A joke making the rounds Wednesday had Governor Ralph Northam agreeing that Virginians did deserve a return of the windfall tax increase flowing to the state due to conformity, but we’d have to take it as Amazon Prime memberships. Don’t expect laughter if the 2019 General Assembly votes out a massive multi-year incentive package for a super-wealthy corporation and refuses a simple and broad-based tax reform proposal for almost everybody else.

Give it back.

In the past few days the General Assembly’s key money committees have discussed what to do about the gush of new revenue the state will garner when it conforms to this year’s new federal tax regime. They should give it back.

After wrestling with different approaches over the last few months and consulting stakeholders, the public policy group I’m affiliated with, the Thomas Jefferson Institute, has settled on two basic steps that have always been on the options short-list.

1) For individual taxpayers, the state should double its standard deduction to $6,000 for individuals and $12,000 for couples. That removes up to $6,000 from the taxable income of an estimated 2.8 million Virginia tax returns, the vast majority of Virginia taxpayers.

2) For Virginia’s incorporated businesses, the corporate income tax rate should be cut from 6 percent currently to 5.5 percent for 2018 and 5.0 percent for 2019.

Both steps should be retroactive to tax year 2018 so they would reduce the taxes you compute for the state in a few months.

Both steps are first steps, because all indications are the state tax increases created by the federal tax changes will accelerate in future, by the state’s own estimates. Even a standard deduction of $12,000 is too low for a family and should rise more.

Neither step squeezes the state budget. The amount of “windfall” revenue returned by these changes is still lower than the estimated new revenue conformity creates. On an individual basis there will still be winners and losers, but the current state budget is not among the losers. No spending need be cut.

The drumbeat on this issue started by multiple posts on Bacon’s Rebellion has spread, sparking only a few comments at a recent House Appropriations Committee meeting and a presentation in front of the Senate Finance Committee Thursday. The tone of the Senate meeting, which I did not attend, may be reflected in this Richmond Times-Dispatch account where any effort to prevent the tax increase is framed as a loss of state revenue.

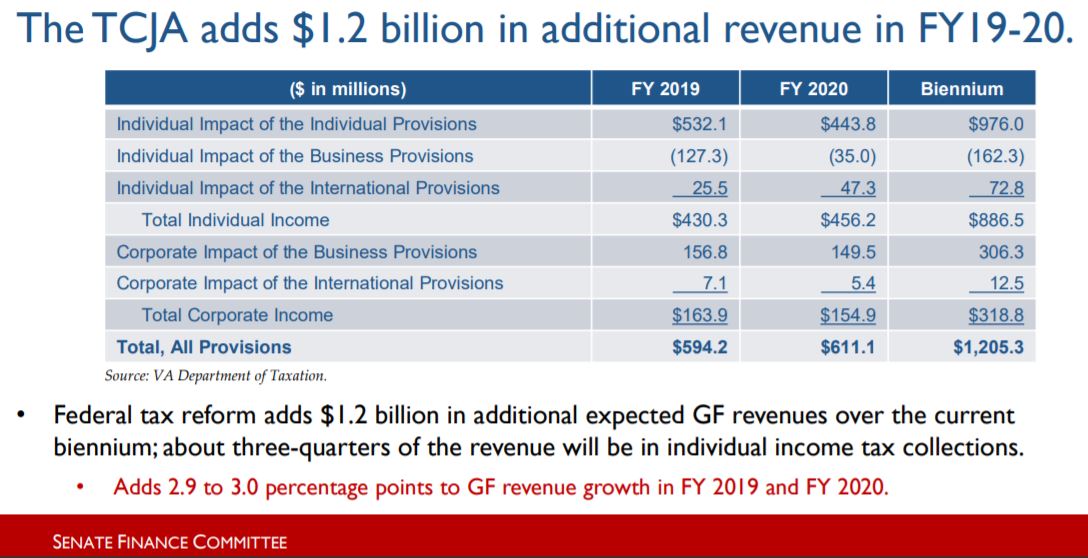

The Senate Finance staff produced the slide used above which slices the conformity revenue projection a new and useful way. It separates the business tax impacts into two measures, those that show up on individual returns because the business is not incorporated and those that show up on corporate returns. With that split you can see that the state impact of conformity is immediately quite positive to pass-through businesses and immediately a substantial tax increase on corporations.

The way the Northam Administration had packaged the same data implied the impact on business in the first year was minimal. Not so.

That extra $157 million hit to corporations in the first year represents about a 17 percent increase over the base projection for corporate income taxes and (don’t you love it when a plan comes together?) we propose a 17 percent cut in the rate.

The idea of increasing the standard deduction for individuals must also have great appeal, because the Senate is considering a temporary substitute – a tax credit that would have a similar impact for taxpayers (perhaps not as substantial) but would not be a permanent change in the rules. What Virginia needs, and what taxpayers should demand, is a permanent change. The idea that Virginia would continue to stand on its ridiculously low standard deduction deeper into the 21st Century is troubling.

People who have large mortgages, second homes, large local property tax bills, large charitable deductions and other ways to lower their taxes will continue to use them as itemized deductions. Low income and middle-class workers who don’t have those deductions have been stuck with the same inadequate standard deduction for decades. This is the best opportunity to change that since 1987.

State revenues are finally growing again, at least in part because of the economic activity resulting from the federal tax changes. In the first four months of the fiscal year (July-October) revenue shot up ten percent, blowing past a 1.5 percent growth estimate. Both the Senate and the House committee staffs this week projected hundreds of millions in new dollars that are not due to conformity, and not yet committed to any spending requirement.

Both committee staffs were quick to add long lists of unexpected bills showing up, the largest due to errors in Medicaid cost forecasting that are embarrassingly large, large enough to question the competence of the forecasters or the diligence of overseers or both. These Medicaid cost overruns will be among the first things cited by people arguing Virginia cannot afford to offer any tax relief and must keep all the “windfall” dollars.

Leave a Reply

You must be logged in to post a comment.