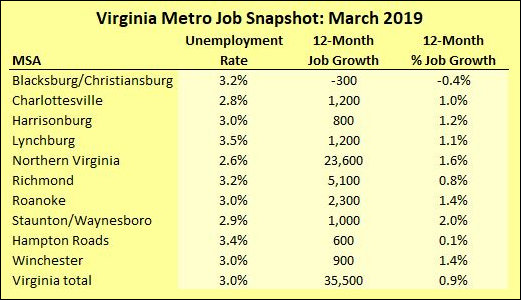

It’s been a long time since the unemployment situation looked this good. From the Virginia Employment Commission, here are the latest unemployment and job growth numbers for Virginia’s metropolitan areas:

You’d think that Virginia’s mainstream media might bring attention to this good news. But I don’t recall seeing a single front-page article touting the Old Dominion’s job growth and low unemployment numbers. The statistics are routinely buried in short, boilerplate articles on the business page.

Perhaps Virginia editors and reporters don’t think that the best unemployment picture in almost 50 years is news worth noting. Perhaps they think that highlighting these numbers might give undue credit to the moronic President Trump, who stupidly insisted that sustained 3%+ economic growth was possible even while his better-informed detractors did not. Perhaps they fret that good news distracts from their preferred narrative of racism, inequality, suffering, and oppression. Whatever their reasoning, I think the news is worth celebrating.

(With a little creativity, the media could give Gov. Ralph Northam all the credit for Virginia’s numbers. … But the media is not very happy with him either.)

The economy might go all to hell in 2020 — massive global credit creation makes me very nervous — but right now it feels really good. You can count on Bacon’s Rebellion to continue exploring the themes of job creation, wealth creation and opportunity for all Virginians.

Leave a Reply

You must be logged in to post a comment.