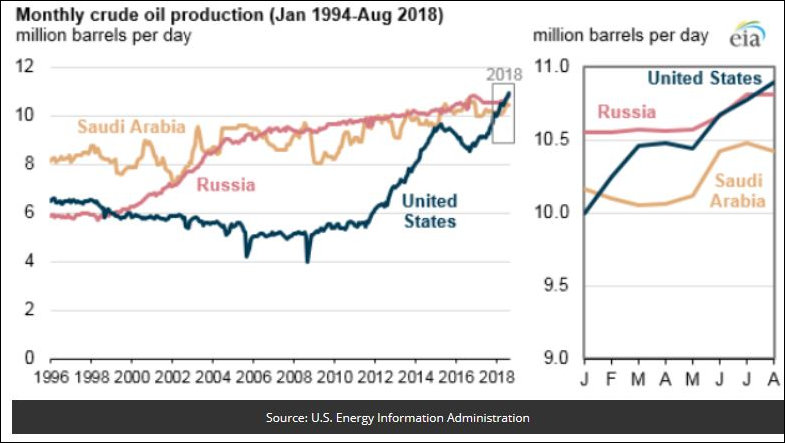

You don’t hear much talk about “peak oil” these days. Perhaps that’s because crude oil production has surged to the extent that the United States has now surpassed Saudi Arabia and Russia as the world’s largest producer.

Back in 2010, the fracking revolution was just a speck on a gnat’s eye. Buying into the “peak oil” paradigm when I wrote my book “Boomergeddon,” I expected the rising cost of petroleum and gasoline production would translate into sky-high prices and a long-term drag on economic growth. That’s one of the reasons why, along with an aging population and a continued rise of the regulatory state, I argued that the U.S. government spending needed to adjust to slower long-term economic growth in order to avoid exploding deficits.

It figures that the one dogma I embraced from the political left would be the one that proved to be the most demonstrably wrong. The fracking revolution has been an incredible boon to the U.S. economy. Oil and gas production, far from being a drag on the economy, has stimulated growth — and will continue to do so as fossil fuel exports surge. You may not like the environmental implications of increased oil and gas production, but the geopolitical implications are fantastic for the United States. Our economic fortunes are less tied to events in the Middle East than any time since the 1974 Arab Oil Embargo, and Russia, one of our two main strategic adversaries, is significantly weaker thanks to lower oil and gas prices.

The Oil Age won’t last forever. Eventually, the global economy will shift to cleaner, renewable energy sources like solar, wind, batteries, and, who knows, maybe even nuclear fusion. One day, electric utilities will be all green. One day, most of the nation’s automobile fleet will be all-electric and all green. One day, oil and gas will be valued only as a chemical feedstock. But that transition will take decades. In the meantime, let’s take advantage of strong global demand for oil and gas and extract our mineral wealth from the ground while it still has value.

Leave a Reply

You must be logged in to post a comment.