Virginia is very well positioned to establish a supply-chain hub for an East Coast wind-power industry, says a report written by offshore-wind consulting firm BVG Associates and underwritten by the Virginia chapter of the Sierra Club.

Although Virginia will not participate in the “first wave” of East Coast offshore wind projects, which is ramping up now in northern coastal states, Virginia-based businesses could supply key components to those pioneering efforts if the Commonwealth acts quickly, concludes the newly published report, “Offshore Wind in Virginia: a Vision.”

The report lays out the following scenario for wind farm-driven economic development:

Virginia will derive immediate economic benefits while maturing its offshore wind supply chain, ensure development of its own 2 GW [gigawatt] offshore wind by 2028, and provide the tipping point for a second wave of lower-cost projects off Dominion Energy’s service territories, notably the Kitty Hawk lease area in North Carolina.

The study should be read with the understanding that Sierra Club-Virginia is promoting Virginia offshore wind generation to advance its long-term goal of eliminating fossil fuels and nuclear power from Virginia’s energy mix. Even with that caveat in mind, the study provides the most detailed analysis yet published of how Virginia can leverage offshore wind into a major economic-development boon for the Hampton Roads maritime sector. The Northam administration has hired a BVG associate to help the state fashion a strategy to build an offshore wind supply chain.

According to the report, Virginia has five big competitive advantages:

- An industrial coastal infrastructure, with large areas for laydown and storage, quayside length for load-out, and direct access to the open ocean with unlimited vertical clearance.

- A large workforce with competitive pay scales and experience in shipbuilding, ship repair, ports, logistics, and vessel operation.

- Highway, rail, and inland waterway connections linking Virginia’s ports to industrial centers throughout the Southeast, Mid-Atlantic, and Midwest.

- Eastern population centers with high and growing electricity demand, particularly for the Internet economy. Northern Virginia has a large and growing data-center corridor, and two new data centers are being built in Virginia Beach.

- High-voltage interconnection capability in Virginia Beach sufficient to handle the anticipated commercial wind-lease area after “moderate investment.”

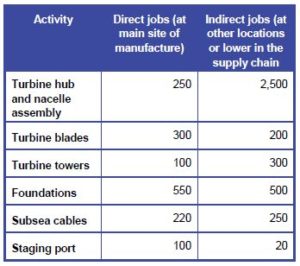

The first two advantages make Hampton Roads an attractive location for the fabrication and assembly of jacket foundations and offshore substation platforms. Two sites in the region could be made ready for a steel fabricator within 20 to 29 months at a cost of $5 million to $15 million. Jacket and substation production could create more than 2,000 new direct and indirect jobs.

The first phase of offshore wind production will be expensive. Wind supply chains in Europe like to see an annual market of at least 1 gigawatt, the equivalent of 80 to 125 turbine nacelles, turbine towers, blades, or foundations. A factory owner would look to produce 200 kilometers of cable per year, a volume needed to apply lean manufacturing strategies. Lacking U.S.-based investment, first movers in offshore wind would have to pay premium prices. Another complication is the Jones Act, which prohibits European-built and based vessels from transporting components between U.S. harbors. Offshore wind-service companies cannot yet justify building state-of-the-art jack-up vessels in the U.S. in compliance with the Jones Act.

First-mover states — Massachusetts, Rhode Island, Connecticut, New York, New Jersey, and Maryland — have committed to build more than 3 gigawatts of offshore capacity. Virginia has committed to build 5 gigawatts of renewable energy, including a substantial component from wind, by 2028. Dominion Energy has proposed to build two turbines with experimental designs to ensure that a larger wind farm could stand up to hurricane conditions frequently experienced in the Mid-Atlantic.

Writes BVG:

By the middle of the next decade, Virginia could be a leading U.S. market for offshore wind, driven by the ability to benefit from the lessons learned from northeast coast states and the maturing U.S. supply chain, complemented by Virginia’s strong infrastructure, location benefits, and deployment of offshore wind at scale.

Suppliers to the wind industry, such as turbine, foundation and cable manufacturers, like to see a regular run-rate for installed capacity. This allows easier investment planning and more efficient facilities. Manufacturers also need projects of a certain size to achieve economies of scale. … The Virginia market in our scenario is … not big enough by itself to attract investment, so the Atlantic Coast market as a whole is crucial. In our scenario, Virginia provides the tipping point, creating the demand needed to support an investment decision.

Some infrastructure investment in Hampton Roads may be necessary. Given the inevitable time lags in gaining regulatory approvals, BVG says, Virginia needs to act quickly. Portsmouth Marine Terminal would need between $11 million and $25 million to upgrade the port for major offshore use, with “additional costs in the facilities themselves.”

The report provides no estimate of how much it would cost to upgrade Virginia’s electric grid to accommodate a massive supply of offshore wind, nor, beyond general statements that wind power is complementary with solar power, does it discuss the impact of intermittent wind power on reliability. Fossil fuel advocates argue that wind and solar provide no surge capacity in extreme, polar vortex-like weather events.

The BVG study make no policy recommendations. It cedes that task to the Department of Mines, Minerals and Energy, which is developing a strategic plant to identify supply-chain businesses and how to market Virginia as a hub for the industry.

Leave a Reply

You must be logged in to post a comment.