by James A. Bacon

When Congress adjusts the tax code to promote income redistribution between the rich and poor, a debate plays out in the national media. When universities adjust their tuition to promote income redistribution, by contrast, the process is so shrouded in secrecy that the public has no idea it’s occurring.

That process is less invisible in Virginia than it once was, thanks to a Youngkin administration initiative to post the most comprehensive higher-ed data analysis ever compiled on the State Council for Higher Education in Virginia (SCHEV) website. But the data will sit there — as good as invisible — until someone looks at it. And even publicizing the data is next to worthless if key decision makers — university administrations, activist groups, Boards of Visitors — don’t use it to inform their discussions.

The report, compiled over a six-month process with guidance from the Boston Consulting Group, explores three broad themes: enrollment trends, labor market trends, and financial effectiveness & sustainability. SCHEV looks at industry-wide trends for Virginia’s system of public education as well as detailed breakdowns by institution.

There is an immense amount of data to explore, some of which will prove familiar to readers of Bacon’s Rebellion and some of it not. For this post I am focusing on tuition as a tool for wealth redistribution because that is data we have never seen before.

Elite private universities employ what’s called a high tuition/high discount model. They charge an extremely high sticker price but discount heavily depending upon income and other factors. The idea, simply put, is to “soak the rich.” By paying the full tab, affluent families generate revenue that institutions can use either to discount tuition or boost financial aid, which are two sides of the same coin. Non-elite public institutions engage in this practice far less. They lack the market power to lure students from wealthy households and they don’t have big endowments that support generous scholarships. To keep up enrollment numbers, they cannot afford to discriminate by income. As a general rule (there are exceptions), they strive to keep tuition as low as possible for everyone.

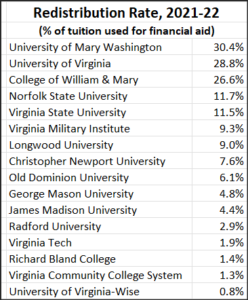

The SCHEV data shows a remarkably wide range of wealth redistribution among Virginia’s public higher-ed institutions. SCHEV classifies a remarkable 30.4% of Mary Washington University tuition as financial aid as a percentage of paid/collected tuition. The data show an astonishing upward trend which can admit of no other explanation than deliberate policy. In 2013-14 the redistribution rate at UMW was 1%. The percentage has risen steadily ever since — thirty-fold.

The University of Virginia and the College of William & Mary are close behind with percentages in the high 20s.

Low man on the totem pole is the University of Virginia-Wise campus, located in the impoverished mountains of Appalachia, which redistributes less than one percentage point of tuition revenue.

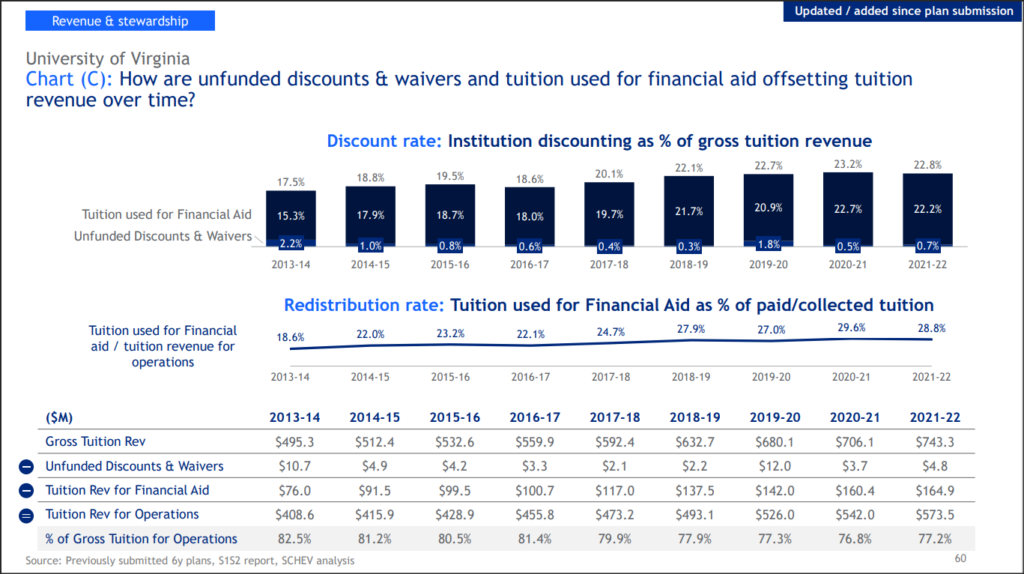

As executive director of The Jefferson Council, I’ve been paying especially close attention to University of Virginia tuition policy. The redistribution rate at the state’s flagship university has been creeping steadily higher, though nowhere at the rate of Mary Washington. In 2013-14 the percentage stood at 18.6%. In 2021-22 it had risen to 28.8%.

Needless to say, there has been zero discussion of this ratio during UVa Finance Committee’s meetings organized to discuss the upcoming tuition increase for the next two years. Here’s a logical question to ask: how much lower would UVa tuition be if nearly 29% of it wasn’t allocated to financial aid?

The administration has indicated it is aiming for a range of a 3.0% to 4.4% increase. How much of that will go to financial aid?

The two finance committee meetings that have occurred so far this fall, one of which included a public hearing that received input from a single student, have consisted entirely of self-serving presentations by the administration with but a few questions, mostly for purposes of clarification, from board members. It’s a safe bet that UVa board members are totally unacquainted with the tuition-redistribution numbers. But even if they were, the meetings and hearings are structured in such a way that board members have no opportunity to ask about them.

It’s also a safe bet that the same holds for the boards of every other public university in Virginia.

The Youngkin administration deserves kudos for compiling and publishing the SCHEV data. It represents a potential big step forward for transparency and accountability — emphasis on the word “potential.” Until alumni groups and Boards of Visitors act upon the information, that potential will likely go unrealized.

James A. Bacon is executive director of The Jefferson Council.

Leave a Reply

You must be logged in to post a comment.