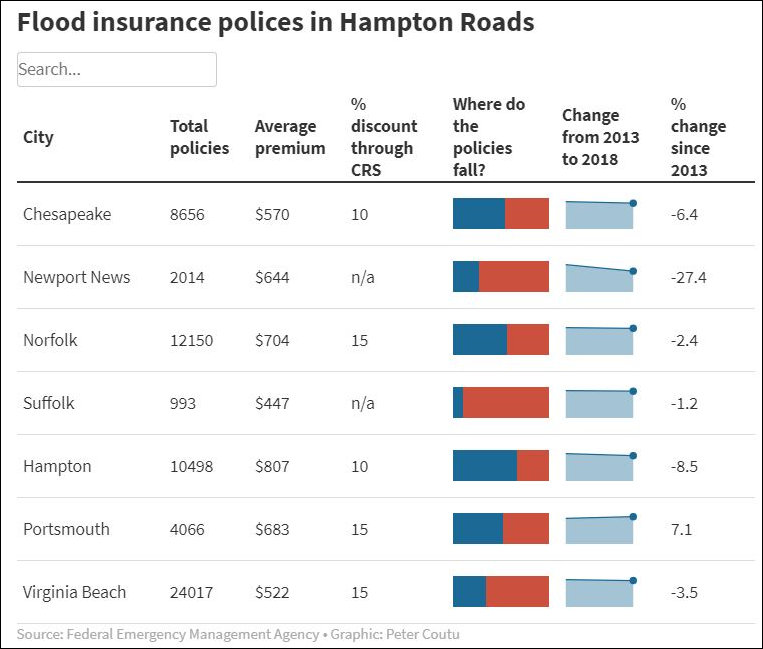

Sea levels may be rising and the risk of flooding increasing, but fewer Hampton Roads residents bought flood insurance in 2108 than five years previously, according to data presented by the Virginian-Pilot. Between 2013 and 2018 the number of households with flood insurance declined by about 5%. The only one of seven localities examined that bucked the trend was the City of Portsmouth.

The Virginia Department of Conservation and Recreation is collaborating with local and regional authorities in Hampton Roads to boost the number of flood insurance policies. A $100,000 campaign, Get Flood Fluent, has launched a website and will continue with a concentrated ad campaign in print, radio and online. Among the points made:

- The most common natural hazards are floods.

- One inch of water in a home can cost roughly $25,000 in repairs.

- In addition to facing the highest rate of sea level rise on the East Coast, Hampton Roads has started to see more intense and frequent rainfall over the past several decades.

- Even those outside of a “high-risk” zone can experience flooding, and the subsequent damage typically isn’t covered by regular homeowners or renters insurance.

Bacon’s bottom line:

Buy the flood insurance! If you fail to do so, don’t come begging to the rest of us to make up for your lack of foresight. And for god’s sake don’t ask taxpayers to pay to rebuild in the exact same spot. Everyone needs to assume the natural disaster-related risks of where they live, whether we’re talking about storm-water surges, river flooding, wild fires, tornadoes, or ice storms. Pay the price, and then factor that cost into your decision about where you want to live and what kind of structure you live in. As a society, we cannot afford to bail out hundreds of billions of dollars worth of poor decisions.

Leave a Reply

You must be logged in to post a comment.