After a month of unproductive political theater, Virginia’s leaders will finally sit down like adults and negotiate the budget. Better late than never. The message is “everything is back on the table,” which leaves the door wide open for the tax increase central to the Democrat’s demands. That deserves a quick no.

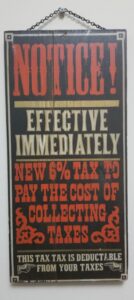

At this point, Virginians do not pay sales tax on their Netflix, Disney, or sports streaming package subscriptions. That is what they want to tax now. If you just paid an online vendor to file a tax return, next year a sales tax of up to 6 or 7% will be added to that bill. Likewise, any annual subscription for Microsoft Office or One Drive storage, or for an internet security system, will be taxed.

Substack will be taxed. Some online news and opinion streaming options will probably be protected by the exemption for newspapers, but others will not. That will be a fun dispute for the Tax Department to broker, one of many new rules to work out.

Did you pay to play that new movie on Amazon using bill credits you had built up? Will tax be added to that, as well? Or will the entire Prime membership trigger a tax? The whole idea is rife with questions and unintended consequences, even more so for the application of the tax to digital goods and services in the business realm. Taxing business purchases produces the big revenue.

At this point, the General Assembly members on both sides of the aisle are under the impression that few voters or business owners care about this proposed $1-2 billion expansion of the sales tax. It was part of a larger sales and income tax package that Governor Glenn Youngkin (R) proposed, which he combined into a net tax cut. The Democrats abandoned the tax cut portion and grabbed the sales tax with both hands, expanding it to the business taxpayers.

Between the regular session’s conclusion in March and this week’s reconvened session for considering vetoes and amendments, Virginians were largely silent on this digital sales tax expansion proposal. The phones were instead ringing about the proposals on gambling machines in convenience stores, and the bills granting local governments the option to propose higher local sales taxes.

Silence implies consent, but perhaps the silence was due to ignorance. People simply do not know what is proposed and which of their monthly bills will suddenly be taxed. With most other contentious issues from the session settled, more public focus on taxes is possible.

It would be helpful if some legislative panel convened a hearing, with both expert analysis and an opportunity for public comment, to raise some awareness of the impact. We need some independent data on how we would compare with other states. The nuances for the business taxpayers conducting transactions across state lines, or combining goods and services in one transaction, demand explanations.

Such a hearing would be helpful, but sadly is unlikely to happen.

Governor Youngkin successfully developed an amended budget that came close, close enough for government work, to the spending levels of the Assembly-passed version. He avoided the need for tax hikes in part by moving some capital projects to debt funding to release some cash, and by tapping into some non-general fund reserves. During the April 17 Kumbaya news conference on starting real budget talks, Democrats finally admitted his version and theirs were “close.”

Democrats could now start the budget negotiating process by keeping all that cash maneuvering of Youngkin’s version and still pushing for the $1-2 billion sales tax expansion. That could result in a budget even larger than the previous Assembly-approved version.

Governor Youngkin’s initial proposal to expand the sales tax and lower the income tax at the same time, increasing reliance on consumption taxes, has merit. But his income tax proposal was too easy to demonize as a tax break for the wealthy, and tax reform had no wind in its sails because it was not an issue during the 2023 elections. Too little advance work was done on the package before he sprang it as a surprise in December, along with an even more improbable car tax cut.

Tax cuts were a big GOP issue in 2021, one Republicans won with, and that led to great success for taxpayers in Youngkin’s first two years. Democrats were trying this year to reverse Youngkin’s tax cuts with a multi-pronged strategy. The digital sales tax, the payroll tax to cover their proposed workplace leave benefit, and the local option sales tax added up to about $4-5 billion a year in higher taxes, all three of them guaranteed to blossom over time with inflation.

The money people saved because the sales tax on groceries has been reduced, for example, would be returned to the state in the tax on digital items and services. Now is the wrong time to hit families with higher costs. Inflation is still ravaging family and business budgets. Virginia electricity bills are rising to chase dreams of renewable energy. Also on electricity bills, the Democrats are bound to push again to use the budget to revive the Regional Greenhouse Gas Initiative carbon tax, ultimately paid by consumers.

Balanced tax reform, even if revenue-neutral, must come from a bipartisan consensus. Accepting higher taxes in this budget simply to boost spending, especially a sales tax expansion the public does not know about and understand, would prevent a more comprehensive approach down the line. What makes sense is starting that process to find a bipartisan bill for 2025.

For now, the budget that emerges when the Assembly returns in May needs to depend on current tax rules only.

First published this morning by the Thomas Jefferson Institute for Public Policy.

Leave a Reply

You must be logged in to post a comment.