Subsidies, tax breaks and other economic development incentives may attract corporate investment to a state, but do they pay for themselves or represent a net drain on state resources? Based on data from 32 states, a study by four North Carolina State University researchers find that the overall net effect is mildly negative, although results vary by the type of incentive.

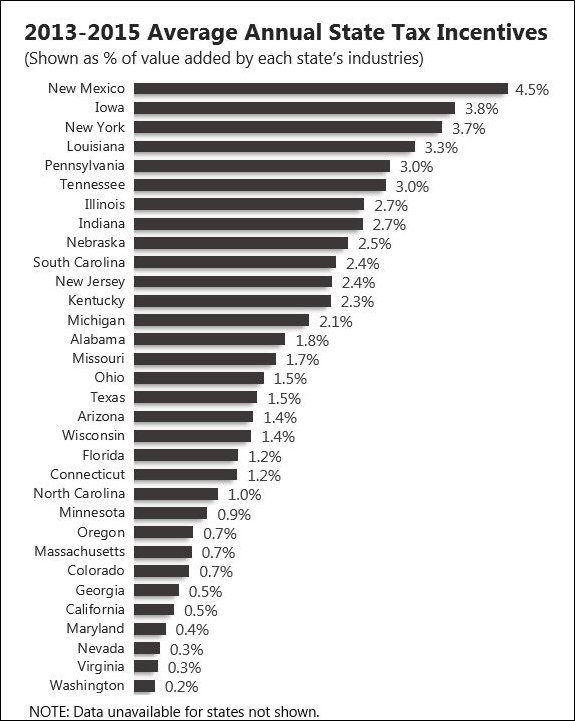

Fortunately for Virginia, according to that data, the Old Dominion ranks second-to-the-bottom for incentives as a percentage of economic value added.

“The results of the analysis show that financial incentives negatively impact the overall fiscal health of the states offering the incentives. ,” conclude the authors of “You Don’t Always Get What You Want: The Effect of Financial Incentives on State Fiscal Health.”

While the effects may appear small, it is important to note that even the smallest of changes in a financial ratio can have large and long-term impacts on a government. This has important implications for states considering the use of financial incentives, particularly those undergoing fiscal stress. While financial incentives may have an economic return on investment, they come with a high cost to the state’s financial sustainability. As such, they are a financial tool that should only be used with caution.

In an interview with Governing magazine, lead author Bruce D. McDonald III said that the incentive most associated with weaker state fiscal health was research and development tax credits. When successful, R&D generates broad effects nationally but relatively little locally. Property tax abatements had a mild negative effect. Job-creation tax breaks had little effect, either positive or negative, on state fiscal health.

Bacon’s bottom line: Extrapolating from the study’s data, I would humbly suggest that Virginia appears to be more parsimonious than most other states in doling out grants and tax-breaks. More than other states, Virginia appears to rely upon the virtues of its business climate to attract corporate investment — as it should.

(Hat tip: Peter Blake)

Leave a Reply

You must be logged in to post a comment.