by Arthur Purves

Local government compensation is better than private sector.

On April 30 the Fairfax County Board of Supervisors will vote on next year’s (FY2025) tax increase. The supervisors have advertised a 7% increase in real estate and car taxes to help pay for $360 million in raises for 38,000 school and county employees.

School raises are 6% and county raises range from 4% to 10%. By comparison, the county says that inflation is 2.5%. For next year, the Fairfax County Board of Supervisors, under Chairman Jeff McKay, is proposing a 7.1% or $618 tax increase for the typical residential household. This is the second largest tax hike in ten years, exceeded only by last year’s 8.9% increase.

Next year’s tax hike is made up of an average 6.5% or $531 increase in the combined real estate and stormwater tax, both of which are based on household assessments, plus a 16% or $87 increase in the car tax.

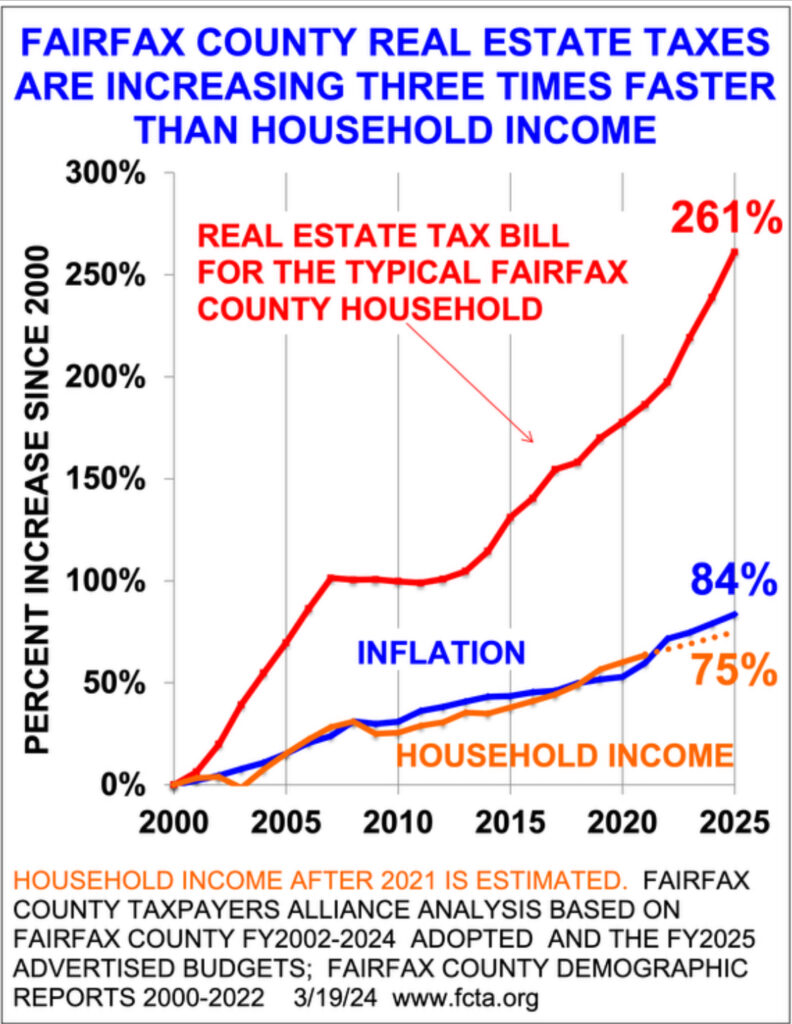

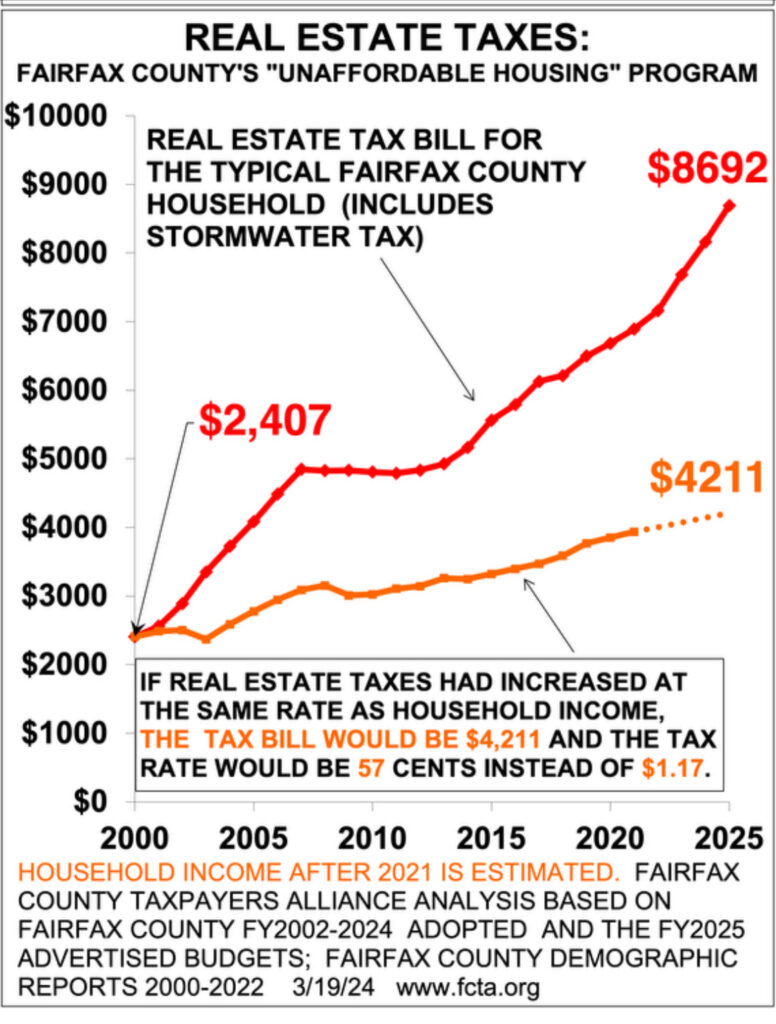

This continues the supervisors’ quarter-of-a century habit of increasing residential taxes three times faster than household income. They are advertising a 4-cent increase in the real estate tax rate, from $1.13 to $1.17 (includes the 3-cent stormwater tax), on top of a nearly 3% average increase in residential assessments.

Unless they hear from homeowners, the supervisors will probably adopt a rate of $1.16 when they finalize the budget on April 30, in hopes that homeowners will be relieved that the rate increased 3 cents instead of 4 cents.

The tax rate that would offset the 3% assessment increase is $1.10. Therefore, the supervisors’ advertised rate of $1.17 is effectively a 7-cent rate increase. A $1.16 rate would be equivalent to a 6-cent increase.

The real estate and car tax hikes would increase county revenues by $309 million. Other taxes plus revenue from high interest rates would generate an additional $54 million

Where do the tax hikes go?

The principal answer is to pay for raises and increased benefits rates for 38,000 county and school employees.

Teachers, who received 7% raises last year and 7% again this year, would get 6% raises next year. The average teacher salary is $85,000.

The Congressional Budget Office projects this year’s and next year’s inflation to be 2.5%. The Bureau of Labor Statistics reports that last year’s inflation was 1.8%.

Non-uniformed county employees, who received 6% raises last year and 7% raises this year would get 4% raises next year.

The average county salary, which is not published in county budget documents, is $90,000. The average salary for police is $97,000, and the average for fire and rescue is $104,000.

The cost of next year’s raises plus $55 million for pension and medical insurance rate hikes would be $367 million, which is greater than the increased revenues from the real estate and car tax hikes.

