Virginia ended Fiscal Year (FY) 2021 with a record-breaking budget surplus of $2.6 billion. (Virginia’s budget year, or fiscal year, is from July 1 to June 30.) Virginia Governor Ralph Northam stated that the surplus was due to Virginia’s great business climate, pointing out that CNBC ranked Virginia as the #1 state for being business friendly. Not everyone agrees with CNBC. The Virginia Industry Foundation last November ranked Virginia as #11.

$800 million in tax hikes. Also, Governor Northam did not acknowledge that perhaps $800 million of the surplus is from two recent tax hikes. One is the internet sales tax, which started July 2019. The other is Virginia’s failure to increase its income tax standard deductions to conform to the federal standard deductions.

Currently the Virginia standard deduction for single and married filers is $4,500 and $9,000 compared to the 2021 federal deductions of $12,550 and $25,100. Many filers have itemized deductions that are less than the federal standard deduction but greater than the Virginia standard deduction. They opt for the federal standard deduction to save on federal taxes but are then forced by Virginia to use the Virginia standard deduction on their state return. They then pay more for their Virginia tax than they did with itemized deductions.

In 2019, the Virginia Department of Taxation estimated that the new internet sales tax would increase Virginia revenues by $175 million in FY2021. The Tax Foundation estimated that the lack of conformity between Virginia and federal standard deductions would increase Virginia revenues by $600 million.

Governor Northam’s press release on the FY2021 surplus did not specify how much of the surplus came from these two tax increases.

Republican gubernatorial candidate Glenn Youngkin has promised to double the Virginia standard deductions and return about $1 billion of the surplus in the form of one-time checks of $300 to single filers and $600 to joint filers.

Extra billions for public schools.

However, whenever Republicans propose cutting taxes, Democrats often counter by saying that the money is needed for the “underfunded” public schools.

For example, when State Senator Janet Howell, D-Fairfax, announced her run for re-election in 2019, she stated, “I am outraged that despite loud breast beating about the importance of education, we do very little to fund it.”

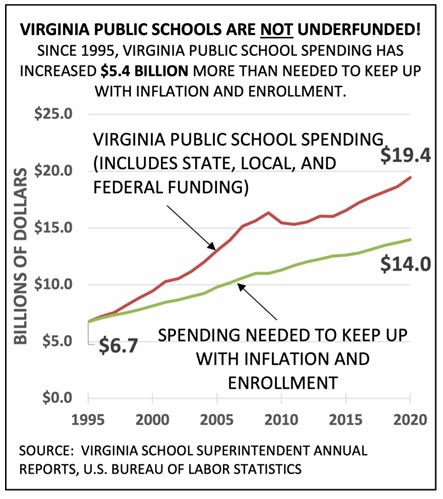

Senator Howell was first elected in 1995. Since then, Virginia spending on public schools has increased $5.4 billion more than needed to keep up with enrollment and inflation. This includes state, local, and federal funding.

Senator Howell, by virtue of the Democrats winning the majority in the state senate, is now chairman of the powerful Senate Finance Committee. It is sobering that the Senate Finance Committee chairman considers an extra $5.4 billion “very little.”

What is student achievement with the extra billions? Not good.

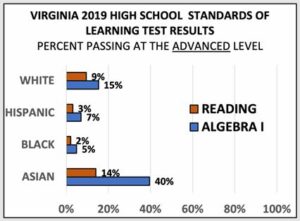

Every year Virginia administers Standards of Learning (SOL) tests statewide, including high school tests for reading and Algebra I. The SOL tests have two passing thresholds, “Pass Proficient” and “Pass Advanced.”

“Pass Proficient” is a misnomer; “Pass Barely Proficient” would be more appropriate as it corresponds to “D” level work, or just above failing. “Pass Advanced” is a better indicator of college and career readiness.

Statewide only 14% of Asians read at the Advanced level; and Whites, Blacks, and Hispanics do worse.

Statewide, 40% of Asians passed Algebra I at the Advanced level, while whites, Blacks, and Hispanics were at 15% or less.

Public schools’ flawed curriculum. The extra billions of dollars did not raise achievement. The reason is that public schools do not teach reading (they use “whole word” instead of intensive phonics for reading instruction) nor math (no math drill), little history (displaced by social studies) nor morals (unconstitutional).

The flawed reading and math instruction results in many children being unable to read and do math facts by 3rd grade, and they never catch up. Teachers are victims too, being forced to use bad curricula and deal with students who are frustrated because they’re not learning.

More taxes for schools that cannot teach reading and math are dollars wasted.

Public schools provide no upward mobility for low-income children. If you are poor in kindergarten, you will be poor as an adult. Also, lack of moral instruction, especially in Family Life Education, undermines the family, which is the other major component of high achievement.

Critical Race Theory. Another problem is Critical Race Theory, now called “Culturally Responsive Education.” Although what little history public schools teach ignores travesties in American history, Critical Race Theory tells students what America has done wrong and nothing about what America has done right. This biases students against the Constitution and towards socialism. Are students taught that Hitler was a socialist and that NAZI stands for National Socialist German Workers Party? It is ironic that public schools, which virtue signal about systemic racism, are perhaps the major reason why minorities have no upward mobility, due to the schools’ flawed curricula.End state control of public schools. What is to be done? First there should be no increase in public school funding until the curricula are fixed. However, state and local school boards have embraced bad curricula for nearly a century and show no signs of relenting.

So, second, end state control of public schools and let local school boards run their districts. Virginians pay the state Department of Education $300 million annually to administer mediocrity statewide. Maybe local school districts would compete to attract good students. Ending state control of public schools would require amending the Virginia constitution, which states in Article VIII that the General Assembly “… shall seek to ensure that an educational program of high quality is established …” The General Assembly has shown it is incapable of doing that.

School choice.

Third, as Glenn Youngkin has advocated but Terry McAuliffe opposes, enact school choice. One option is for school districts to give a voucher equal to the per-student cost for every child that leaves public school for private or home schooling. Another option is to replicate West Virginia’s Hope Scholarship, which allows parents to spend the state portion of school funding for private schools or home tutoring.

In any case, we need to stop increasing spending for public schools that perpetuate mediocrity and poverty and turn children against our country. Both students and teachers deserve to teach in schools where children really learn, teachers really teach, and students are not turned against a country that is (was?) so free and prosperous that the rest of the world wants to migrate here.

Arthur G. Purves is president of the Fairfax County Taxpayers Alliance. This column was originally published in the FCTA’s The Bulletin.

Leave a Reply

You must be logged in to post a comment.