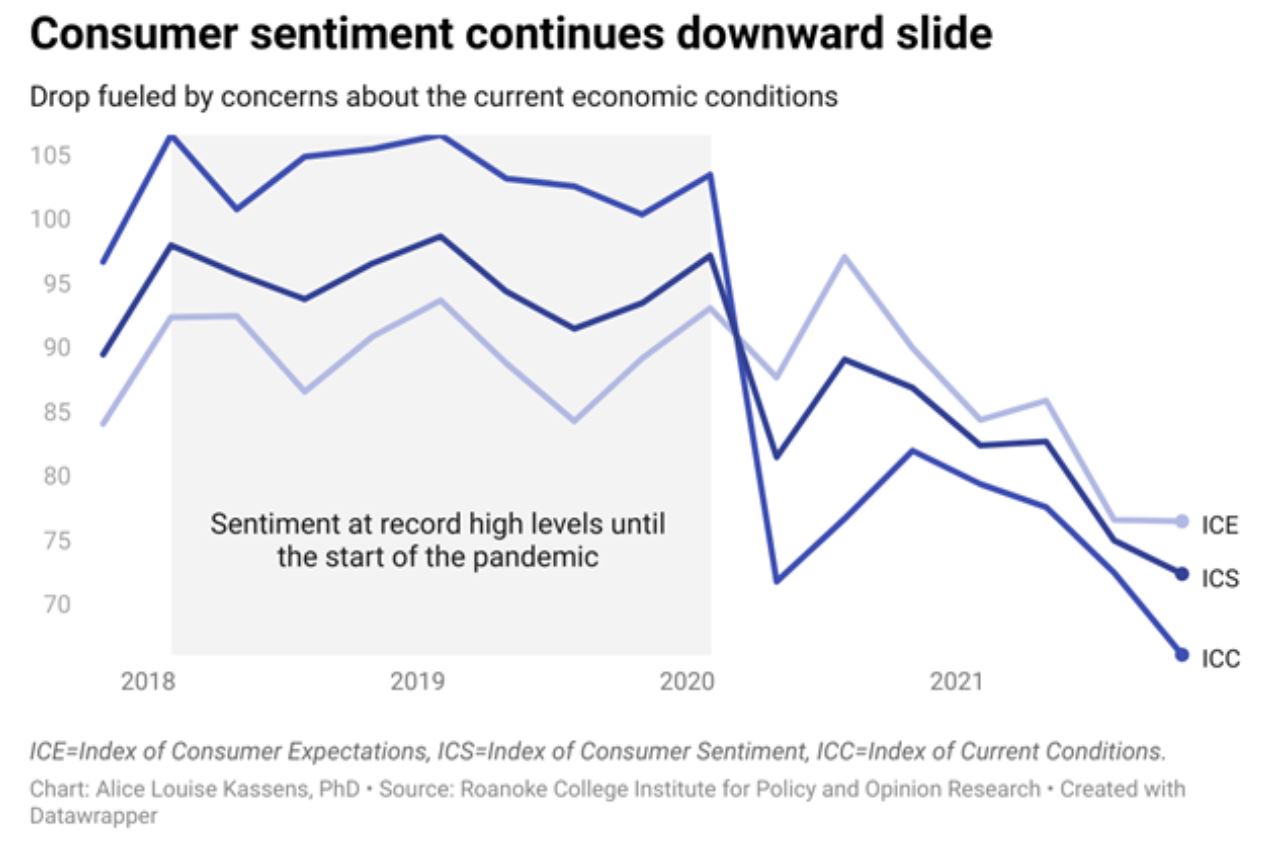

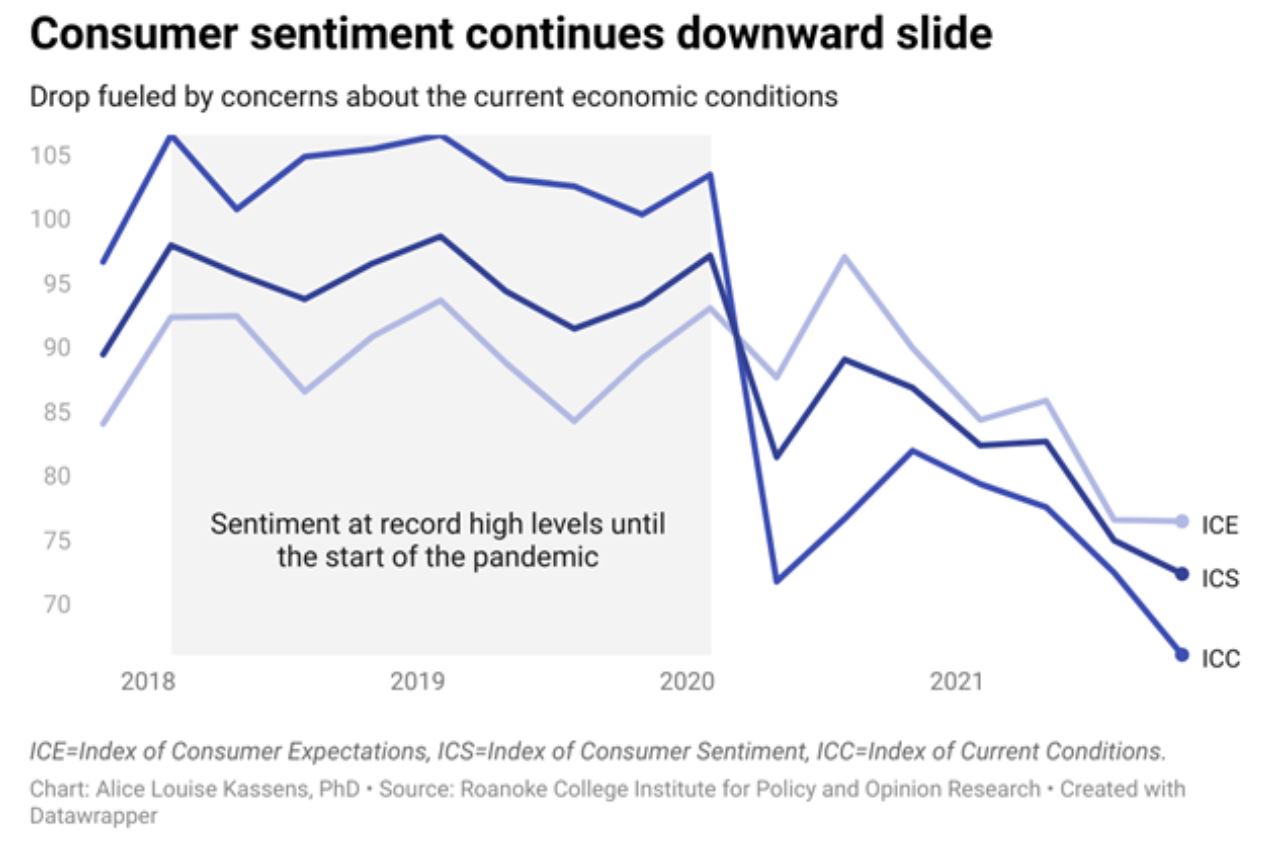

For commentary on the graph, see The Roanoke Star.

For commentary on the graph, see The Roanoke Star.

(comments below)

(comments below)

At least it mirrors Joe’s mandate that we lower our expectations.

They are so cranky that they spent 12.2% more in September 2021 than they did in September 2020. On a year-to-date basis, they had spent 15.4% more by the end of September than they had last year. https://www.finance.virginia.gov/media/governorvirginiagov/secretary-of-finance/pdf/master-revenue-reports/October-2021-Revenue-Letter.pdf

How much of the additional spending was inflation in the prices of goods and services?

“Since April 2020, consumer spending on goods has jumped 32%. It’s now 15% above where it was in February 2020, just before the pandemic paralyzed the economy. Goods account for roughly 40% of consumer spending now, up from 36% before the pandemic.

U.S. factories have tried mightily to keep up with demand. Production rose nearly 5% over the past year, according to the Federal Reserve, despite periodic ups and downs, including disruptions to auto production caused by chip shortages.

Imports have narrowed the gap between what America’s consumers want and what its factories can produce. From January through September this year, the U.S. imported 23% more than in the same period in 2020. In September, thanks to surging imports, the U.S. posted a record deficit in goods trade: Imports topped exports by $98.2 billion.”

https://apnews.com/article/business-global-trade-e9b91af9bce8e32a7df2d5b4f75a30ee

plandemic. I fixed for you.

Now Dick! Now! Hit ’em with the unemployment numbers!

Actual spending is a lagging indicator. Consumer sentiment is a leading indicator. 2021 has been buoyed by a number of government actions, including now-forgiven business loans (which kept people employed), stimulus checks, bans on evictions, etc. While some of 2020 included some of these government giveaways, all of 2021 included those effects.

