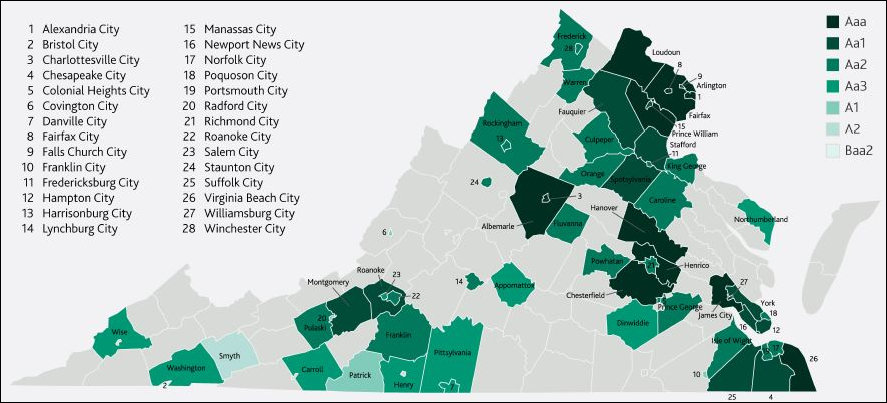

Moody’s, the bond-rating firm, has disseminated a new report on the credit quality of Virginia local governments — answering many of the questions we have been posing on this blog.

The good news is that Moody’s rates Virginia’s business climate highly and says that local governments have “wide latitude” to protect their bond ratings by raising taxes and cutting expenses.

The bad news is that local-government flexibility to raise property tax rates might reassure bond holders but is not a prospect that taxpayers will relish. Which raises the question: How likely are local governments to raise property tax rates? Moody’s does not get into that, but it does observe that that Virginia local governments have high debt burdens, big pension obligations, and aging infrastructure to contend with.

For your reading pleasure, I have extracted verbatim the high-level conclusions from the Moody’s report:

- High debt burdens can constrain local governments’ financial flexibility. In general, Virginia local governments have debt burdens that exceed national medians, largely due to debt issued for schools. High debt burdens lead to higher-than-average fixed costs, including debt service, the annual required contribution for pensions, and the “pay-as-you-go” portion of retiree health benefits. In turn, local governments’ flexibility to raise funds to address capital needs faces limits.

- The federal government’s major role in Virginia’s economy is a strength but carries some risk of cutbacks. The state is home to the world’s largest naval base and the Pentagon as well as a number of non-military operations. In 2016, it ranked first in the US in military spending as a share of gross state product (11.8%). While the Hampton Roads and Northern Virginia economies benefit from the large federal government presence, both face exposure to federal budget reductions, though massive cuts are unlikely.

- Continued private-sector investment will boost revenues and provide stability. A highly education workforce, weak union protections and significant population growth will continue to generate private-sector expansion. The expanding private sector will fuel tax base growth and provide a stabilizing factor in case of cuts in military and other federal government spending. Virginia has experienced a substantial bump in Eds and Meds with the higher education and healthcare industries consuming a greater share of employment.

- Legal framework helps local governments maintain solid reserves. Cities and counties can raise property taxes, their largest revenue source, without state-imposed caps or voter approval. The ability to control the tax rate, along with flexibility to reduce personnel costs, has contributed to strong financial positions. However, operating funds include school operators, so reserves generally trail national medians.

I’ll provide details in future blog posts.

Leave a Reply

You must be logged in to post a comment.