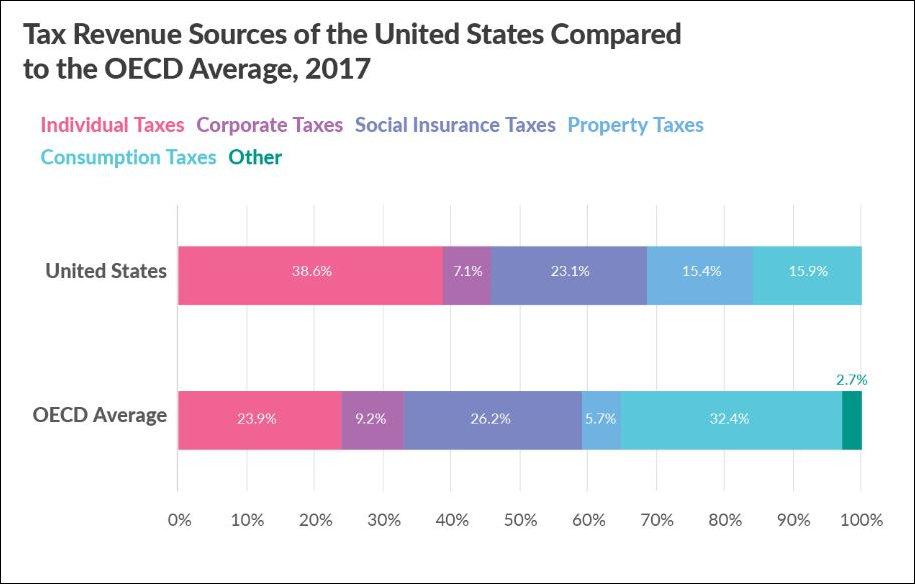

A reminder to all you Bernie Bros out there who think that the U.S. federal/state/local tax system is stacked far more in favor of the rich than in the social democracies in Europe. This graphic based on data from the Organization of Economic Cooperation and Development (OECD), which, incidentally, is not funded by the Koch Brothers, shows that the U.S. relies much more upon individual income taxes and property taxes (thus taxing income and assets) than other nations with advanced economies. Other countries rely more heavily on regressive social insurance taxes and consumption taxes. The Europeans have figured out that they can crank up the income taxes only so high on the wealthy before they pack up and move. Instead they tax consumption.

Leave a Reply

You must be logged in to post a comment.