Looking backwards at actual spending to project the economy is like driving your car forward while staring at the rear view mirror.

Biden’s increasingly obvious inability to control inflation is directly hurting the stock market. As people watch their 401(k)’s shrink they become more skittish about spending.

Finally, the endless hype around COVID-19 by the government and the media was bound to dampen consumer sentiment. The omicron variant is a classic example. The doctors who discovered it in India say the actual patients who have gotten the variant have shown “very mild” symptoms. Yet aged jackwagons like Fauci can’t help themselves from going on the Sunday morning talk shows to sow uncertainty and fear. His 15 minutes of fame has now grown to over 15 months and its time for it to expire.

Inflation will be a problem but with one stimulus already in the pipeline and two more probably coming, I don’t see how the economy goes bad.

Tax cuts build wealth for some – people keep it or invest it, but higher taxes actually flush that money directly into the economy for many more. Infrastructure, K-12 pre-school, child-care, etc, those are jobs.

For Fauci – he drives Conservatives nuts, no question, but his views are pretty much mainstream science not just in this country but in many other countries and around the world.

The truth is that we don’t know and will have to wait to see what happens. It could be much ado about nothing, we’ll see.

But in terms of media, I’ll take MSM any day over FOX an similar…

Totally true the MSM gets spun up and over their skis but they generally don’t lie and engage in conspiracy theories and other idiocy that some seem to suck up willingly.

401k’s are for losers. Winners have government pensions.

Half the trouble in BR some days is just trying to untangle the false narratives…

That doesn’t make sense. Certainly, purchasing is up from 2020. But when looked in terms of percentages, a significant part (certainly not the majority) is from inflation. My question is: How much?

demand is up despite inflation……..

We get that. Demand could hardly go down after the first part of the pandemic. But how much of the additional revenue is from a higher price for the same product or service or the same price for a lesser amount of a good or service? Week after week going to the grocery store provides evidence of inflation. How much in Virginia and various reasons thereof?

we do have inflation , no question but demand is up despite inflation:

” U.S. factories have tried mightily to keep up with demand. Production rose nearly 5% over the past year, according to the Federal Reserve,

Imports have narrowed the gap between what America’s consumers want and what its factories can produce. From January through September this year, the U.S. imported 23% more than in the same period in 2020. ”

Demands for good is UP – despite inflation!

” … over the past year …” is a poor comparison. The much better question would be where is production this year compared to 2019 (pre-pandemic).

You’re comparing 2021 to 2020. What’s the comparison between 2019 and 2020? Unless the production was the same, your argument doesn’t work.

Bureau of Economic Analysis. Factor inflation into the 2021 numbers and then you have a comparison.

If you actually READ the articles….:

” U.S. factories have tried mightily to keep up with demand. Production rose nearly 5% over the past year, according to the Federal Reserve,”

See- DEMAND is demand no matter the inflation level…….

“Imports have narrowed the gap between what America’s consumers want and what its factories can produce.”

see that word GAP and PRODUCE?

If you naysayers were not so all consumed with searching for the gloom & doom side….

😉

” The recession is officially over. It ended more than a year ago, but it takes time for the group of economists at the National Bureau of Economic Research, the organization that determines peaks and troughs of a business cycle, to wait for all the revised economic data to formally determine the start and end of recessions.

This recent recession ended last April. It was the shortest recession and deepest recession in the post-World War II period.

But that was then, and this is now. The economy is growing on most cylinders. It rose 6.5% in Q2. In Q3, growth is expected to be slightly more robust, with the Bloomberg economic consensus estimate around 7.0%. If that plays out, it will be the strongest quarterly growth rate of this year and the most robust rate of growth going back to 2000, outside of last year’s Q3 reopening.”

Gross Domestic Product

Capacity Constraints Put a Cap on Growth

The economy grew 6.5% in Q2. Although slower than expected (forecast 8.5%), the gentler growth rate was due to the lack of supply, not demand. The decline in inventories alone took away 1.1 percentage points. As the economy works through bottlenecks, the supply will meet the demand, keeping economic growth strong.

Still, at 6.5%, we are talking about a breakneck pace, more than three times the economy’s pace averaged during the past expansion. Moreover, demand is expected to stay strong due in part to the high level of savings. Although the saving rate is off its recent unsustainable highs, it is still well above the average for the past few decades.

