Pick any member of the General Assembly at random, stop them in the grocery store for a chat, and quiz them about the digital sales tax they approved a week ago Saturday. It will quickly become clear that most had no idea what they were voting for when they approved it.

What will the tax add to the cost of your Amazon Prime or Netflix? (For most, 6-7%.) Will the tax be collected on both the monthly fee and on anything extra you download? (Yes) Will it add to the cost of preparing your tax to file online, your annual lease for Microsoft programs on your laptop or your security system program? (Yes, most digitally-based services will all be taxable to individuals, and many of them will be taxable to businesses. If you are doing something on a computer or phone that costs money, it is likely to become taxable.)

Even for a business, if some software package its employees use includes a combination of online services, will it owe tax on the entire package? (Yes, unless the vendor is willing to break apart the bill, which many may refuse to do. That is because of the new language about taxing bundled services.) If an out of state vendor does not add tax to the invoice, taxpayers will be required to calculate and pay it as a use tax, with auditors ready to pounce if they don’t.

Think of engineering, law, banking, or medicine. So many of their processes are now controlled by expensive software, most of which is about to be 6-7% more expensive. At the shipyard in Newport News, paper blueprints and printed job instructions were replaced with tablets and digital design programs years ago.

While not all digital services are taxed to businesses, are they also exempt from tax on the “digital personal property” roped into the sales tax law with a new definition? (No, most existing sales tax exemptions mention “tangible personal property” only. And if tangible property is bundled with digital items, the new rules on bundled transaction may override the old exemptions.)

The fact that legislators are truly clueless on these tax issues should not surprise anyone. Tax professionals are still pondering the meaning of several provisions of the final language, some of which appeared for the first time only 48 hours before the vote.

An army of stakeholders, lawyers, and lobbyists will spend months fighting over the regulatory guidelines which will provide crucial details. As is always the case with this inside game, if you are not at the table, you are on the menu. Who will be speaking up for the average consumer?

Fortunately for Virginians, Governor Glenn Youngkin (R) seems determined to reverse the vote and keep the new tax out of your pockets. Unfortunately for Virginians, if the Democratic majority that voted for this without understanding it stands firm, he may have to veto the entire $190 billion state budget to wipe out this one $2 billion tax hike.

So be it. Vetoing the entire budget is about the most drastic thing a Governor can do, but experience has proven the state can adopt a budget as late as May or June and still function when the new fiscal year begins on July 1. The sooner serious negotiations begin, the better.

This one tax policy change probably extracts as much or more cash from Virginians than all of the various tax increases the previous Democratic majority imposed four years ago. It may exceed the major tax package approved under Governor Mark Warner (D) exactly twenty years ago, which had stronger bipartisan support.

The often–lethargic business community is finally waking up. The Virginia Chamber of Commerce issued a rare call to action to its membership March 15, available to anyone on its public website, asking for a veto of this new tax.

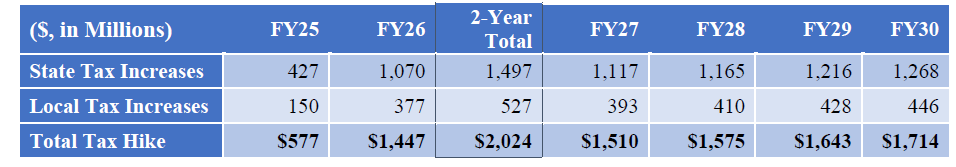

If anything, the Youngkin Administration’s estimate that the tax will cost Virginians $2 billion in its first two years is conservative. The current estimate is that once the tax is fully in force, the annual take will exceed $1.5 billion, or $3 billion per biennial budget. The money goes into several government pots but comes out of just one pocket – yours.

The other major tax increase buried in the budget opposed by Governor Youngkin is the revival of the Regional Greenhouse Gas Initiative, the electricity carbon tax. Virginia quit RGGI in 2023 but the majority Democrats demand that Virginia rejoin. If this mandate stands, and if the other states of the regional CO2 allowance marketplace allow Virginia to come back, Youngkin is claiming that will be another $300 million per year.

Again, that future RGGI tax amount may be a major underestimate. In 2023, Virginia sold $304 million in CO2 allowances based on the auction prices that year. An auction held last week (with Virginia not participating) set a record carbon tax price of $16 per ton. That price was up 28% in one year and an amazing 111% since Virginia first imposed the tax in 2021.

Yes, the carbon tax more than doubled in just three years. The goal of the cap–and–trade process is to drive up the carbon tax to higher and higher levels. By the end of another three-year RGGI contract period, $500 million per year in Virginia carbon tax receipts will be easy to reach. And our power grid will still rely on coal and natural gas.

The General Assembly is banking on your apathy. Speak up now or hold your peace and open your wallet.

First published this morning by the Thomas Jefferson Institute for Public Policy.

Leave a Reply

You must be logged in to post a comment.