Some well-meaning person tagged me and about 100 others on Facebook last weekend urging us to pray to Saint Rocco. The patron saint of pandemics.

I appreciate the sentiment. But I have a better idea. Find me the patron saint of lost life savings. I want to pray to THAT guy.

I want to send up petitions for all of us who worked hard, lived within our means, paid our bills, saved our money, invested in American companies and who – in a few horrible weeks – watched our life savings shrink to alarming levels while several morally reprehensible members of Congress dumped their investments just before the stock market crashed.

Yes, I’m talking about a quartet of alleged profiteers in the U.S. Senate: Richard Burr, Kelly Loeffler, James Inhofe and Dianne Feinstein. Inhofe may have a plausible excuse for his actions. The others? Not so much.

Their wealth was protected. The little people? Meh, who cares.

All around the country Americans are fretting about how they’ll pay their rent, mortgages, car payments or buy food after suddenly losing their jobs due to shutdowns ordered by governors. Many small business won’t be able to survive even short-term closings. Airlines and hotels risk bankruptcies if travel bans last through the spring.

Yet late Sunday night – in the middle of a national emergency – the Senate was unable to pass a $1.8 trillion coronavirus rescue package. After negotiating all weekend, Democrats at the last minute blocked the plan that would have sent relief to individuals and businesses.

Craven gamesmanship while people suffer. This was disgusting behavior by partisan hacks.

Even The New York Times expressed astonishment over the late-night development.

The party-line vote was a stunning setback after three days of fast-paced negotiations between senators and administration officials to reach a bipartisan compromise on legislation that is expected to be the largest economic stimulus package in American history…In voting to block action, Democrats risked a political backlash if they are seen as obstructing progress on a measure that is widely regarded as crucial to aid desperate Americans and buttress a flagging economy.

A vote on the package set for Monday morning was pushed back to noon reportedly at the insistence of Democrats, guaranteeing another harrowing day on Wall Street.

Almost as if they’re trying to crash the economy for political reasons.

Five Republican senators missed the vote. Sen. Rand Paul of Kentucky tested positive for the virus this weekend and left Capitol Hill. Senators Mike Lee and Mitt Romney of Utah, Corey Gardner of Colorado and Rick Scott of Florida are all in self-quarantine because they’ve been in contact with Paul or other individuals who tested positive.

Members are not allowed to vote remotely – even in the middle of a pandemic. Senate Majority Leader Mitch McConnell has so far resisted pleas to make such accommodations.

Ridiculous.

They should all be working from home. If they stall long enough there won’t be 1/3 of the members healthy enough to vote.

Angry? You bet I’m angry. You should be too. Not just about craven partisanship in Congress. Or the financial chicanery of a few elected officials. Or the double standards. We should also be outraged that for more than a month politicians deliberately kept critical information about a looming pandemic from the public.

According to news reports, some members of Congress were briefed on the threat of the coronavirus on January 24. Yet they remained mute.

Behind the scenes, of course, it looks like three – maybe four – senators used that knowledge to save their derrieres from financial devastation. They’ll continue to slurp up their salaries no matter how badly the economy is battered, with their fortunes tucked safely under their mattresses.

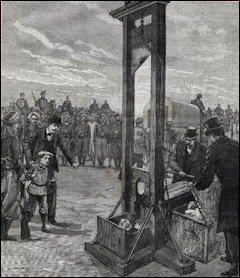

This is the sort of behavior that spawned the French Revolution.

A huge sacrifice is being asked of Americans. Most want to do their part to slow the spread of this virus – without eating cat food for the rest of their lives.

In times like these we need a Congress that puts aside partisanship to work together for the common good.

Clearly we don’t have one of those.

This column was published originally at www.kerrydougherty.com.

Leave a Reply

You must be logged in to post a comment.