Dominion Energy Inc. will sell a 25% interest in its Cove Point liquid natural gas-exporting facility to Brookfield Super-Core Infrastructure Partners, an infrastructure fund, for $2 billion, the company announced this morning. Said Dominion CEO Thomas F. Farrell II: “The agreement highlights the compelling intrinsic value of Cove Point and allows us to efficiently redeploy capital toward our robust regulated growth capital programs.”

That raises an interesting question: What does Farrell mean by “regulated growth capital”? Does this mean Dominion is redeploying capital from competitive, lightly regulated business enterprises such as natural gas exports toward heavily regulated enterprises such as electric utilities, as evidenced by its acquisition of SCANA in South Carolina?

In a word, the answer is, “yes.”

An article in S&P Global Marketing Intelligence sheds light on Dominion’s strategic thinking and capital spending plans. In March 2019 the company unveiled a $26 billion “growth capital plan” for 2019 through 2023. The first three years will be financed by $7 billion in operating cash flow, the issuance of debt, and the cobbling together of capital from other sources.

Dominion’s business structure now consists of Dominion Energy Virginia, Dominion Energy South Carolina, Dominion Energy Gas Transmission & Storage, Dominion Energy Gas Distribution, and Dominion Energy Contracted Generation. Of these, Dominion Energy Virginia remains by far the most important. The parent company will lavish $17 billion, about 64% of its capital spending, on its Virginia-North Carolina utility over the next few years.

Dominion Energy Virginia foresees investing about $4.3 billion in electric transmission from 2019 to 2023, with about $1.6 billion earmarked for grid transformation projects under the Grid Transportation and Security Act. Other spending includes $2.4 billion on regulated solar growth, $1.3 billion on contracted solar, $1.1 billion for offshore wind, and $1.2 billion for operating license extensions at its Surry nuclear units.

The investments are expected to grow the Virginia utility’s base rate from $23 billion in 201 to $32-$34 billion in 2023. The larger the capital base, the more money the State Corporation Commission allows the company to earn, and the more the company can charge rate payers.

The parent company plans to spend another $3.6 billion at its gas transmission & storage subsidiary. That business, says S&P Global, includes “regulated and regulated-like assets,” most notably the Cove Point export facility and Dominion’s partnership share in the Atlantic Coast Pipeline. Dominion expects to invest an additional $3.5 billion in its regulated gas distribution companies. All told, the company expects this plan to achieve a 6.7% compounded annual growth rate in earnings per share through 2020 and for EPS to grow by more than 5% annually from 2020 to 2023.

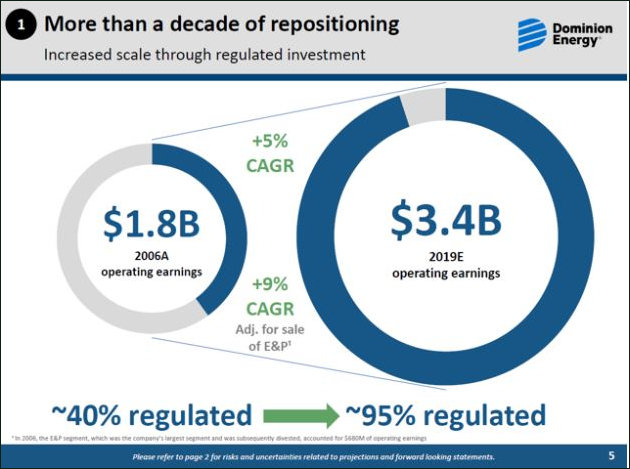

According to an article in Seeking Alpha, “From 2006 to 2019 (based on management’s estimate), Dominion Energy sees the rate regulated or “like-regulated” side of its business growing from ~40% to ~90% of total operating income generation. Roughly two-thirds of Dominion’s Energy’s total operating income now comes from rate-regulated utilities. Of Dominion’s major assets, the Cove Point LNG facility in Maryland is the most exposed to market pricing risk.

Bacon’s bottom line: A positive way to spin today’s announcement is that Dominion is selling a stake in its Cove Point LNG facility in order to finance continued capital investment in its Virginia utility. The parent company is funneling a big chunk of its own equity capital, $2 billion worth, into the Commonwealth of Virginia. That $2 billion will leverage another large sum — a roughly equal amount — in debt investment.

A negative way to spin the announcement is that it marks a huge step in Dominion’s ongoing reinvention of itself from a company with a strong exposure to the competitive energy marketplace to a company active primarily in regulated markets. Today’s transaction today moves $2 billion from a venture with significant market price risk to an enterprise with much lower market risk. One might argue that the company’s competitive advantage increasingly springs from achieving beneficial legislative and regulatory outcomes — what some might call rent seeking — and less from marketplace innovation.

Leave a Reply

You must be logged in to post a comment.