“I’m not going to get into it unless anybody wants me to.”

So said Kristin Collins, policy development director for the Virginia Department of Taxation, as she neared the end of her November 19 slide presentation on federal tax conformity and its impact on Virginia state taxes. The final handful of slides focused on the business tax issues, and not one member of the legislative panel asked her to get into them.

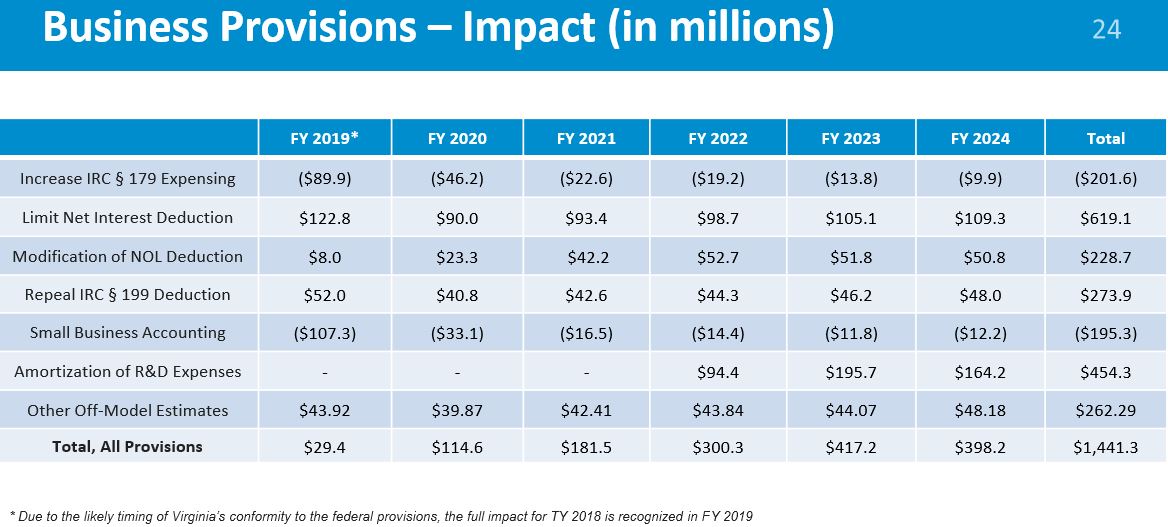

With all the focus and political discussion swirling around individual income taxes and conformity, the business tax issues have received little notice. In the projections on the state’s revenue windfall the higher business taxes produced by conformity play a big role. In 2023 and 2024, the later years in the state’s projection, higher business taxes account for over 40 percent of the new revenue, according to an outside consultant’s study.

Collins was presenting to the Joint Subcommittee to Evaluate Tax Preferences, the closest thing Virginia has to a permanent tax commission in its legislative body. Many key players on the money committees belong. The chair, Delegate Lee Ware of Powhatan, who also chairs House Finance, intends to call the joint panel together again for a deeper discussion and perhaps some decisions before the General Assembly starts in January.

Collins was presenting to the Joint Subcommittee to Evaluate Tax Preferences, the closest thing Virginia has to a permanent tax commission in its legislative body. Many key players on the money committees belong. The chair, Delegate Lee Ware of Powhatan, who also chairs House Finance, intends to call the joint panel together again for a deeper discussion and perhaps some decisions before the General Assembly starts in January.

A group I’m working with has already recommended on the individual side that Virginia increase its standard deduction, and on the corporate side we think Virginia should start to cut the corporate income tax rate, from 6 percent now down to 5.5 percent for this tax year and 5 percent for next tax year. The full Thomas Jefferson Institute paper on our proposal is now available.

The business community needs to get its act together and decide what it wants, or it’s going to get the full effect of these business tax increases. Unincorporated businesses – S corporations, pass-throughs, partnerships – do very well under conformity but incorporated businesses get hit. The cut in the corporate income tax rate we propose effectively short-circuits that tax increase in general but does not return the benefit directly to the companies hit with the highest new taxes.

Some in the business community would prefer to leave the tax rates intact but instead get the General Assembly to restore the corporate deductions targeted by Congress. They would have Virginia refuse to conform to those certain aspects of the federal system, which does target the corrective action directly to those facing higher taxes.

Our proposal is full conformity but rate cuts aimed at all corporate taxpayers. It represents general tax reform, not maintenance of the status quo.

A short list of changed business provisions create the big tax hike, and they are spelled out in the Tax Department chart above. You can see that several grow in impact over time, and a major change in the treatment of research and development expenses doesn’t even kick in for three years. Unlike some of the new individual tax provisions, these changes have no sunset date.

What is wrong with that chart – and potentially misleading – is it includes provisions for both unincorporated and incorporated businesses. The two changes producing lower taxes are mainly for the entities exempt from the corporate income tax, and most of those raising taxes are for corporations. It also fails to detail one of the more controversial changes dealing with repatriated international earnings.

That provision, which goes by the wonderful acronym GILTI, is already the subject of a lobbying effort by some Virginia corporate taxpayers, who note some other states (Tax-achusetts included) have already elected to allow that deduction despite the federal action. It stands for Global Intangible Low-taxed Income, and the IRS guidance runs to 150 plus pages. The argument over whether and how to tax intangible income (royalties on patents and copyrights for example) is an old one.

The Section 199 deduction also known as the domestic production activities deduction (DPAD) has been a source of contention in Virginia before, because when Congress expanded it Virginia balked at going along in full. Its purpose was to lower the effective tax rate on manufacturers, and by lowering the tax rate for everybody by 40 percent Congress largely addressed that problem. It then killed Section 199. (Virginia should do the same: accept the change and lower its rates!)

The largest cash impact comes from new limits on the deduction for interest expenses, and here Congress also had reasons for its move. Why subsidize excessive debt? Apparently there is also a push on in Virginia to keep that deduction in place on Virginia corporate returns.

The limits on amortization of research and development expenses have a delayed impact, but eventually a large one. That’s another one where Virginia could stay the course, maintain the old rules, but at the cost of a lost opportunity to lower overall rates.

The business community has some decisions to make, and it may be a handful of companies who have a developed presence at the General Assembly who get to make them. Long-term considerations and discussion of overall economic policy tend to get ignored when lobbyists can angle for their own client’s advantage. That game is now afoot.

Leave a Reply

You must be logged in to post a comment.