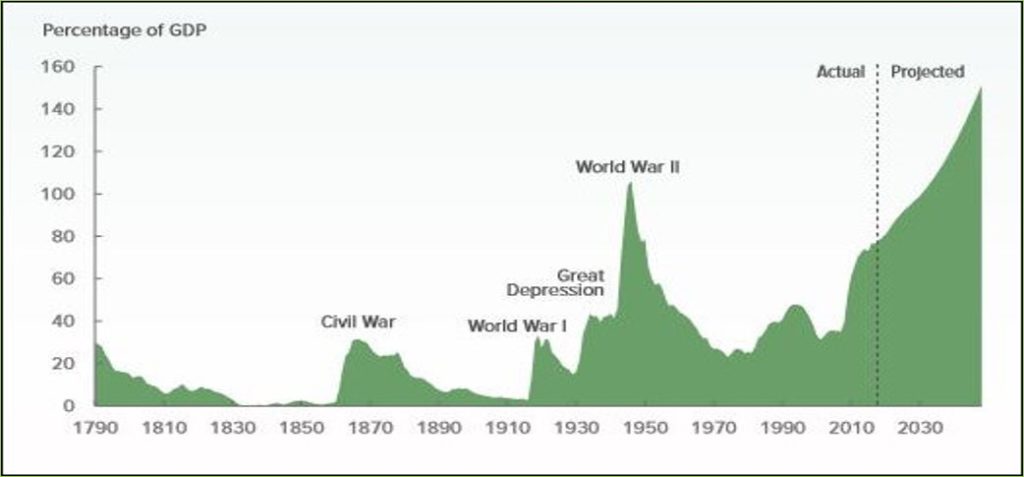

Let me set the scene by reviewing a few numbers. The federal deficit is on course to hit $1 trillion annually by Fiscal Year 2020. With retiring Baby Boomers swelling Medicare, Medicaid and Social Security expenditures, deficits will increase inexorably for decades. The U.S. national debt stands at $21.7 trillion. As deficits pile up and interest rates rise, the national debt expressed as a percentage of the GDP, 78% today, will reach 96% by 2028. CBO projects that interest payments on that debt will increase from $263 billion in 2017 to $915 billion by 2028, putting increasing deficits on autopilot that no amount of budget cutting can offset.

Worse, those numbers don’t include hundreds of billions of dollars in liabilities from unfunded military and public employee pensions, federal pension guarantees for bankrupt companies, U.S. Post Office pensions, or defaulting student loans. Meanwhile, the trust funds for Medicare and Social Security are running out: Medicare in 2026, and the Old Age and Survivors in 2034. Washington is gripped by dysfunctional gridlock for at least two more years, and possibly longer, so nothing will be done to defuse these fiscal landmines before they explode.

Over the next decade, Congress will be coping with one fiscally driven political crisis after another. When another recession occurs in the not-too-distant future — the current business expansion has run twice as long as the average expansion since World War II, and JPMorgan Chase recently boosted its odds of a recession occurring in the United States within the next 12 months to 30% — the federal government will be too consumed with its own problems to bail out the states.

None of this seems to faze Virginia’s political establishment as the 2019 General Assembly session approaches. Why should we worry? After all, we’re one of only 14 states with AAA bond ratings, and we’re widely regarded as one of the best-managed states in the country.

Well, we are, aren’t we?

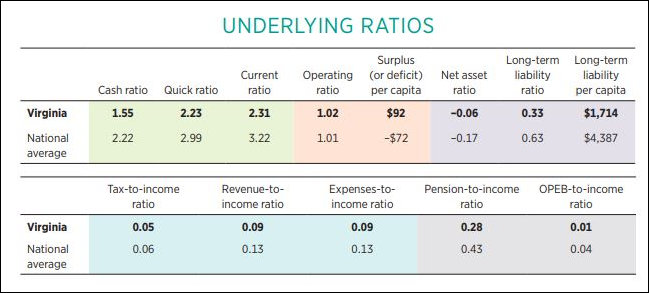

It’s time to get real. In the 2018 edition of its “Ranking the States by Fiscal Condition” report, based on Fiscal 2016 data, the Mercatus Center at George Mason University ranked Virginia 13th in terms of overall fiscal health but only 28th by cash solvency. Similarly, an October report by Moody’s Analytics declared, “The states least prepare to weather another recession are: Louisiana, Oklahoma, North Dakota, New Jersey, Montana, Kentucky, Virginia…” (my emphasis).

