The state of Georgia is throwing $500 million a year down a film-subsidies rat hole. Virginia throws only $14.3 million down its own film-subsidies rat hole. If we want to stay competitive with Georgia, we need to up our game and flush even more cash down our rat hole.

Essentially, that is the argument of Virginia Film Office Director Andy Edmunds in defense of Virginia’s film incentive program.

Boosting tax credits for film production in Virginia could help boost the number of productions, create infrastructure and cement the state’s place as a filming destination, Edmunds says in Inside Business, the Hampton Roads business journal. “Demand is growing exponentially,” he said. “This creates an opportunity.”

Demand is growing exponentially for free money? Wow, let’s jump on the bandwagon!

Sure, with the emergence of Netflix, Hulu, Amazon Prime and other streaming media services, film producers are cranking out more movies and series than ever before. Everyone wants a piece of that pie. And many states are willing to give something away to get it. Georgia spent $500 million in tax credits in 2015, awarding up to 30% of a movie’s production cost. The film industry spent $2 billion in the Peach State in 2017.

In Virginia, qualifying film producers get a 15% base tax credit — 20% if the project is filmed in an economically distressed area. In fiscal 2016 the state handed out $14.3 million in tax credits and grants. (I’m not sure how that squares with another statement in the article that there is a $6.5 million cap on incentives.) According to a 2017 Joint Legislative Audit and Review Commission (JLARC) report on film incentives, the film industry supported 580 jobs and $51 million in state GDP.

Not mentioned in the article, the JLARC report also concluded: “The film tax exemption has little effect on film location decisions, a negligible benefit to the Virginia economy, and provides a negligible return on the state’s investment.” Moreover, the subsidies were not spread evenly throughout the state: 90% of the tax credit and 80% of the grant funding was awarded to productions in the Richmond area.

Nationally, the overwhelming majority of movie-making activity takes place in California and New York where the infrastructure and crew skill sets are located. Other states are competing at a huge competitive disadvantage. Concludes JLARC: “Stakeholders reported that although the state has seen a modest increase in some film industry infrastructure, including production and post-production activity, Virginia still lacks crew depth (availability of skilled film production staff) and has significant gaps in areas such as preproduction, production design, script supervising, and wardrobe.”

Economists have articulated the concept of alternate opportunity cost. What would have been the impact of investing the $14.3 million in a different set of economic development incentives. Film and TV production constitutes a tiny percentage of total “film production” in Virginia. But there is a non-insignificant activity in filming commercials, corporate videos, and the like. Could Virginia get more bang for the buck by targeting commercial film-making sector? Could it reap greater rewards targeting tourism? Would we be better off by letting the money circulate untaxed in the economy according to the wishes of Virginia consumers and businesses?

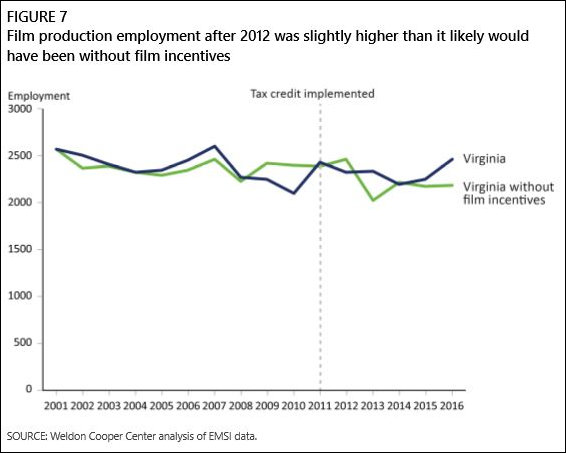

The overall impact of movie making on Virginia’s economy has been minimal. “Since 2012—when the tax credit took effect and available grant funding increased—Virginia’s film industry employment has been slightly higher (100 additional jobs per year on average) than estimates of what it would have been if Virginia did not have the incentives,” JLARC concludes.

Do the math: $14.3 million a year in incentives, 100 jobs created that wouldn’t have been created otherwise. That’s $143,000 per job created. Even if the numbers are off by an order of magnitude, that’s still a huge sum of money to create jobs that are inherently temporary in nature. The the movie wraps, the jobs disappear!

Sure, it’s fun to be able to say you got to see Claire Danes, the star of “Homeland,” while working as an extra. But is that a legitimate investment of tax dollars? Is Hollywood even an industry that Virginians want to be subsidizing? I don’t think so.

Leave a Reply

You must be logged in to post a comment.