Experience shows that increased salaries will not raise school achievement. In fact, SAT scores are down. The only students who succeed are those who are taught the basics at home. Fairfax County Public Schools provides no upward mobility for the low-income students eligible for free or reduced-price meals, who now make up more than a third of the enrollment.

The commercial real estate tax base will probably not increase. The supervisors want a casino rather than developing more business-friendly permitting and inspection processes.

One indication of the direction of the county is that since FY2000, while parks and library staffing decreased by 83 positions, public assistance staffing increased by 300 positions.

The high taxes plus the deteriorating economic conditions may explain why the George Mason Center for Regional Analysis reported that Fairfax County ranks between Philadelphia and Chicago in domestic out-migration as a percent of total population between July 2021 and June 2022.

The supervisors say the salary hikes are needed for recruitment and retention. However, they have provided no data to show that they are losing employees to the private sector, which has no pensions, less job security, and probably lower salaries.

Perhaps another reason for the raises and tax hikes is that for the last election the Democrat supervisors received $260,000 in union contributions. This is a conflict of interest.

Also, if the county raises salaries to compete with neighboring school districts, local governments, or even states, those neighboring jurisdictions keep raising their salaries and nothing is gained. The real problem is the aging population and the shortage of workers to replace retiring baby boomers, a problem higher salaries will not fix.

Given the substantial taxes hikes of the past quarter-century, it is time for a salary freeze, just as WMATA has done to balance its budget, until:

1) The school system fixes its K-3 reading and arithmetic curricula so parents don’t have to teach the basics at home and so low-income children master reading and arithmetic by the crucial 3rd grade;

2) The county shows it is making business-friendly permitting and inspection processes and blocks casinos;

3) The county and schools provide data showing that they are losing employees to the private sector due to compensation; and

4) Supervisors pledge not to accept union contributions.

Even if payroll stays the same, employees can still get some pay increase due to turnover.

Homeowners need to tell their supervisor it’s time for a salary freeze until these conditions are met. Supervisor emails and phone numbers are on fcta.org here. You can identify your supervisor on the county website here.

A rare, if not the only, opportunity to question supervisors and school board members is to attend their budget town halls, which are posted here.

Arthur Purves is president of the Fairfax County Taxpayers Alliance.

Leave a Reply

You must be logged in to post a comment.