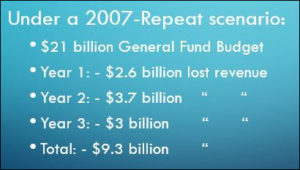

Virginia escaped a downgrade to its credit rating earlier this year only through a last-minute infusion of cash into its cash reserves. Secretary of Finance Aubrey Layne was so concerned about Virginia’s ability to weather a recession-induced revenue downturn that he asked his staff to calculate the effect of another 2007-2008 recession on the state budget. The results are horrifying.

To be clear, Layne is not predicting a recession of the same magnitude as the last one. But if the U.S. had one recession as sharp as the so-called Great Recession, it could have another. The scenario is not outside the bounds of the possible.

Under a 2007 Repeat scenario, General Fund revenues, now about $21 billion a year, would shrink $2.6 billion the first year, $3.7 billion the second year, and $3 billion the third year before bottoming out — $9.3 billion in all. The General Fund goes to K-12 schools, higher education, public safety and corrections, mental health, payments on the state debt, the environment, and, of course, the metastasizing Medicaid program. Cuts amounting to 44% would be calamitous and disruptive beyond imagining.

Under a 2007 Repeat scenario, General Fund revenues, now about $21 billion a year, would shrink $2.6 billion the first year, $3.7 billion the second year, and $3 billion the third year before bottoming out — $9.3 billion in all. The General Fund goes to K-12 schools, higher education, public safety and corrections, mental health, payments on the state debt, the environment, and, of course, the metastasizing Medicaid program. Cuts amounting to 44% would be calamitous and disruptive beyond imagining.

That’s the near-term problem. The longer-term problem is what I call hidden deficit spending. True, the Virginia Constitution requires the state and localities to balance their budgets every year. But the General Assembly has proven adept at skirting the Constitution.

The first trick is under-funding pension funds and other retirement obligations such as retiree medical care. The Virginia Retirement System has a $5.4 billion funding shortfall that will have to be made up eventually. Fairfax County, which administers its own pensions, has a $5.6 billion shortfall. The Washington Metropolitan Area Transit Authority, which operates the Washington region’s mass transit system and is partially funded by Virginia, is $3.5 billion shy of what it needs. Last year, Chesterfield citizens were shocked to learn that their school system had accumulated an unfunded liability for an obscure “supplemental retirement program” that could reach $99 million. There are hundreds of cities, counties, towns, and independent authorities in Virginia, many of which administer their own pension plans. No one knows what their total pension liability is. No one has bothered to add it up.

