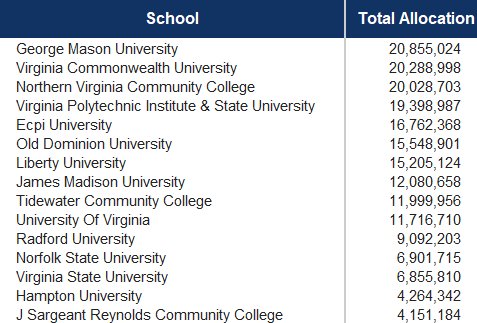

How much money are Virginia colleges and universities getting in federal COVID-relief helicopter dollars? More than $294 million, according to data published by OpenTheBooks in Forbes. The biggest winners are Virginia’s big public universities — George Mason University, Virginia Commonwealth University, and Virginia Tech foremost among them — but Liberty University, a private nonprofit, and Ecpi, a private for-profit, made the top ten as well.

The money will surely help higher-ed institutions, many of which have felt compelled to partially refund tuition revenue, and all of which are terrified how continued emergency shutdown measures will impact fall enrollments and tuition revenue. Many smaller, private institutions were facing enrollment crises even before the pandemic struck.

But will it be enough? While the funds surely will be welcome, they will fall far short of offsetting lost revenue at many institutions. VCU has said it faces a loss of $50 million, while the College of William & Mary has projected a shortfall of $3 million to $32 million.

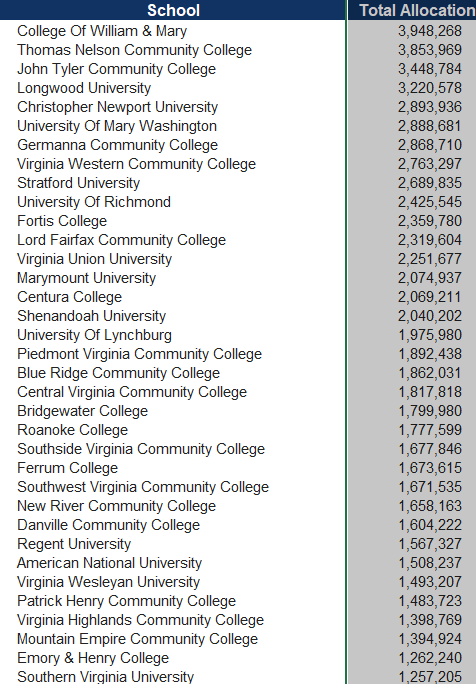

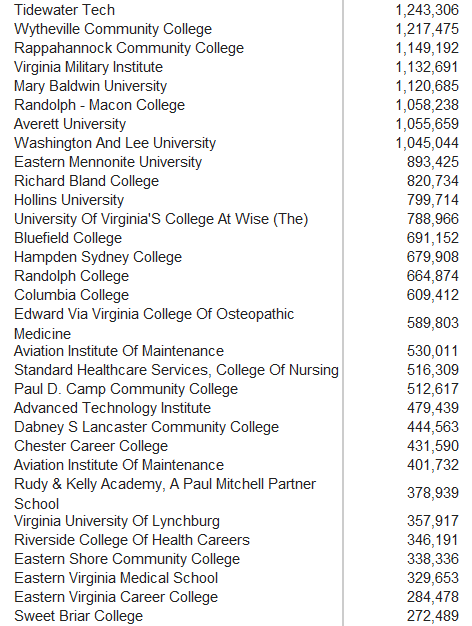

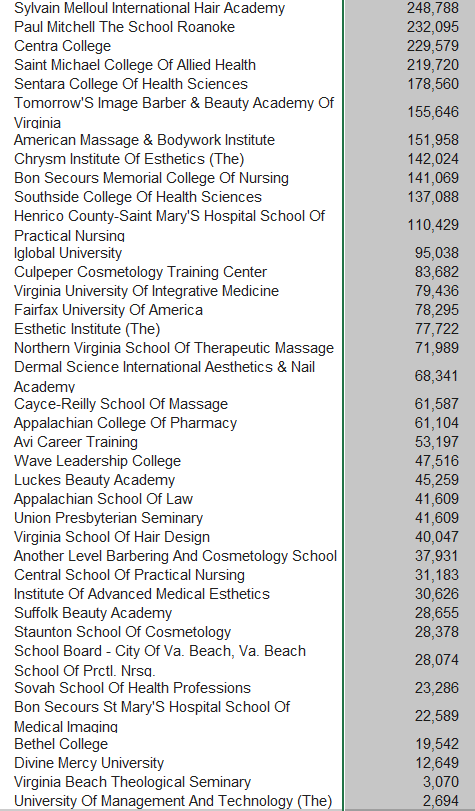

I show the top 15 recipients above and the rest below.

Leave a Reply

You must be logged in to post a comment.