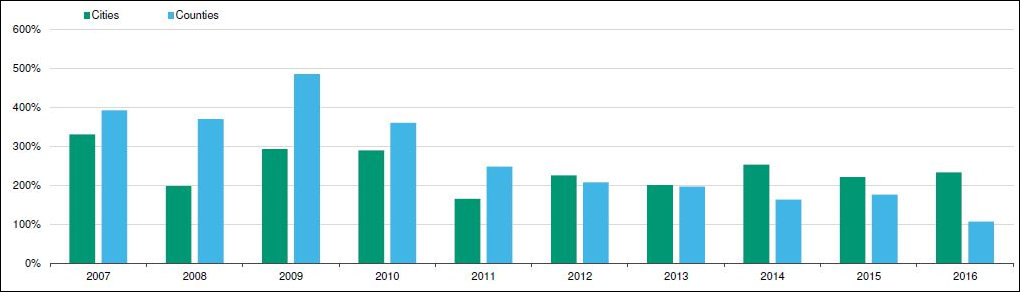

I’ve been strenuously making the point over the past several months that there are many ways for state and local governments to run hidden deficits. One of those is deferred maintenance — an issue that has played out most prominently in the debate over aging, run-down school buildings. What I never realized is that there is a way to measure the extent to which local governments kick the maintenance can down the road. It turns out that we can track what Moody’s calls the “median capital asset reinvestment ratio.”

I cannot find an exact definition of this ratio, but, generally speaking, it expresses a local government’s capital investments as a ratio of its assets. A higher ratio indicates that local governments are spending more — building new buildings and infrastructure and/or renovating, retrofitting and otherwise updating older facilities. A lower ratio is a tip-off that a local government might be falling behind on repairs and maintenance.

The chart above shows that Virginia localities had healthy capital asset reinvestment ratios a decade ago, but those ratios have declined sharply in recent years — barely reaching replacement value for Virginia counties. As Moody’s writes in a recently issued report on the credit quality of Virginia localities:

The condition of capital assets has suffered from a lack of investment. Asset quality will likely improve if local governments make capital investment a priority. But funding will be a challenge, given the already above-average fixed-cost burdens many Virginia local governments carry.

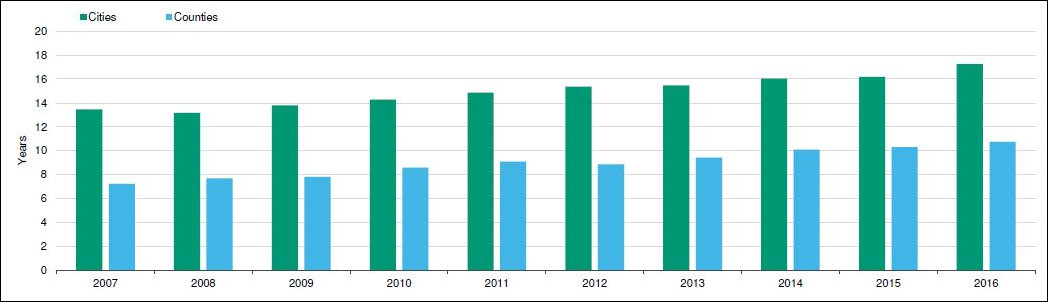

A slowdown in capital investment is reflected in another statistic, the median age of capital assets.

As this graph shows, the average age of Virginia’s capital assets is steadily and relentlessly increasing for both cities and counties. Needless to say, there is variability between jurisdictions. Some localities do a better job of maintaining the level of capital investment than others. The Richmond Public School System is noteworthy for doing a particularly poor job — keeping open more schools than justified by the number of students and scrimping on maintenance and repairs. But the problem goes far beyond the City of Richmond.

Growth Ponzi scheme. In past posts I have discussed Charles Marohn’s concept of the “growth Ponzi scheme,” a malady afflicting fast-growth counties. Under the logic of the growth Ponzi scheme, counties encourage inefficient growth (low-density, autocentric, segregated land uses in contrast to walkable, mixed-use projects) to get a quick hit of revenue from new development. Typically, developers pay for their own roads, water and sewer, plus proffers and impact fees, and then turn the assets over to counties for maintenance, so counties have only modest up-front costs. After 20 or 30 years, however, the assets need replacing and aging and tax-inefficient projects now cost more than they reap in revenue. Counties have kept the system going by soliciting more growth.

Eventually, the Ponzi scheme sputters and stalls. Counties run out of new land to develop. Recessions put an end to growth. We can see this happening in the top chart. In the go-go days of the early 2000s (not seen on the chart) and even in the recession, Virginia counties dedicated considerably more to capital investment than did cities. They built a vast, costly infrastructure of roads, utilities and other public amenities. Since then, maintenance has consumed an increasing share of capital spending. Absolute levels of capital spending may look robust compared to past levels, but as a ratio of assets, they’re not.

If you think Richmond Public School buildings are a blight, just wait twenty years and see what happens to the infrastructure quality of Virginia counties as they continue to under-invest in capital spending.

Essential ratios. There are undoubtedly complexities and nuances to the capital spending I’ve discussed here. And a general statement that applies to one locality may not apply to another. But these ratios are critical to evaluating the fiscal health of local government. Every city and county manager should have these ratios at their fingertips. Every council and board member should know them by heart. If they don’t, they have no idea what they’re doing, and they should be booted out of office.

Leave a Reply

You must be logged in to post a comment.