The compromise income tax bill hailed for preventing a tax policy train wreck in Virginia includes one new provision not included in earlier bills, not mentioned in any of the Republican press releases and not yet included in any fiscal impact statements. Democrats wanted it.

It is yet another departure from the new federal Tax Cuts and Jobs Act. The bill maintains a formula to reduce or cap itemized deductions known as the Pease limit. TCJA removed the Pease limit at the federal level but the substitute tax bill voted on in committee Friday restores it at the state level.

Democrat Delegate Paul Krizek reported in his constituent newsletter that this creates a cap of $313,000 on Virginia deductions, “saving $80 million which can help fund some excellent programs like the Housing Trust Fund.” The Pease limit is a bit more complicated than that, as seen in this Forbes article from two years ago.

Democrat Delegate Paul Krizek reported in his constituent newsletter that this creates a cap of $313,000 on Virginia deductions, “saving $80 million which can help fund some excellent programs like the Housing Trust Fund.” The Pease limit is a bit more complicated than that, as seen in this Forbes article from two years ago.

This is the only variation from conformity to TCJA that added revenue for the state, rather than subtracting it. All the other variations from conformity in the pending bill lower taxes for people or businesses.

In a February 7 email to Delegate Vivian Watts, the senior Democrat on the House Finance Committee, the Department of Taxation estimated that keeping the Pease limit in Virginia’s tax rules increased state revenue $465 million over six years. All of that would come from taxpayers with substantial itemized deductions on high-end incomes. Charitable deductions would be among those limited.

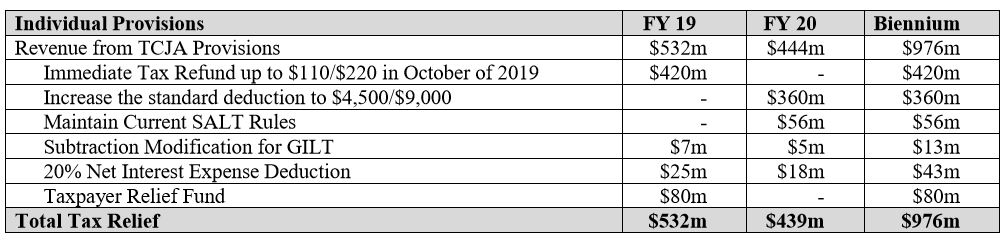

It was previously reported that the tax policy changes being pushed by General Assembly Republicans counteract (“give back”) only half of the $4.5 billion six-year total increase in income tax collections caused by conformity. Add this in, and the amount of tax relief is closer to 40 percent of the total additional collection, with more than 60 percent retained by the state treasury.

Looked at another way, more than 60 percent of the “tax increase” which has been the source of partisan bickering through much of 2018 and 2019 is surviving the General Assembly process. What relief is coming is front loaded, with the largest element to be delivered in the form of a one-time check a month before the 2019 elections.

Following a short standoff between the Republicans in the House and Senate over competing approaches, the Senate approach has prevailed, with this late addition related to the Pease limit. The bill is still to be voted on by the full House and Senate.

The surviving bill includes two elements benefiting most taxpayers. The first is the one-time lump sum rebate of $110 per person or $220 per couple, proposed for payment in October of this year. That is intended as compensation for the higher 2018 taxes imposed by conformity on tax returns now being filed with the state.

The second general element is a 50 percent increase in the standard deduction, the first for individuals since 1988 and the first for couples since 2005. The increase, well below other amounts proposed in bills that failed, is not enough to compensate for inflation over the years. The higher standard deduction reduces taxes by $360 million in the first year, but that covers an 18-month collection period. The total benefit to taxpayers is lower in future years.

An earlier House version would have allowed individuals to split their election on tax deductions and use the federal standard deduction while continuing to itemize on their state returns. That split election is not included in the bill which passed committee Friday. Taxpayers will still need to file the same way on both forms.

A surviving element from the House bill allows Virginians who do itemize to deduct their entire local real estate and property tax bills. On federal taxes, that deduction is now capped at $10,000. On Virginia taxes, the deduction will only be reduced if it bumps into the Pease limit. For some it will.

The final two elements of the compromise bill deal with variations from the federal law which produce lower state income taxes on large corporations. Several other elements of the federal law producing higher state business taxes were not addressed, and the Assembly rejected proposals to trim the corporate income tax rate. This is an indisputable corporate tax increase.

The political pronouncements Friday mentioned $1 billion in tax relief, but the benefits to average taxpayers included in that are limited to their share of the $420 million one-time rebate and the $360 million tax cut from the higher standard deduction. For tax years 2020 and beyond the tax reductions are much lower.

To tally up the results, the good things are (1) Virginia does conform in time for a smooth filing season this spring, and conformity by itself provides great benefit to some taxpayers, (2) all taxpayers get a one-time rebate (with no relationship to how much additional state tax they paid, if any), and (3) the standard deduction increase is permanent.

On the negative side, (1) less than half of the higher tax revenue is counteracted, or “given back”, over the first several years, (2) Virginia’s effective corporate tax rate will rise and (3) the list of provisions where Virginia varies from full conformity has grown again, now including one that raised taxes rather than lowering them.

The bill does capture additional dollars in a “Taxpayer Relief Fund” but the language directs that once those one-time rebate checks go out, the balance and any additional balances generated from federal tax reform “shall be transferred to the Revenue Reserve Fund.” Where the money goes from there is up to a future General Assembly.

Leave a Reply

You must be logged in to post a comment.