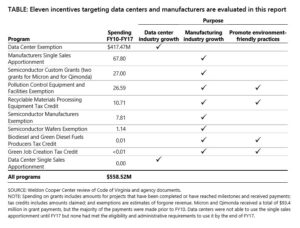

The recent report from the Joint Legislative Audit and Review Commission on economic incentives related to manufacturing (here) goes far beyond a discussion of data centers, and if the General Assembly accepts it as gospel some of the existing incentives might be in jeopardy.

Two programs aimed at environmental goals should be eliminated, the staff (and by its vote the full legislative panel) concluded: The Green Jobs Creation Tax Credit and the Green Diesel Fuel Producers Tax Credit. Neither is being used to any extent.

The 127-page report also says a Rosary over some highly touted grants and incentives offered to microchip manufacturers but does not recommend burial just yet. Virginia’s early success in that arena did not continue to build, not at the same rate as the data centers. Virginia employment in the semiconductor arena is declining now.

Manufacturing is a key part of Virginia’s economy. The jobs pay well, factories need complex supply chains that also generate jobs and taxes, and local governments suck property tax dollars out of their manufacturing operations like vampires. It is unfortunate that this report mingled manufacturing issues with the data centers, which are a service industry with low employment and minimal supply chains. The data center information grabbed the headlines.

This report looks at two tax provisions important to manufacturing across the board, the single sales factor apportionment option and the property tax exemption for pollution control equipment. And it looks in depth at how Virginia’s effort to attract semiconductor manufacturing has sputtered, despite various state incentives. This column focuses on that industry’s incentives.

There is one useful observation that comes from reading the data center analysis and the information on the microchip industry in sequence. The data center exemption focuses on the capital cost of building the facility and filling it with equipment. The semiconductor industry didn’t get that. Should that become the model for manufacturing incentives across the board? (Translation: The machinery and tools tax and other business property taxes are the problem.)

Virginia approved $195 million in incentives for five manufacturing facilities but paid out only $93.4 million between 1996 and 2017 (most of it before 2010). That sector’s employment in the state has declined precipitously since 2001, at about twice the rate of decline as the nation as a whole has seen. The international competition is winning overall, but other states are also beating out Virginia for domestic production. Production in Virginia continues at Micron and Qimonda.

This was all as of 2017. The report intentionally ignores the planned expansion of Micron in Prince William County fueled by another $70 million grant approval, since it is too soon to know how that works out. Looking at the past, the JLARC staff (well, actually Weldon Cooper Center under contract) reported that the help given to Micron had more impact than the grants awarded to the other major Virginia entity, Qimonda.

“The return in revenue from both custom grants is also moderate, with Micron again yielding a higher return. The return in revenue for every $1 spent on the Micron custom grants was 97¢ annually, on average, and the return in revenue for the Qimonda custom grants was 49¢. These returns in revenue are similar to the returns (55¢) for all grants collectively per $1 dollar in total grant spending. (See Economic Incentive Grants 2018, JLARC, 2018.)”

We’ve been here before. That 2018 report cited sparked this from me on Bacon’s Rebellion. Nothing in this report indicates a change in methodology and citing a comparison to that report indicates it is the same methodology. Here is a key paragraph from my report:

“In analyzing the payback on the grants and tax incentives, Weldon Cooper has added another factor seldom mentioned: It estimated and accounted for “reduction in economic activity because of the tax increase to pay for the sales and use tax exemptions (or grants).” This is the kind of dynamic scoring of opportunity cost that is rarely used by the state. In fact, not everybody on the state payroll is willing to admit that raising or lowering taxes has an inverse impact on employment and gross domestic product.”

The money paid to Micron and Qimonda has been in form of post-performance grants, tied to job creation and capital investment. For Weldon Cooper and JLARC to treat that as “spending” is legitimate. It is not clear in this report if the 97 cents of revenue it claims the state and localities have received is the combined benefit from each $1 in grants, or an annual return on that $1. If annual and recurring, that is a fantastic return by anybody’s standards.

The report also looks at two tax exemptions tied to that industry, which combined produced less than $9 million in tax savings over eight years. Teasing out the impact of those versus the grant programs can’t have been easy, but JLARC credits them with creating 43 additional jobs, $7 million in state GDP and $4.3 million in annual personal income ($100,000 per job.)

Here’s an ominous note buried in the report on these provisions, perhaps a sign of things to come? “One factor likely limiting the economic benefits of the sales tax exemptions for semiconductors is that, unlike the data center exemption and many incentive grants, eligibility is not contingent on the companies achieving certain levels of job creation and capital investment.”

Everybody interested in the state’s economic development incentives and related tax policy needs to dig into this report. If this is how a Republican-dominated JLARC views things, wait until the other team has its hands on the reins.

Leave a Reply

You must be logged in to post a comment.