Consumer spending is the driving force behind the high Q2 GDP. There was a torrid pace of spending in Q2. It was up 11.8%, which was on top of Q1’s eye-popping gain of 11.4%. Outside of the craziness of last year’s closing and opening, these have been impressive gains in the first two quarters of this year, about three times greater than the long-term average of 3.3%. The $2.5 trillion in extra household savings has been burning holes in consumers’ pockets.”

Of course the economy is growing, Dems are in the White House…

There is no question that there is inflation AND it will impact demand and has already, BUT demand for goods and production to meet that demand has gone up despite inflation to this point.

Basically, people have more money to spend – i.e. demand – that is in excess of what companies can produce and deliver.

there are more dollars chasing fewer goods.

Don’t take my word but do listen to folks who do know:

“Inflation is sometimes classified into three types: Demand-Pull inflation, Cost-Push inflation, and Built-In inflation.’

” Understanding Demand-Pull Inflation

The term demand-pull inflation usually describes a widespread phenomenon. That is, when consumer demand outpaces the available supply of many types of consumer goods, demand-pull inflation sets in, forcing an overall increase in the cost of living.

Demand-pull inflation is a tenet of Keynesian economics that describes the effects of an imbalance in aggregate supply and demand. When the aggregate demand in an economy strongly outweighs the aggregate supply, prices go up. This is the most common cause of inflation.

In Keynesian economic theory, an increase in employment leads to an increase in aggregate demand for consumer goods. In response to the demand, companies hire more people so that they can increase their output. The more people firms hire, the more employment increases. Eventually, the demand for consumer goods outpaces the ability of manufacturers to supply them.

There are five causes for demand-pull inflation:

A growing economy: When consumers feel confident, they spend more and take on more debt. This leads to a steady increase in demand, which means higher prices.

Increasing export demand: A sudden rise in exports forces an undervaluation of the currencies involved.

Government spending: When the government spends more freely, prices go up.

Inflation expectations: Companies may increase their prices in expectation of inflation in the near future.

More money in the system: An expansion of the money supply with too few goods to buy makes prices increase.

Demand-Pull Inflation vs. Cost-Push Inflation

Cost-push inflation occurs when money is transferred from one economic sector to another. Specifically, an increase in production costs such as raw materials and wages inevitably is passed on to consumers in the form of higher prices for finished goods.

Demand-pull and cost-push inflation move in practically the same way but they work on different aspects of the system. Demand-pull inflation demonstrates the causes of price increases. Cost-push inflation shows how inflation, once it begins, is difficult to stop.”

https://www.investopedia.com/terms/d/demandpullinflation.asp

Don’t forget he is an “expert” in everything. I guess he went to kaaallllege.

well no, but I know the difference between those who actually know and not… sometimes…

we are ALL ignorant… right?

Federal Reserve!!! Are you kidding?

Economists estimate that about half the increase in consumer spending is due to inflation. https://www.marketwatch.com/story/u-s-consumer-spending-sizzles-in-october-and-its-not-just-all-high-inflation-11637766739

this might seem like a “duh” but it’s actually at least part of what is going on – it’s caused by a shortage of goods and labor in response to strong demand from consumers:

” Fed Survey Finds Supply-Chain Shortages Boosting Inflation

The Federal Reserve is reporting that many parts of the country were hit by supply chain disruptions and labor shortages in November.

In a survey of business conditions around the country, the Fed’s 12 regional banks found that the economy continued to grow at a modest-to-moderate pace, and the outlook for future growth remains positive.

But some of the Fed’s some business contacts expressed uncertainty about when the problems presented by supply chain bottlenecks and labor shortages might begin to ease.

In part because of the supply chain problems, price increases were reported to be widespread across the economy.

…..

The Fed report said that companies were complaining about “persistent difficulty in hiring and retaining employees” with many leisure and hospitality firms still limiting operating hours due to a lack of workers.

The report said businesses had heard a variety of reasons for the labor shortages. Those included the lack of childcare, retirements, and continued safety concerns revolving around the persistence of COVID cases. The survey was conducted before the emergence of the new omicron variant.

“Nearly all districts reported robust wage growth,” the Fed said. “Hiring struggles and elevated turnover rates led businesses to raise wages and offer other incentives, such as bonuses and more flexible working arrangements.”

Thank you. It took you only 14 simple words to answer tmtfairfax’s question.

Contrasting your response with that of another commenter who [ultimately] posted nearly a thousand words which did NOT answer the same question says a lot about who at BR is genuinely interested in serious discussion and discourse.

Leave a Reply

You must be logged in to post a comment.