by James C. Sherlock

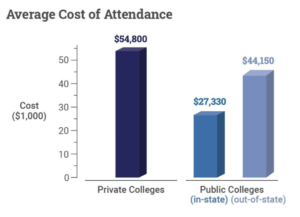

A College Board report, “Trends in College Pricing and Student Aid” estimated the total costs of attending college in 2021. The figures above represent total annual budget costs.

This is a drill that many parents have been through. But I offer for the broader audience the differences in costs for one year of on-campus undergraduate tuition, fees, room, board, books and supplies and “other living expenses” at two Virginia schools in 2022.

I have chosen the University of Virginia and Radford in an attempt to show a range of state school costs in the Commonwealth. I have calculated total costs for both in-state and out of state students from the financial web pages of each school. They estimate “other living expenses” and I have included them.

That is as close as I can get to a total budget.

Radford has flat tuition and fees rates for all of its programs. At UVa, the costs vary significantly depending upon the program and year.

University of Virginia. The most potentially lucrative degree programs are the most expensive. Third and fourth years in all programs except education are more expensive than the first two.

The undergraduate ed school is the least expensive program and was the same in 2022 regardless of the year in school. The McIntire School of Commerce (third & fourth year only) was the most expensive program.

- In-state tuition and fees varied between $14,878 and $25,956.

- Out-of-state tuition and fees ran between $50,348 and $61,870.

Annual on-grounds housing, meal plan, other living expenses, books and supplies have been estimated by the University at $17,514.

The least expensive total costs are thus:

Radford undergraduate tuition and fees are fixed at $11,916 per year for in-state and $24,453 per year for out-of-state regardless of program.

The least expensive accommodations are $5,160 annually. The least expensive meal plan is $4,526 per year.

So the least expensive room and meal plan at Radford is $9,686 per year.

Doing the addition: tuition, fees, room and meal plan at Radford can be had by in-state students for $21,602. To that we add a nominal $4,000 for books and supplies and other living expenses to make the costs comparable to those of UVa and the College Board.

So, all in:

- Radford: in-state $25,602 and out of state at $38,139.

- UVa: in-state $32,392 to $43,470 and out-of-state $67,862 to $79,384.

And Radford is the one losing students hand over fist.

As a side note, tuition, room and board at UVa for first-year Jim Sherlock sixty years ago was $500 per semester.

I just checked. Inflation since 1962 has made a 1962 dollar worth $9.29 today.

If higher education had inflated at that rate, UVa would cost $9,290 for tuition, room and board for an in-state undergraduate today.

The actual comparable costs are over $30,ooo.

Updated Oct. 7 at 20:20.

Leave a Reply

You must be logged in to post a comment.