The tax relief proposals advancing in both the Virginia House of Delegates and Virginia Senate return at most half of the estimated additional state revenue created by the federal Tax Cuts and Jobs Act (TCJA) over six years.

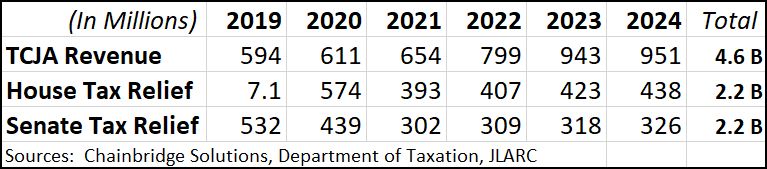

As Virginia leaders have debated what to do about the situation, all have been working off an estimate of the additional revenue provided by an outside economic consultant last year. It projected $1.2 billion in the first two years and more than $4.5 billion in the first six years as the addition revenue Virginia would collect from conforming to the TCJA, absent changes in Virginia tax policy.

According to the official fiscal impact statements on the House and Senate legislation, so far sponsored and voted for only by Republicans, the two bills end up with a very similar six-year impact of just over $2.2 billion, leaving the state treasury with the other $2.3 billion. One of the impact statements was challenged by the Republicans but confirmed by the Joint Legislative Audit and Review Commission.

According to the official fiscal impact statements on the House and Senate legislation, so far sponsored and voted for only by Republicans, the two bills end up with a very similar six-year impact of just over $2.2 billion, leaving the state treasury with the other $2.3 billion. One of the impact statements was challenged by the Republicans but confirmed by the Joint Legislative Audit and Review Commission.

The question of how to respond to TCJA was showing signs of a partisan train wreck on Friday, before the revelations about Governor Ralph Northam’s yearbook page photo and the subsequent effort to force his resignation. The 14 months Virginia leaders have sat on their hands, failing to broker a compromise before the session, may now prove disastrous.

The Senate bill, which contained the conformity provision and an emergency clause, was defeated on a party line vote (an emergency clause needs 80 percent approval). Senate Majority Leader Thomas Norment then stripped off the clause, so the bill could pass with the 21 Republicans only, and openly acknowledged the need for a broader conversation. What was true Friday afternoon had also been true in February 2018.

It has been obvious all along that any bill seeking to conform Virginia’s tax code to TCJA, allowing taxpayers a smooth filing process, needed a strong bipartisan vote. It has been clear what the Governor and Democrats wanted in the deal (cash benefits for low income workers), Republicans had a laundry list of proposals in front of them, and there is no valid excuse for their failure to act during 2018. Who didn’t return who’s phone call? We may never know.

It was also clear in the Chainbridge Solutions data released in August that the initial two years were just the start, and the revenue impact would grow in subsequent years, especially from the state’s corporate income tax.

The Senate proposal includes no individual tax reform element for the first year of the TCJA windfall, tax year 2018, but instead offers a flat $110 per person, $220 per couple state rebate for every taxpayer with a tax liability, a disbursement of about $420 million by their estimate. That can be done through the budget, and indeed it is reflected in the budget amendments adopted by the Senate Finance Committee Sunday on a unanimous, bipartisan vote.

For individual taxpayers starting with the next tax year the Senate GOP plan increases the standard deduction by 50 percent, saving taxpayers $415 million this year and then about $280 million in 2021, with slight growth from there. The 2020 number is higher because it represents 18 months of collections. A higher standard deduction, especially in the out years, was and still is possible. Indexing key benchmarks to inflation remains possible. The business community has blown its chance for a corporate income tax cut with its apathy toward the idea.

The House bill on conformity may suffer the same fate as Norment’s today, failing because it needs a bipartisan vote. A second House bill dealing with the tax policy issues could advance, as did Norment’s, without an emergency clause and with a simple majority vote. Like the Senate bill, the House version makes no individual tax policy changes for 2018. Instead, the bill dealing with conformity directs the TCJA revenue (estimated at over $500 million) into a holding fund for a decision later this year on how to disburse it.

For 2019 and beyond, the House bill increases the standard deduction 33 percent and allows individuals to split their decision and continue to take itemized deductions on their state tax return while taking the now-higher standard deduction on their federal return. Both the House and Senate bill allow people who itemize to disregard the new $10,000 federal cap on deducting local taxes. Both restore deductions important to a handful of huge businesses.

It was noted by Senator Steve Newman Friday that it takes an 80 percent vote to pass a bill with an emergency clause, but only a simple majority to adopt an emergency clause offered as a Governor’s amendment. That only further underlines that a bipartisan compromise was always required, and the only way to get the Governor to sign a bill was to offer something – in the parlance – he could not refuse. Starting in August, Secretary of Finance Aubrey Layne was claiming to be open to discussions, and to his credit Governor Northam didn’t rule out tax relief provisions in recent comments.

Now, almost 14 months after the federal bill passed, it seems we can start the real work. Let’s hope.

Leave a Reply

You must be logged in to post a comment.