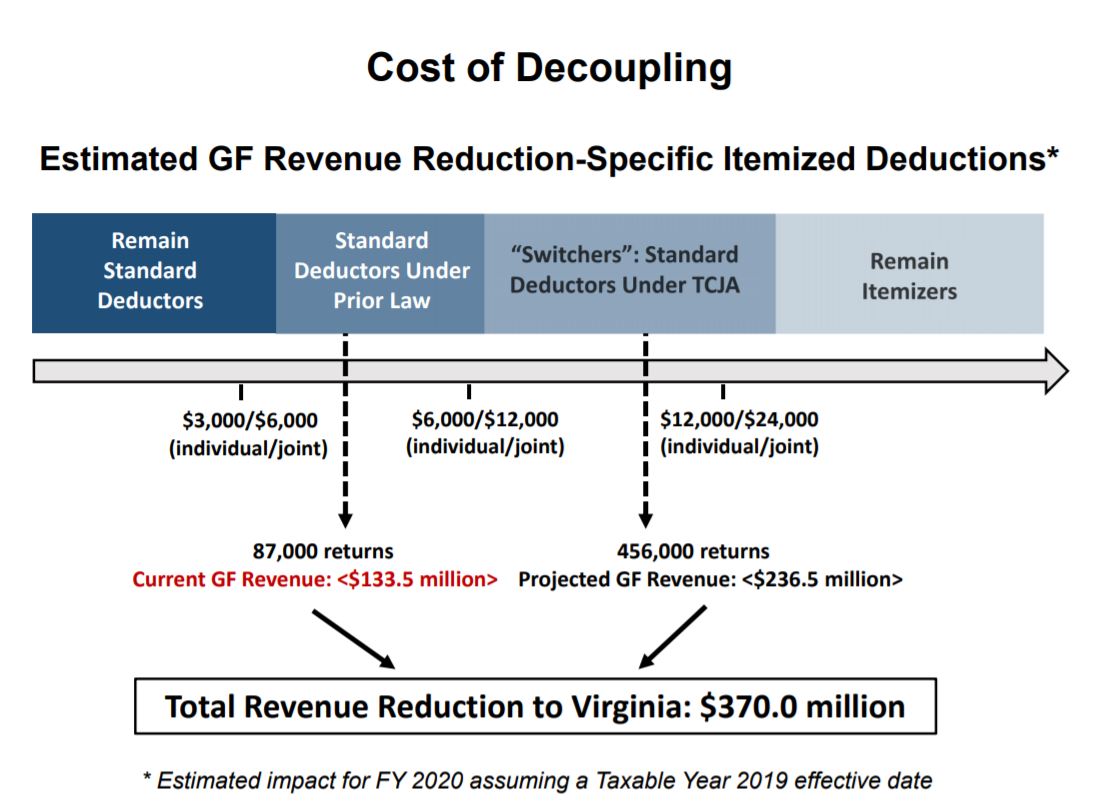

If Virginia were to allow its taxpayers to keep taking itemized deductions at the state level, even though they take the new higher federal standard deduction, almost 550,000 more would be expected to itemize at the state level, Secretary of Finance Aubrey Layne told state legislators Thursday.

Almost 90,000 would be people who were not claiming itemized deductions before.

That idea is popular with some legislators, many of them House of Delegates Republicans, who are hearing from taxpayers who face a difficult choice. Under current Virginia law, which would remain in place if Virginia simply adopted straight conformity with the new federal rules, the decision on standard deduction vs. itemized must be the same on both state and federal returns.

When Layne reported on an earlier projection that Virginia would gain $532 million in new individual income tax revenue during 2019, and $3 billion over six years, much of that would come from that situation. More than 600,000 Virginia taxpayers were expected to switch from itemized to standard deductions, lowering their federal tax but increasing their state tax.

Along with the number of returns that might split their method, he also estimated the amount of tax dollars involved as $370 million. That estimate was for 2020, and its not clear what the more immediate impact would be. Layne presented that as lost revenue for the state but turn the coin over and it’s a tax cut for those families.

Why does this matter? It puts a price tag on that proposal being discussed in some circles, and that price tag is less than the estimated revenue gain from conformity. The idea could be implemented without blowing a big hole in the state’s already-adopted budget – a big point in its favor. The budget was written with no conformity tax gains included.

Also, the price tag Layne announced (probably working with that new tax model the state has developed) is a bit lower than the revenue loss/tax cut value on the other big idea. Previously Layne had estimated that if the legislature doubles the state’s standard deduction (to $6,000 per person or $12,000 per couple) that would cost (or save) $440 million. He repeated that number Thursday in an interview with Bacon’s Rebellion.

The information is in a slide that Layne prepared for the monthly meeting of the Senate Finance Committee, but according to the Richmond Times-Dispatch the committee didn’t want to take up the topic today. The newspaper story, at least the first iteration, seemed to characterize the $370 million as the state revenue impact if the state doesn’t conform to any of the federal changes.

That number would be far more complicated. A failure to conform at all would involve a state-specific addition or subtraction on more than 20 individual and 30 business provisions and would remove from Virginia returns many highly positive changes – changes taxpayers would be furious to find they lost on their state returns. Layne confirmed that his number was just focused on the proposal to let people split their decision the deduction method.

Layne also reproduced some pages of the forms that Minnesota taxpayers will use to accomplish just that, to back out all the various federal changes when they prepare their state returns. That is a nightmare that no Virginia leader is promoting for here, but it is a very possible outcome if the General Assembly fails to act in early 2019 after having failed to act through all of 2018. Conformity will require a positive vote by a super majority in both chambers to be retroactive for tax year 2018.

In his un-given presentation Layne continued to discourage the General Assembly from doing anything to remove the conformity tax bite for tax year 2018. He argued against both proposals circulating, to double the standard deduction or allow the option state itemized deductions.

“Such responses will not only impact taxpayers whose state taxes were increased as a result of the (Tax Cuts and Jobs Act) but will also impact taxpayers whose tax liability did not change as a result of the TCJA,” Layne said. That is correct. For tens of thousands of Virginians, they would not be revenue neutral removal of “conformity tax” but would be real tax cuts.

Leave a Reply

You must be logged in to post a comment.