By Steve Haner

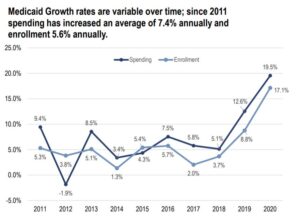

Just under two years into Virginia’s Medicaid expansion, and less than one year into a pandemic-sparked economic crisis, enrollment in the program is now about 1.5 million Virginians. Enrollment has grown more than 25% in less than two years and spending more than 30%.

The financial impact on state taxpayers has been blunted by a COVID-19 related boost in the federal share of the program costs, which is expected to continue well into 2021. But the federal legislation providing the money also prohibited the state from removing recipients from the program unless they actually moved away.

The Senate Finance and Appropriations Committee got an update from staff on the Medicaid program at its virtual “retreat” on November 19. Additional information is available from the Medicaid expansion dashboard still maintained by the Department of Medical Assistance Services (DMAS).

Beyond its importance as a very expensive and the fastest-growing state budget element, Medicaid will play a role in two other 2021 stories.

It will likely be a major issue in the contest for the Republican nomination for Governor, with Senator Amanda Chase of Chesterfield criticizing Republican colleagues who supported the 2018 decision to expand eligibility and provider payments. Those include former House Speaker Kirk Cox of Colonial Heights, who is running, and Senator Emmett Hanger of Augusta County, who may run.

Also, every household on Medicaid in the service territory of one of the two major electricity providers will be eligible for the new Percentage of Income Payment Plan. Their actual income or electricity costs will determine the benefit, if any, but being on Medicaid qualifies them for consideration. The electricity bill subsidies could be substantial.

Some of the important points from the November 19 briefing presentation:

- Enrollment has grown more than 85% in ten years, from about 800,000 in 2011 to 1.5 million, far faster than the state’s population.

- When the 2018 General Assembly approved Medicaid expansion, it was projected to add 378,000 recipients by now. Instead it has added 480,000, perhaps accelerated by the pandemic.

- The maintenance-of-enrollment requirement imposed to receive the additional COVID funds added about $127 million in costs. How many recipients would otherwise have lost eligibility is not detailed.

- Eventually, the enrollment growth may overcome the benefit from the COVID-19 enhanced federal share, leaving the state with net growth in costs. And the enhanced federal benefit is set to end in 2021.

- If program growth continues into the 2022-24 period at just 6% per year (half the recent rate), another $1.1 billion in taxpayer general funds will be required.

- Legislative decisions to increase the state minimum wage and create a new Medicaid dental benefit for adults will drive up costs in future years once fully in force.

The 2018 General Assembly approved two assessments on private hospitals, one to fund expansion and the other to cover higher payments for service to hospitals and other providers. In the first full year they were imposed, Fiscal Year 2020, they collected $602 million. It is projected to be just under $1 billion by FY 2022, and to exceed $1 billion the following year.

The money flows right back to medical providers with matching federal funds attached, providing what is expected to be net additional revenue for them of $1.9 billion this year and more than $2.2 billion in FY 2023.

Whether those hospital assessments are taxes or fees is debatable, but they will continue to grow rapidly and remain missing as an income item on most state budget summaries. At $1 billion-plus per year they will rank among the four or five largest state revenue streams.

As is usually the case, the committee presentation focused mainly on enrollment and dollars, with no attention paid to any improvements to the health of the population served. Even on the DMAS program summary, there is only rudimentary information on services utilized, still without any health metrics. It provides some “before and after” data on expansion but mentions different things, so is not a comparison (while it looks like one.).

It mentions that before expansion, 25% of Virginians used emergency departments for routine care, 25% spent more than $500 out of pocket, and 37% reported a health condition that prevented employment. So, two years into expansion with another half-million people covered, have those changed? Since expansion, 80% of that population has used at least one service, and two-thirds have filled at least one prescription. Is there actual evidence of better health? Wouldn’t that be good to know?

Leave a Reply

You must be logged in to post a comment.