In the analysis of unfunded state pension liabilities, there are two main components: assets and liabilities. Here in Virginia, most attention is focused on the asset side of the equation — how much money have state and local governments set aside to pay for retiree benefits, and how well is the Virginia Retirement System managing the pension portfolio? Less attention is given to the benefit side — how rapidly are the liabilities increasing?

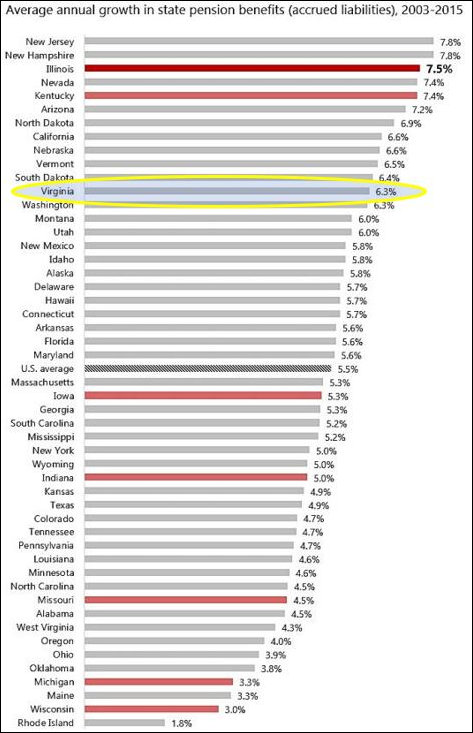

Wirepoints, a group that provides research and commentary on Illinois’ economy and government, has published a research paper arguing that the Prairie State’s massive pension liabilities are not the result of insufficient funding — asset growth has increased at an annualized rate of 5.9% from 2003 to 2015 — but of runaway increases in pension benefits of 7.5% annually. The difference: a 2.6% gap.

Many other states, including Virginia, have experienced the same problem of mismatched growth rates for assets and liabilities, though not to the same degree. Over the same 12-year period, Virginia’s pension benefits increased at a compounded annual rate of 6.3% while its assets increased by 4.2% annually. The difference: a 2.1% gap.

A few years ago, the increase in pension liabilities became a concern. Under pension reforms enacted during the McDonnell administration, state employees hired in 2014 or after were enrolled in hybrid pension plans, which combine a defined benefit plan with a defined contribution plan and an option for voluntary contributions. In essence the new package shifted some risk for funding retirement benefits from the state to the employees.

Thanks to the bull market in equities, Virginia’s asset performance has been stronger the past few years, and presumably the shift to a hybrid pension system has dampened the growth rate in pension benefits (and will continue to do so over time). Wirepoints’ numbers, based upon Pew Charitable Trusts data, goes only to 2015. More recent numbers might show more favorable trend lines.

Bacon’s bottom line: Growth in pension liabilities is one of the Virginia Retirement System metrics we should be watching. The onus for ensuring that the Commonwealth meets its pension obligations should not fall solely upon taxpayers and VRS portfolio managers. The state needs to keep pension costs under control, too. Legislators should check periodically to see if the hybrid pension plan is working as advertised.

Leave a Reply

You must be logged in to post a comment.