With some of its closest legislative allies facing primary challenges next week, much of what Dominion Energy Virginia filed Friday in response to questions about the consumer cost of its future plans is redacted. The story in Tuesday’s Richmond Times-Dispatch (here) could only cover that portion of the data not kept secret.

Three of the four documents filed by Dominion are about its motion requesting protected status for the information, and the fourth (here) includes numerous blacked out portions, which we will not see unless the SCC rejects those motions.

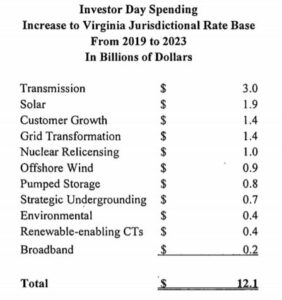

The newspaper headline was bad enough, especially for the many legislators who voted for the 2018 Ratepayer Bill Transformation Act. The $12 billion in capital investment, much of it related to that legislation, could add $29 a month to a residential customer’s bill. For the many residential customers who use more than the illustrated 1,000 kWh per month, the cost will be higher.

The report filed appears to include the total bill impact for the various proposed investments but keeps secret the impact of the individual projects and their timing. When does Dominion really plan to build offshore wind, apply to extend its nuclear licenses, or proceed with a new pumped storage facility promised to Southwest Virginia legislators? What is their bill impact? That’s all covered up with black ink.

“The Projected Rate Information is competitively-sensitive information that, if not afforded the highest level of protection, could result in harm to Dominion Energy Virginia and its customers,” Dominion’s lawyers wrote in their motion for protected status. Another theory is the full truth might be politically sensitive in certain circles.

The filing is now part of the insanely-thick record (here) for the pending Integrated Resource Plan case. The additional data was demanded by the SCC after Dominion held an investor presentation on its plans in late March, outlining several capital projects which were not included in the original IRP or an amended version. The SCC staff, it its commentary on this new data (here) and the chart copied above, refers to it as “Investor Day Spending.”

The staff’s analysis states that the current value of the company’s capital rate base for its Virginia jurisdictional customers is $18 billion and the various proposals would add another $12 billion by the end of 2023. That growth is somewhat offset by a reduction of $3.6 billion in the rate base as existing assets are paid off or retired. The actual assets the utility projects will leave the rate base are not detailed.

But will customers actually see reductions in their bills due to those assets being paid off or retired? That change could only occur following a true rate case looking at the totality of the company’s finances and lowering the base rate, a process the company has persuaded the General Assembly to delay, prevent or manipulate several times to date.

The company is also offsetting the projected cost of the new projects with expectations that fuel costs will go down, with declining cost for natural gas and the increased use of renewable generation with no cost for fuel. The details on those projections are also lacking from the public portions of this filed testimony.

The substantial drop in fuel prices, if it comes to pass, means a very different impact on residential and large commercial customers. Large customer bills are more dependent on the cost of fuel. Assuming all of Dominion projections come to pass and all the projects go forward at the present cost estimates, a large GS-4 customer might see only a 2 percent net increase where the residential hike is closer to 18 percent.

The political sensitivity of this filing by the company is highlighted by who signed the cover letter, President and CEO Paul Koontz. None of it is redacted and here are a couple of key paragraphs:

Many of these investments are promoted and enabled by the public policy priorities of the 2018 Grid Transformation and Security Act (“GTSA”). Some of them will be funded through rate adjustment clauses (with Commission approval), and others will be recovered through existing base rates, which have not increased since 1992, and which by law cannot increase any earlier than 2025. All investments will be made in furtherance of ensuring a more modern, resilient, secure, diverse, and lower emission energy system to meet our customers’ growing needs and preferences for electric service….

In fact, the Company expects, based on current projections, that the new chapter of regulation under the (Grid Transformation and Security Act) will mirror the successful record over the last decade. The 2007 Act prioritized investment in new electric generation resources to make Virginia self-reliant and minimize the risks of supply from volatile external markets. Between 2008 and 2018, the Company committed over $6.5 billion to develop more than 6,000 MW of new, cost-effective utility-owned generation infrastructure that will serve Virginians for many decades. The Virginia jurisdictional rate base grew from just under $10 billion in 2008 to $18 billion in 2018. However, the typical residential bill increased only to $114.42 from $107.20 over the same period—just 6.7% in the aggregate over ten years, or less than 30% of the general rate of inflation. And the industrial rates actually decreased between 2008 and 2018 by 3%, from 6.3 cents/kWh to 6.1 cents/kWh.

If things really are that great, why all the secrecy again?

Leave a Reply

You must be logged in to post a comment.