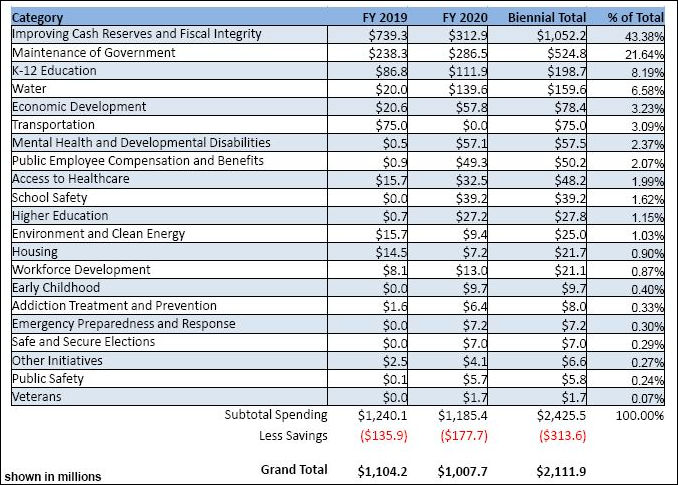

Thanks to economic growth and windfall tax revenues, Governor Ralph Northam expects Virginia to spend $2.1 billion more in its next biennial General Assembly budget. He proposes setting aside 44% in financial reserves and spending the rest. He does not propose giving anything back to Virginia taxpayers, according to documents released by the Department of Finance today.

Medicaid (which falls under “maintenance of government” in the table above) takes the lion’s share of new revenue, followed by state support for K-12 education, clean water, economic development, transportation, and mental health.

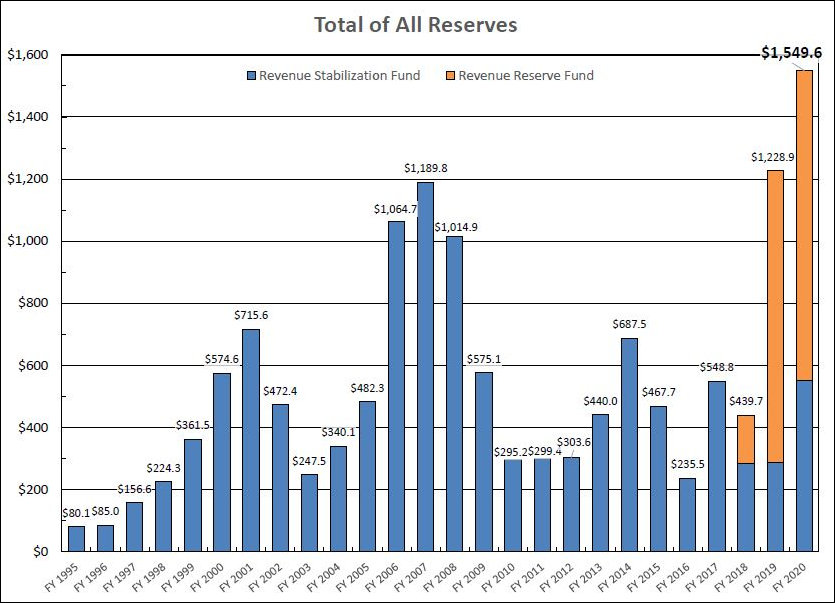

Critical to Northam’s proposed budget is a distinction between ongoing revenue sources and one-time resources. The influx of revenue from conformity to the 2018 tax reform act will yield hundreds of millions of dollars to the state. However, because changes to the federal tax last only five years, the Northam administration reviews the resulting windfall as temporary, not the basis for long-term budgeting. Accordingly, “temporary” revenue sources are spent on one-time budget items — primarily adding a bit more than $1 billion to Virginia’s meager revenue reserves and revenue stabilization fund over the next two two years, with smaller sums for water quality and rural broadband.

The draining down of budgetary reserves threatened Virginia’s AAA bond rating and was averted only by a significant injection of funds in the 2018 budget. But Virginia is still ill equipped to deal with another recession. A repeat of a 2007 recession scenario could result in a three-year lost of $9 billion in General Fund revenue. Even Northam’s budget would boost the budget reserves to only $1.549 billion by fiscal 2020.

Northam’s budget provides $216 million in Earned Income Tax Credit (EITC) benefits to lower-income Virginians and $20 million in higher-ed financial aid, but there’s not much in the budget for middle- and upper-middle class Virginians, who will pay most of the extra taxes.

Update: Republicans are not happy with the proposed budget. Said House Speaker Kirck Cox: “They are touting around $2.2 billion worth of spending and that is really paid for mainly by $1.2 billion worth of tax increases on the middle class.”

Leave a Reply

You must be logged in to post a comment.