by James C. Sherlock

Governor Youngkin on Wednesday spoke to the Joint Advisory Board of Economists (the Board), part of a genuinely bipartisan structure established under Virginia law to support revenue assessments.

Which in turn must be used to support budgets. Which are, at least in Virginia, far more political than the revenue estimates.

The process is governed by Code of Virginia § 2.2-1503. Filing of six-year revenue plan by Governor.

In accordance with that law, every year by December 15 the Governor must prepare and submit to the members of the General Assembly an estimate of anticipated General Fund revenue, an estimate of anticipated transportation fund revenues, and estimates of anticipated revenues for each of the remaining major non-general funds, for a prospective period of six years.

In Glenn Youngkin, Virginia may never have had a governor with large scale revenue estimates so clearly in his experiential wheelhouse. He is a valuable asset when this year those estimates will be perhaps as difficult as they have been in at least four decades.

Wrong or right, especially for the coming year, they will have major impacts.

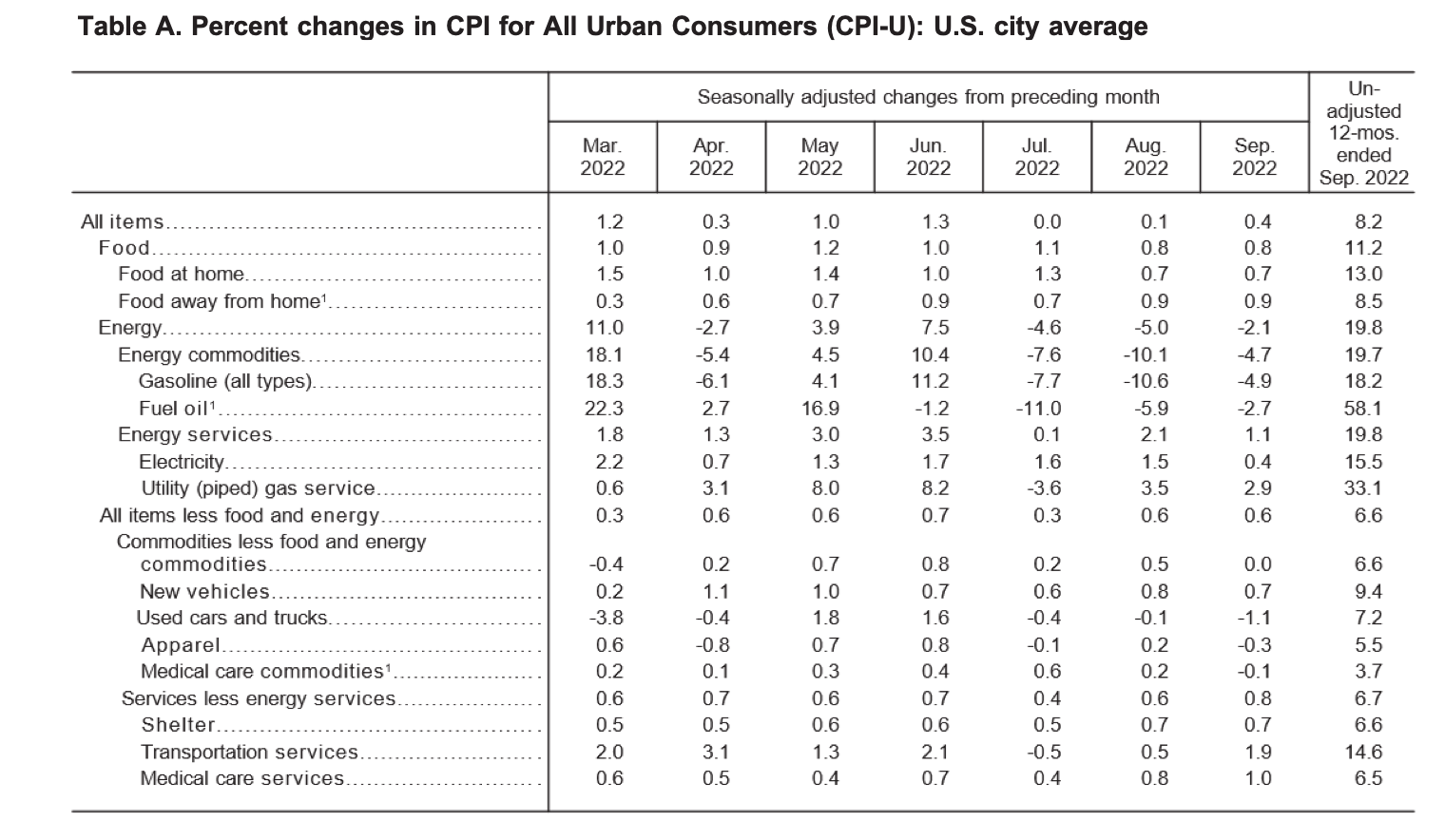

- Inflation can inflate both government revenues and government costs in perhaps unequal measure; and

- Recession can bring decreased revenue in the face of increasing demands for services.

The Governor’s estimates are based in part on the advice of the Board and of an Advisory Council on Revenue Estimates (the Council).

- The Board is chaired by the Secretary of Finance. It consists of the Staff Director of the House Committee on Appropriations, the Staff Director of the Senate Committee on Finance and Appropriations, and 15 non-legislative citizen members, 12 to be appointed by the Governor, at least eight being citizens of the Commonwealth, and three by the Joint Rules Committee, at least two being citizens of the Commonwealth.

- The Council, of which the Governor is chairman, shall include the Speaker and Majority Leader of the House of Delegates; the President pro tempore and Majority Leader of the Senate; the Chairmen of the House Committee on Appropriations, the House Committee on Finance, and the Senate Committee on Finance and Appropriations or their designees; two members of the House of Delegates to be appointed by the Speaker of the House; two members of the Senate to be appointed by the Chairman of the Senate Committee on Finance and Appropriations; and 15 to 20 non-legislative citizen members representing the private sector, appointed by the Governor.

Governor Youngkin on Wednesday shared with the Board his thoughts on issues important to the work. He asked them to pay attention to housing and energy prices, consumer expectations, labor participation, corporate investment and small business health.

His focus on housing costs and energy markets was driven by both primary and secondary effects those costs have on the rest of the economy.

The bad news. This morning, the Governor, those two panels, and the rest of us were presented with data that will make their tasks both more difficult and more important this year.

Year-over-year inflation increased in all categories as of September 30th.

In this particular exercise of projecting future state revenue, debates about who or what is responsible for that inflation are not relevant.

The Governor and his advisors have to deal with it. But even more difficult, they need in their revenue estimates to embed expectations:

- not only for whether inflation will get better or worse and whether it will lead to recession, and if so how deep; but also

- when in their six-year time horizon those things may happen.

The revenue estimates, of course, are the basis for budgets.

Does the General Assembly need to adjust last year’s biennial budget? If so, by how much? The exercise will be even more impactful next year as the basis for a new biennial budget.

The estimates in December will face major scrutiny, as they should. But at least Virginia has a bipartisan process for developing them.

We wish them well.

The budget decisions will be tougher yet.

Leave a Reply

You must be logged in to post a comment.