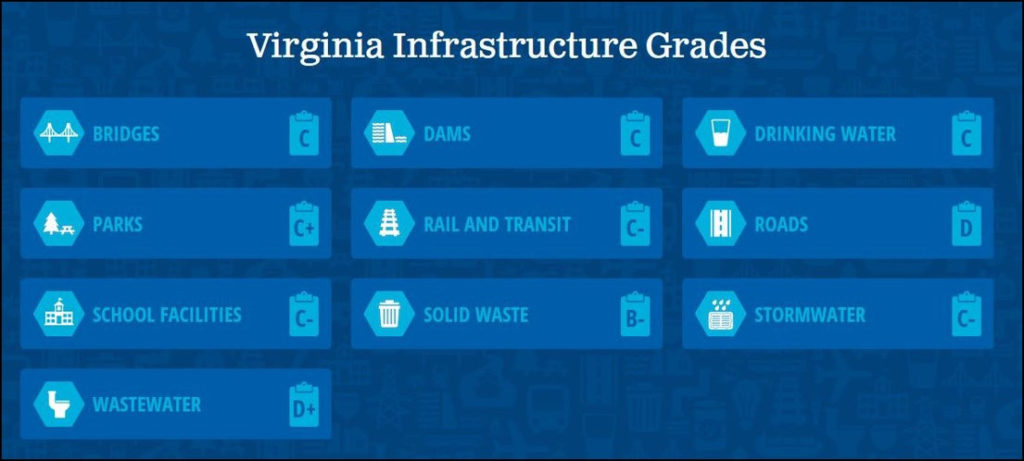

The second trick is under-funding maintenance of public infrastructure such as roads, bridges, highways, mass transit, water and sewer plants, water and sewer pipes, fire and police stations, communications systems, administrative buildings and school buildings. Infrastructure depreciates, slowly at first but with increasing speed if not properly maintained. Even well-maintained facilities have a limited lifespan and need replacing. Government can let maintenance slide a year or two without ill results, but persistent under-funding can create a huge liability when everything starts falling apart — as the Richmond Public School system has discovered to the consternation of all.

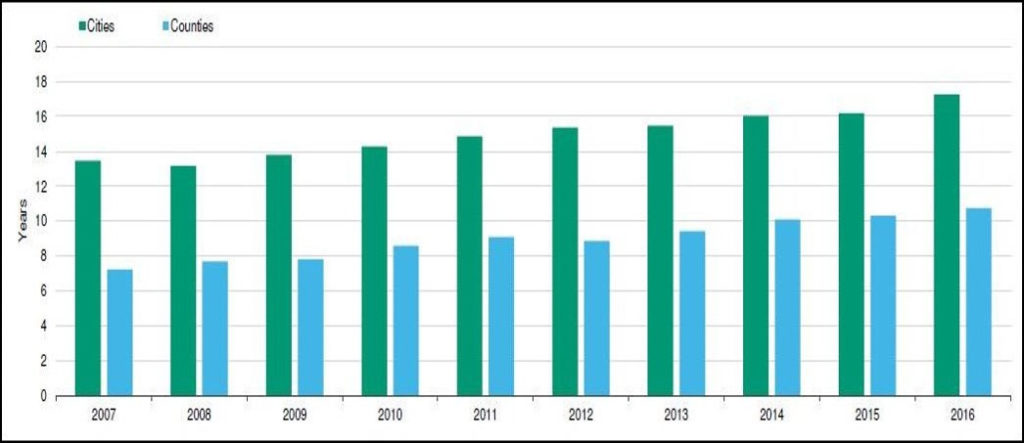

A decade ago both cities and counties in Virginia were devoting significant resources to capital expenditures. Since peaking in 2009, however, capital spending as a percentage of capital assets has declined markedly for cities and precipitously for counties. As a consequence, the average age of infrastructure, as calculated by Moody’s Analytics, has gotten considerably older. For cities, the average age has increased from about 13 years to 17 years; for counties, the average age had gone from about 7 years to more than 10.

The third trick isn’t even a trick — it’s the use of shameful accounting gimmicks. Prime example: the accelerated sales tax. During the last recession the General Assembly told retailers to accelerate payment of the sales tax by a month, allowing the state to collect 13 months of taxes in 12 months. The legislature has rolled back accelerated collections for smaller retailers but not for larger retailers accounting for the bulk of tax revenues. What’s the legislature going to do next time — order retailers to pre-pay taxes based on sales that have not yet occurred?

Virginia’s economy is performing pretty well this year, and the state will have more revenue to spend in the next biennial budget. Broadly speaking, lawmakers have three choices when they convene the General Assembly session in January. They can spend increased revenue, they can return some of it to taxpayers, or they can shore up the Commonwealth’s balance sheet.

Spending and rebating revenue is fun for politicians. Stashing the money in rainy day funds and paying down pension liabilities isn’t. But if Virginia experiences another recession like the last one, we’ll curse ourselves for our failure to set money aside when we had it.

Leave a Reply

You must be logged in to post a comment.