by James A. Bacon

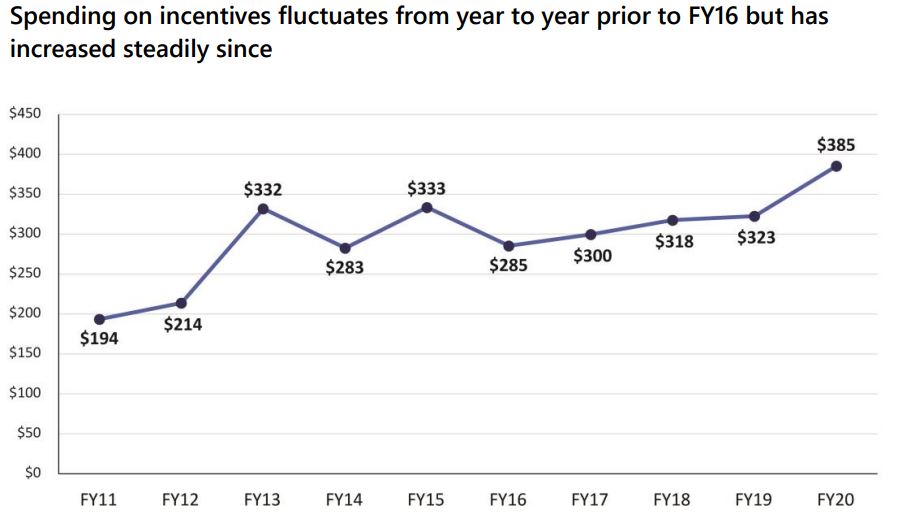

Virginia spent $3 billion on economic incentive programs during the decade of the 2010s (between FY 2011 to FY 2020), equivalent to 1.5% of the total General Fund budget. Although there is considerable variability from year to year, incentives grew roughly twice as rapidly as the rest of the total budget, concludes the Joint Legislative Audit and Review Commission (JLARC) in a new report.

About 70% of incentive “spending” was comprised of tax credits and exemptions, and the lion’s share of those went to data centers.

The numbers are likely to increase in the next few years as the massive incentives to Amazon, which located its East Coast headquarters in Arlington, start kicking in.

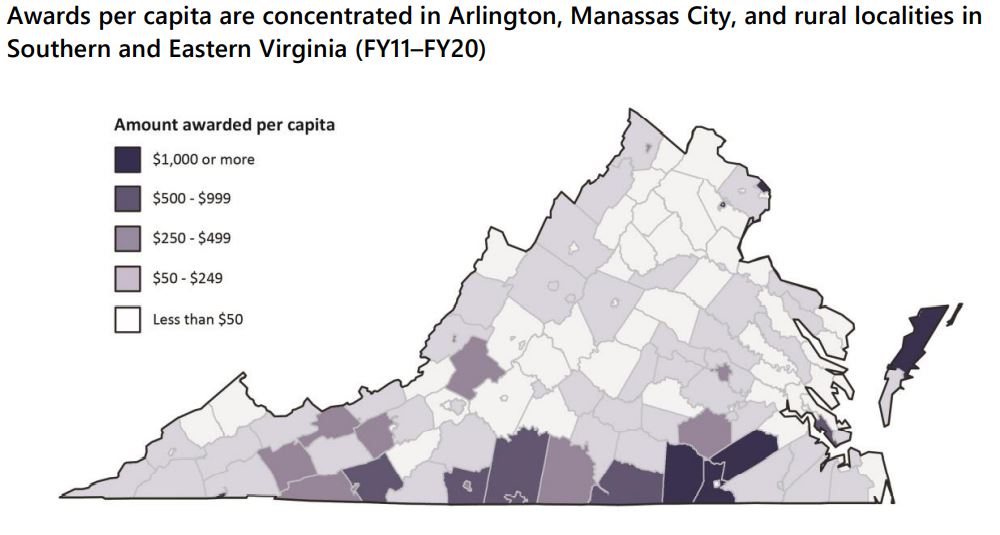

Although most of the biggest grants and tax breaks went to projects in Virginia’s major metropolitan areas, on a per capita basis, localities in Southwest and Southside Virginia were the biggest benefactors.

That bias is explainable, at least in part, by the fact that one of the biggest sources of grants — tobacco-settlement funds amounting to $336 million over the decade — was the largest pot of economic-development grant money available to the state. Funding is restricted to projects in Southside and Southwest Virginia.

The biggest individual recipients of economic developing incentives include Amazon’s HQ2 project in Arlington ($750 million), Newport News Shipbuilding in Newport News ($86.8 million), and Micron Semiconductor in Manassas ($70 million).

Sixty-eight percent of the economic development projects met or exceeded their goals for capital investment or other spending. Forty-six percent met their average wage goals, and only 25% met their job-creation goals. Grant awards totaling $181 million were canceled, reduced, or recaptured for projects that did not meet their goals.

JLARC made no effort in this study to conduct a cost-benefit analysis of the incentives, a topic it has addressed in previous reports.

Leave a Reply

You must be logged in to post a comment.