The Virginia Auditor of Public Accounts has applied a nationally-recognized strategic financial analysis tool to Virginia’s fourteen public colleges and universities, revealing that only one – the University of Virginia – has a strong financial foundation and several are vulnerable to stress.

The work done by Eric Sandridge, Director of Higher Education Programs at the APA, was published in a full report in late October and was summarized in a presentation to the House Appropriations Committee on November 13. It is the first of what are planned to be annual reports tracking the results over time, focused on the same kind of risk created for the state by stressed local governments.

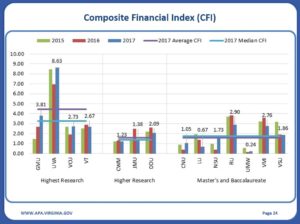

The key composite financial index (CFI) he used has a ten-point scale. “A score close to one indicates that the institution may be very light on expendable resources and have difficulty meeting operating demands in the current environment,” Sandridge wrote in his main report. Longwood University, Christopher Newport University, Norfolk State University and the University of Mary Washington have all had recent years with a composite score of one or below.

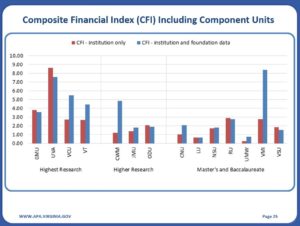

The College of William and Mary’s scores have only barely exceeded a one on this scale in recent years, but look far better when the financial resources held in its foundation are factored in. Several of the schools see better scores with their foundations included in the measurement. But not all have substantial endowments.

A score of three “generally indicates that an institution is financially healthy,” Sandridge wrote in his report. Even with their foundations included, eight of the fourteen schools miss that mark, although Radford University is close.

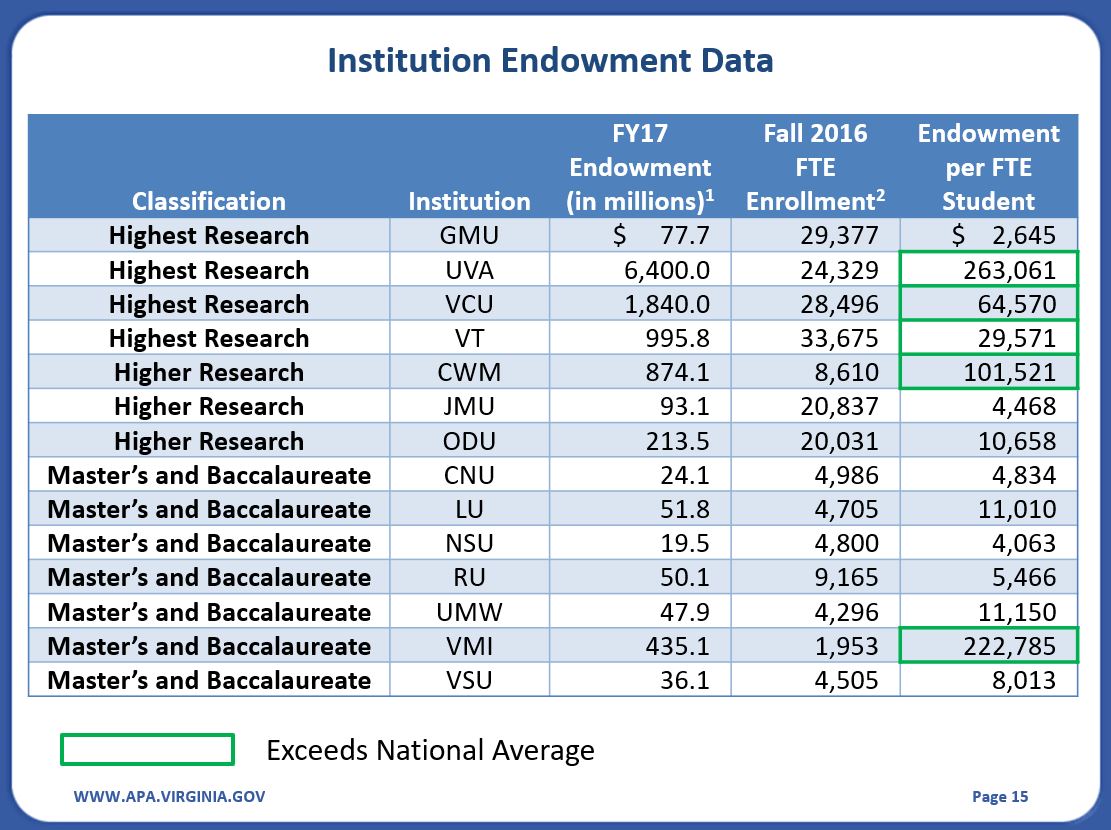

The University of Virginia is everybody’s rich uncle, to the point Sandridge pulls it out of some averages. VMI’s endowment is also off the charts for public schools of that size thanks to its loyal alums.

“The Composite Financial Index or CFI combines four core ratios by assigning various weights to generate an aggregate score for financial strength and stability. These ratios: Primary Reserve ratio, Viability ratio, Net Operating Revenues ratio, and Return on Net Position ratio provide for an understanding of the institutions’ available resources and results of current operations,” is how Sandridge summarized the method, devised by the accounting firm of Prager, Sealy & Co., LLC.

The various financial tests, similar to those a business analyst might use, look at the schools’ debt, the comparison between their operating revenue and expenses and available reserves. Their auxiliary enterprises are measured, along with their endowment and the investment success on that endowment. The age of facilities is factored in. Enrollment trends count. The haves and have nots comparison that results is stark, but it is not clear just what if anything the state might do about it.

One possible conclusion: Virginia is the only school well-positioned to fully end its status as a state school.

Sandridge was the APA expert called in when the University of Virginia’s Strategic Investment Fund was making headlines, and the legislative attention on that issue might have sent the state looking for a deeper analysis tool.

One of the slides he used with the House broke down endowment divided by student head count, and the disparity there really underlies much of the rest of the report. The per capita amount at the University of Virginia exceeds $260,000 and the per capita amount at George Mason is just one percent of that, about $2,600.

You don’t get more have and have not than that.

Leave a Reply

You must be logged in to post a comment.