The Northam Administration’s plans to spend most of the additional revenue created by federal tax reform may not prove popular if the public understands the alternative plans for real tax relief under consideration.

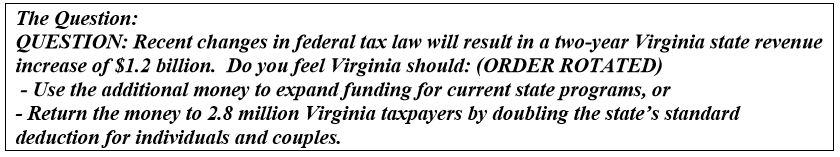

Three weeks ago, I complained that a poll from the Judy Wason Ford Center at Christopher Newport University didn’t ask the right questions, so the Thomas Jefferson Institute for Public Policy paid Mason-Dixon Polling & Strategy to add a private question to its recent poll of 625 Virginians. We added just the one question to clarify one aspect of the debate, with the results announced today.

The poll was in the field nearing its end when Governor Ralph Northam released his budget, which did indeed call for spending most of the federal tax change windfall over the next several years. One way he proposes to spend it is by expanding the existing state Earned Income Tax Credit into a program which pays cash grants to low-income Virginians. Is that expanding an existing program? Close enough.

So, the choice in this question was keep and spend it on programs or give it back by doubling the state’s standard deduction. Once Virginia conforms, up to 2.8 million tax returns are expected to use the standard deduction. That tax reform idea was chosen because it is the Thomas Jefferson Institute proposal, and because the CNU questionnaire provided the choices of a broad based (but undefined) tax cut or a targeted tax credit, with no mention of the state keeping the bread.

With overall support for giving the money back through the standard deduction at 59 percent in response to our question, and with support reaching into the 60 percent plus range in some regions and among those 35-49 years in age, that’s a popular approach. Support for keeping and spending the money was 28 percent overall and topped out at 36 percent in the Richmond region and among the youngest voters, and at 41 percent among black voters. The full report from Mason-Dixon is here.

As today’s earlier EITC discussion demonstrated (two posts back), this whole process has already blown past facts and moved straight into political posturing. Democrats are starting to drag President Donald Trump into the discussion, because it was his tax changes which set up the whole scenario. Republicans on the other hand can’t stop tweeting about the Northam tax increase. The real blame rests squarely with the General Assembly in toto, which punted on this in 2018 and may yet bollix this opportunity in 2019.

Having spent six months writing and talking about conformity, the federal Tax Cuts and Jobs Act and tax policy proposals, it is clear only a handful of people understand this, half of them CPAs. Most people’s eyes just glaze over. So as wrong as it is, we might as well decide this based on polling.

A practiced politician would look at first the CNU poll, and then this single additional question, and conclude returning the money is the smart play. A failure to pass something broad based that counteracts the impact of the inadvertent state tax increase will be punished at the polls. I further submit that promises made as something passes in February, which do not match with reality when tax returns are filed in May, will also irritate voters. Don’t promise relief for the middle class and actually leave them out.

Its not my usual practice to post two items on the same general topic on the same day, but this is my last chance for a week. It has been an interesting start, dear readers, with almost 120 posts for 2018. I appreciate those who do read these musing, and even more those who spread them around with the forward button. Enjoy the rest of your holiday!

Leave a Reply

You must be logged in to post a comment.