by James A. Bacon

In a properly functioning marketplace, consumers exert power through their ability to comparison shop and bargain with sellers. One of the main limits to this consumer power is something economists call “information asymmetry.” Information asymmetry occurs when sellers of a good or service possess more information than buyers, and it typically allows them to charge more.

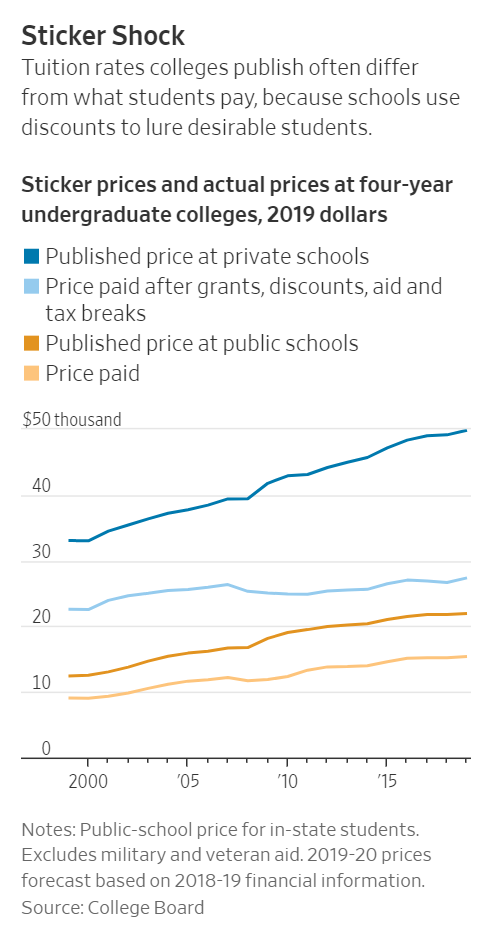

Information asymmetry is likely a contributor to the runaway cost in the cost of college attendance over the past few decades. A major factor in any consumer’s decision is price; in the case of higher education, price refers to charges for tuition, fees, room, and board. Higher-ed institutions traditionally knew a lot more about a student’s finances than students knew about the institutions’. Enjoying a tremendous advantage through this information asymmetry, higher-ed institutions have been able to charge higher prices than they would have otherwise. But the asymmetry is eroding.

A recent article in the Wall Street Journal describes how families are bargaining over college costs — and winning. After decades of runaway tuition increases, families are pushing back. Students are applying to more schools in the hope of having more options, and in the COVID-19-driven recession, in which enrollment is expected to decline, they are emboldened to press for bigger breaks on tuition. Desperate to fill dormitories as classrooms, many higher-ed institutions are yielding.

We won’t know how these trends are playing out here in Virginia until the State Council of Higher Education for Virginia compiles this fall’s enrollment numbers. But some combination of enrollment declines and price discounting seem inevitable at most institutions.

The Journal article does not discuss information asymmetry per se, but it sheds light on how colleges and universities have enjoyed significant information advantages in the bargaining process in the past, but now are losing their edge.

The first thing to understand is that posted tuition numbers are increasingly meaningless. A college posts high sticker prices in order to offer discounts or financial aid to applicants, depending on how price sensitive students are and how badly the colleges want them. Colleges offer bigger discounts to students considered more desirable, either because they are high academic achievers, fit favored demographic profiles, or have other desired characteristics.

Indeed, according to Journal, an industry has grown up around the admissions process to help colleges and universities maximize revenue yield.

The industry of enrollment-management consultants has helped colleges emulate for-profit companies. One consultant told attendees at an admissions-officers conference last year to be more like Starbucks and Amazon, improving customers’ experiences and maximizing net revenue and “yield,” the percentage of accepted students who enroll.

To tailor discounts, colleges tap personal data much as companies do, said David Hawkins, an executive director at the [National Association for College Admission Counseling]. “Colleges are picking up the same information that Coca-Cola or, you name it, Forever 21, all of those entities are picking up.”

A treasure trove of financial data comes from the Free Application for Federal Student Aid, or Fafsa, a form that is submitted to apply for federal aid, as well as apps, websites, ad information that prospects provide. Access to Fafsa provides institutions detailed financial information about students that they might not otherwise obtain. Students have few offsetting information sources regarding a college’s cost structure, enrollment objectives, and willingness to cut tuition or provide financial aid. Thus, students are at a significant disadvantage in the negotiating process.

But the balance of bargaining power is shifting. The American Council of Education, a university trade group, expects college enrollment to drop as much as 15% nationwide this fall. Others think enrollment could rise, but only because higher-ed institutions will engage in pervasive discounting. In the past, colleges were barred from recruiting beyond May 1 students who have paid deposits at other schools. Under a consent decree with the Justice Department, however, that restriction is lifted. In the Journal’s words, “Schools can dangle bigger discounts in front of a student who has accepted a rival’s offer.” That will give students more power to play one institution off against the other.

Another sign of shifting bargaining power is that students are applying to more colleges than in the past. Applying to more colleges increases the odds of being accepted at multiple institutions, and acceptance at multiple institutions gives families an opportunity to seek the best financial package.

The cost of attendance has gotten so high that it now pays families — especially well-to-do families likely to get socked with the biggest tuition payments — to hire their own consultants. The Journal cites the example of Todd Fothergill in Austin, Texas, who gathers data such as the net tuition schools charge families in different income groups, then plugs it into software to reveal which schools a particular student will have the most leverage over. Universities, he says, are using discounts more strategically: raising tuition and then offering more-desirable applicants bigger discounts.

Students’ increased price sensitivity and bargaining power will put unaccustomed pressure on public colleges and universities to go off the published rates. Count on Bacon’s Rebellion to track how these trends play out in Virginia.

Leave a Reply

You must be logged in to post a comment.