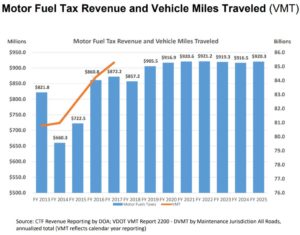

In the middle of a booming economy, with many state revenue sources surging, flat transportation revenues were the focus of warnings Monday in presentations by Virginia Secretary of Finance Aubrey Layne and Secretary of Transportation Shannon Valentine.

“I think we are heading for a cliff,” Layne told the House Appropriations Committee. “For the first time in our history, we’re seeing no increase in fuel tax revenue while vehicle miles traveled goes up.”

With the transportation funding package of 2013, Virginia became less reliant on an excise tax, fixed cents-per-gallon gasoline approach and started using the sales tax, percent-of-average-price model. Wholesale prices have fallen rapidly since. The tax was 17.5 cents per gallon before 2013, and is now 16.2 cents. The Department of Motor Vehicles tracks prices and adjusts it annually.

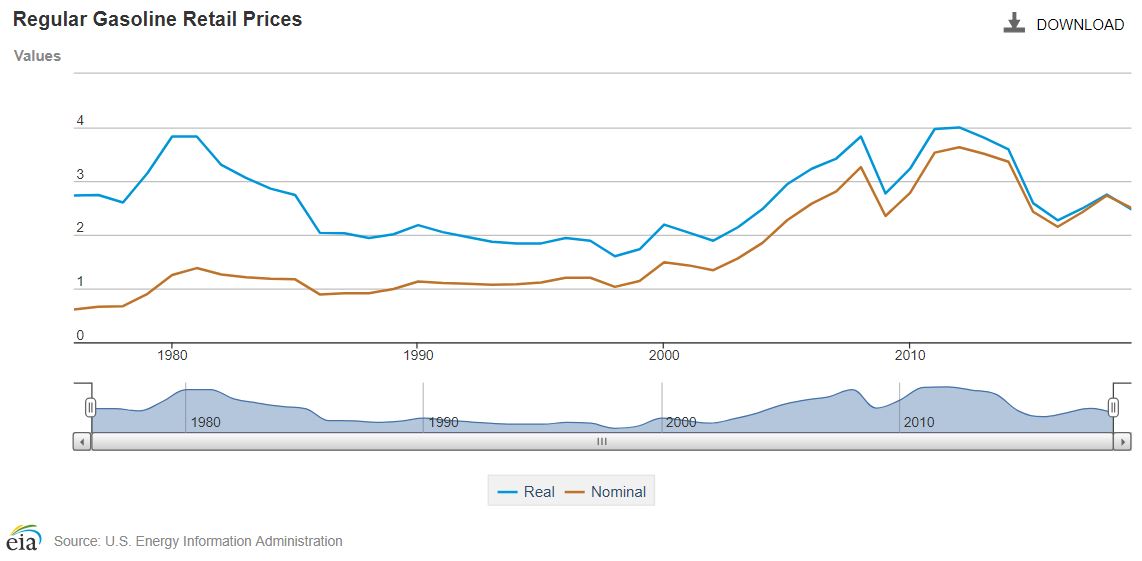

Adjusted for inflation, as tracked by the federal Energy Information Agency in the chart above, the real price of gas has moved little in four decades and if anything is now about as low as ever.

Seriously, did anybody really expect to see gas prices in Virginia so far below $2 a gallon ever again? Well, it was always a possibility. There is a floor under the statewide tax, preventing a total collapse of the revenue stream, which Virginia is now standing on. The projection Layne shared seems to assume we stay at the floor for a while. The growing use of non-combustion engines is adding to the fiscal pinch.

Motor fuel taxes are now third on the list of transportation revenue sources, behind the general sales and use tax and the sales tax on motor vehicle sales and transfers. The $750 million being collected in tolls around the state annually is closing rapidly on the $900 million or so paid in fuel taxes.

Five years after that highly-touted package the Fiscal Year 2018 transportation revenues missed their forecast. The forecast for this fiscal year was reduced by $43 million. It seems the improved revenues from the general sales tax, shared with transportation, are preventing even deeper deficits. Total revenue for this year is estimated at about $3.6 billion, excluding the tolls.

Valentine outlined the massive projects underway in the wake of the 2013 transportation revenue measure. She talked about the Next Big Thing, a $2 billion plus set of projects to deal with overloaded Interstate 81, with the expectation that tolls will cover that cost. At a projected 17 cents per mile for heavy trucks and about 11 cents per mile for autos, the 325-mile transit will be expensive for people making the full trip (not Virginians, mainly, which is the point.)

Once those tolls are in place, and the tolls for the expanded Hampton Roads Bridge Tunnel, will toll revenue pass gas tax revenue? Very soon, Virginia, very soon. It will be the third highest revenue source, then the second. Virginia’s tax at the pump is getting smaller and smaller relative to other states.

Virginians – indeed any person driving an automobile or smaller truck, wherever they live – may be able to buy a pass good for a year of driving on I-81 for a relatively modest fee. Valentine took great pains Monday to explain why that option works for the I-81 corridor, but not for the highly-tolled I-95 and Washington Beltway corridor. If an I-81 annual pass does become part of the final approach, however, the demand for that idea elsewhere will be enormous.

The I-81 legislation has not been introduced.

I was a broken record on Bacon’s Rebellion for years, advocating for an increase in the basic fuel tax, hated though it is, and worrying that the change in approach would backfire. That debate over high gas taxes continues in Washington as federal highway funds dwindle. The debate is over in Virginia. Tolls will be the default position now.

Valentine explained that with tolling revenue, the bonds to support the I-81 plan will likely have AAA rating. A similar amount of revenue, using a 2.1 percent add on to the gas tax and an additional 0.7 percent on the general sales tax, would likely earn AA rating, meaning higher interest payments and fewer dollars for pavement and technology.

Who cares what the voters want, listen to Wall Street. The gas tax is so 20th Century. The underwriters know that the forces eroding its usefulness will grow, not abate, and the political will to hike it from time to time to keep up with general inflation is lacking, in Richmond or Washington.

Leave a Reply

You must be logged in to post a comment.