Virginia’s most effective tax collector is inflation.

Virginia’s long refusal to adjust any element of its income tax for slow but constant inflation means that each year, a slightly higher percentage of your growing income is taxed, and the rising costs of living shrink the value of the standard deduction and push more of your income into the top tax bracket.

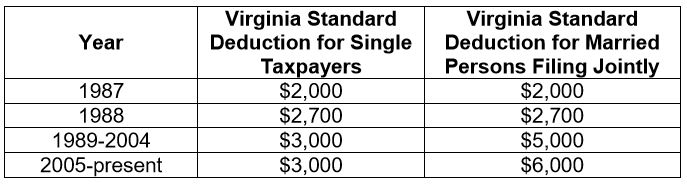

In 1990 Virginia’s income tax looked like it does today – an $800 personal exemption, a $3,000 standard deduction for a single taxpayer, and income above $17,000 was taxed at the maximum rate of 5.75 percent.

Had the 1990 tax code also included a provision to adjust those amounts annually for inflation, today the personal exemption would be $1,578, the individual standard deduction $5,916 and the top tax rate would not kick in until $33,524. The higher personal exemption and standard deduction combined would eliminate the tax bite on almost $9,000 income for a family of four – saving over $500.

Those figures come from a simple on-line calculator, with the baseline of January 1990 and the amounts adjusted to December 2018, a period of about 97 percent inflation. Call it indexing, call it a cost of living adjustment, the bottom line is the same. Such annual adjustments are widespread in the economy, and the federal tax system adjusts annually.

In 1990, the federal personal exemption was $2,050 and by 2017 that had risen to $4,050. The 1990 federal standard deduction was $5,450 and was $12,700 in 2017. That’s indexing at work.

The Virginia General Assembly has consistently refused to recognize the impact of inflation on our tax code, doing the most damage to those working middle class families who dominate campaign rhetoric.

It has another chance during the 2019 debate over how to respond to recent changes in the federal tax system, which are producing a $600 million or more annual boost in state revenue. Several pending bills pick up on a Thomas Jefferson Institute for Public Policy call to start indexing in 2020, with the next state budget cycle. They would use the same measure used by the federal IRS.

Those bills would also make one of the key inflation adjustments immediately, a 100 percent increase in the standard deduction to $6,000 per person or $12,000 per couple. Technically, that is just the 1990 amount adjusted for inflation. A failure of the legislature to at least do that, to make that one fair adjustment, would be hard to explain given this opportunity.

But the beauty of slow and steady inflation, to the Tax Man anyway, is most people don’t notice it. These aren’t the days of the 1970s, with double digit annual price increases. And the most politically-aware and connected taxpayers have a strong protection against the erosive power of inflation – they take itemized deductions.

When inflation increases their home value and local tax bill, when they buy a new house (or second house) and get a larger mortgage or buy a new car and get a larger car tax bill, the tax system subsidizes those costs. They get some of it back by deducting it off their state tax bill. If they have high medical costs, again, those can produce some tax savings. Since 1990 most of those people have seen those costs and other costs rise, but the tax code has shielded the full impact.

Not so people taking the standard deduction. They pay higher rents than in 1990 (with their landlords deducting taxes and interest), they also pay higher car tax and medical costs, but the state standard deduction today is worth half what it was in 1990. Half. It will continue to drop in real value if nothing is done.

Protecting people who take itemized deductions, especially people who pay the highest local real estate and car taxes, is an incredibly important priority to a short-sighted group of Virginia legislators. We sort the members of the General Assembly by party, gender, and note which have rural and urban districts. Perhaps we should also ask all 140 which way they do their taxes: using Virginia’s frozen and eroded standard deduction, or using the itemized method which protects them from inflation?

Itemized deductions with their automatic inflation protection show how the tax code is written by the well-off to benefit the well-off. The federally-driven economic safety net system for low-income families is also adjusted for inflation, including the Earned Income Tax Credit grant program that Governor Ralph Northam is promoting.

Will the General Assembly leave town without giving the same protections to everybody in the middle?

Leave a Reply

You must be logged in to post a comment.