by James C. Sherlock

There were lots of comments in my last post about government programs to mitigate flooding damage in flood plains, specifically about buying and tearing down houses that repeatedly flood.

One of the carrots to do so is Community Rating System (CRS) discounts to flood insurance in communities that take an active role in flood plain risk mitigation.

CRS is a part of the National Flood Insurance Program (NFIP). It is an incentive program that recognizes and encourages community floodplain management activities that exceed the minimum program requirements.

When that happens, not only is the risk of flooding diminished, but flood insurance premium rates for all citizens of a community that accomplishes the goals are appropriately discounted to reflect the reduced flood risk.

To quote the program web page,

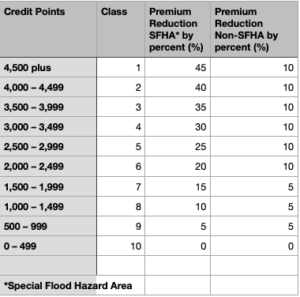

“For National Flood Insurance Program Community Rating System participating communities, flood insurance premium rates are discounted in increments of 5 percent.

A Class 10 is not participating in the Community Rating System and receives no discount. A Class 9 community would receive a 5 percent discount to a Class 1 community which would receive a 45 percent premium discount.

The Community Rating System classes for local communities are based on 18 creditable activities, organized under four categories:

- Public Information

- Mapping and Regulations

- Flood Damage Reduction

- Flood Preparedness

The table below shows the credit points earned, classification awarded and premium reductions given for communities in the National Flood Insurance Program Community Rating System.

CRS and floodplain management:

“Participating counties, municipalities and tribal nations can become stronger and more resilient by risk reducing actions, such as the following best practices:

- Adopting and enforcing higher floodplain management standards than NFIP minimum requirements (e.g., higher freeboard, lower substantial damage ratios)

- Maintaining rigorous enforcement

- Promoting open space through property buyouts and community planning.

- Encouraging responsible building practices (ASCE or IBC, for example, including IBC Appendix G)

- Promoting the purchase of flood insurance”

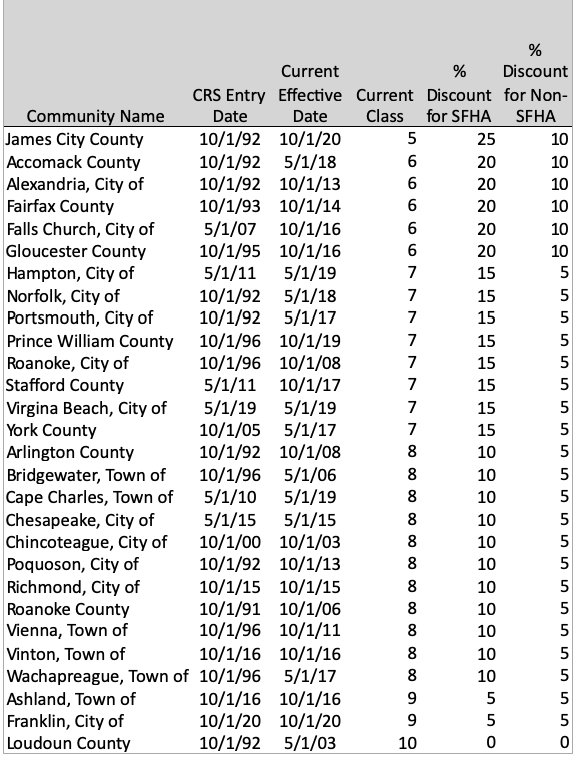

I have tailored below the CRS rating system eligible communities spreadsheet to Virginia communities only. You can see which Virginia communities participate and what percentage of monthly premium is saved by their residents starting October 1, 2020.

A flood insurance rate map (FIRM) displays the floodplains, more explicitly special hazard areas and risk premium zones, as delineated by the Federal Emergency Management Agency.

South Hampton Roads and the Virginia Peninsula are awash (to coin a term) in Special Flood Hazard Areas.

Loudoun County’s northern boundary is the Potomac river. It has nearly as many flood hazard areas as golf courses. Loudoun County does not participate in the CRS at a level that earns its citizens flood insurance discounts.

James City County on the Virginia Peninsula, bordered by the James and Chickahominy rivers, does participate and has the best scores, thus the most discounted insurance rates in Virginia. Its residents who buy flood insurance will get discounts of 25% in October if they are in a special flood hazard area and 10% if they are not.

Pretty sure that the reason Loudoun County does not actively participate in CRS is not a lack of money.

If your county or city is not listed in the spreadsheet above, it does not participate in CRS at all.

You can ask your city or county manager to explain.

In the case of Virginia Beach where I live, that action finally got the ball rolling in 2019. Of course Virginia Beach could afford it. Some can’t.

Leave a Reply

You must be logged in to post a comment.