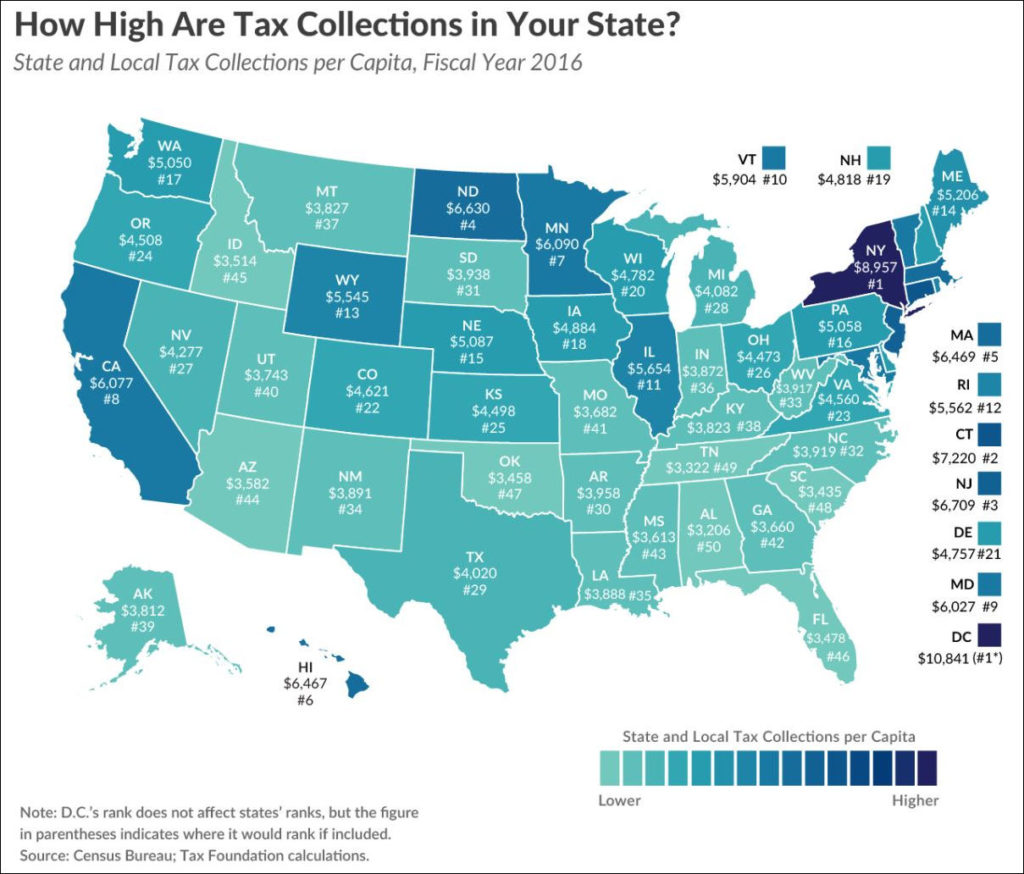

An average tax collections per capita of $4,560 ranked Virginia 23rd in the country for highest state and local tax burden in Fiscal 2016, according to the 2019 Tax Foundation report. That’s up from $4,204 and a 26th rank in Fiscal 2014.

Is it worth it? Are we getting a big bang for our buck, or are we, as the northernmost Southern state, becoming more and more like the Northeastern and Mid-Atlantic states?

Leave a Reply

You must be logged in to post a comment.