After shrinking 1.1% in 2016 and growing only 0.9% in 2017, the economy of the Hampton Roads metropolitan area is on track for a 2.2% expansion this year, and employment has surpassed the peak reached before the 2007-2008 recession, reports the new State of the Region report by Old Dominion University’s Strome College of Business. Summarizes the report:

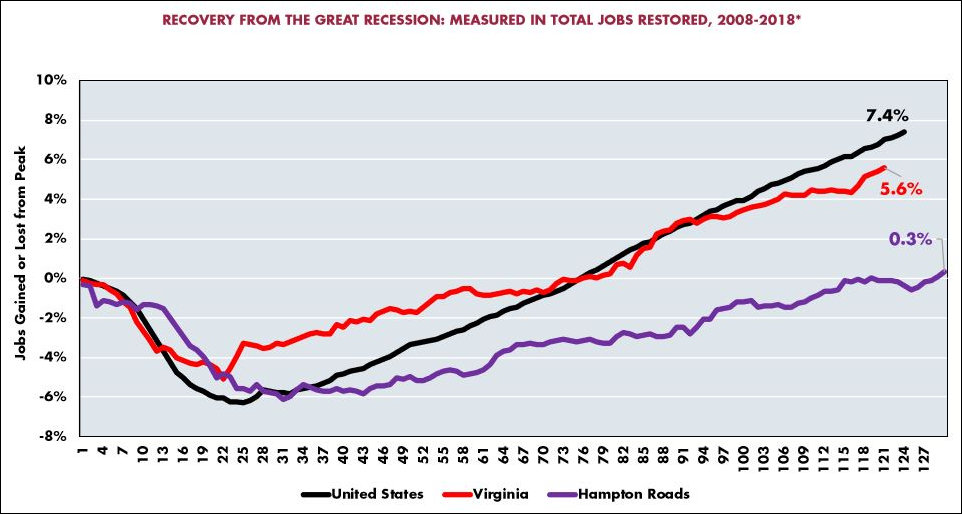

Hampton Roads finally appears to be putting the Great Recession in the rearview mirror. By mid-2018, we had about 0.3 percent more jobs than at the prerecessionary peak of July 2007. … By 2010, Hampton Roads lost more than 38,000 jobs from its previous peak level of employment, in 2007. In 2017, our region had about 4,000 more jobs on an annual basis than in 2007, making 2017 the first year our annual level of employment exceeded the prerecessionary peak.

However, the report sounded a cautionary note for Virginia’s second-largest population center:

Compared to our neighbors, we have fared poorly in generating jobs. While Virginia added almost 212,000 new jobs by May 2018 compared to the prerecession peak, only a few of these jobs have been in Hampton Roads. Most have been in Northern Virginia (149,400) and Richmond (54,800).

Defense spending

. The rebound this year is driven by an increase in defense spending. The region remains captive to the fortunes of the defense industry, which is dictated not by market fundamentals but the ebb and flow of politics in Washington, D.C.

From 2013 to 2016, defense spending in our region remained around $19 billion. In 2017, direct defense spending approached $20 billion and we forecast that it will be $21.5 billion in 2018, subject to how much of the increased spending is for multiyear procurement contracts (ships, for example) and how much is for operations and maintenance.

In 2011 defense spending accounted for 46.1% of the region’s economic activity. The percentage declined to 40.8% in 2017 and has inched back up to 42.0% this year. Compounding the impact of defense spending on regional prosperity, the average compensation of a military service member was on average 2.2 times that of the average compensation of someone working in the private sector.

The authors take a sober view of how long the burst in military spending can continue. Interest expenditures on the national debt are projected to climb from $316 billion in FY 2018 to $992 billion in FY 2028, crowding out discretionary funding, including that for defense. “The optimism for the next two years is due in large measure to the lack of fiscal restraint by lawmakers in Washington,” the authors write.

Port of Virginia. Outside the military, the major driver of economic activity in Hampton Roads is the port. After suffering from a brutal contraction in seaborne trade during the 2007 recession, volume has recovered smartly. In the past two years general cargo tonnage and container traffic have leaped ahead by 5.3% and 7%. The state budget included $350 million this year to start the process of dredging shipping lanes to a depth of 55 feet and widening the channel to 1,400 feet, maintaining the Virginia’s ports competitive advantage of accommodating cargo ships of ever-increasing size.

The biggest uncertainty is the prospect of trade war with China, which is the No. 1 country of origin and destination for shipping in and out of the Virginia ports.

Affordable housing. One benefit of Hampton Roads’ slow-growth economy is that housing remains more affordable than the national average — as it has for many years. While the monthly payment for a median-price resale house comprises 24.4% of median household monthly income nationally, it’s takes up only 20.2% in Hampton Roads. If the region can get its economy cranked back up, there isn’t much danger that high housing prices will discourage in-migration.

Leave a Reply

You must be logged in to post a comment.