Angry consumer complaints are starting to appear on a growing case record at the State Corporation Commission, which opened the case on its own authority to demand insurance company presentations on the long-term care product market and its history of massive rate hikes.

A typical comment so far: “This frankly, appears to be a ploy of the insurance providers to raise rates so high that they will be completely unaffordable, everyone will drop their policies and the insurers will be able to exit the long term care industry. Consumers must be protected from these predatory practices and these rate hikes must be denied by the SCC.” Others (the record is here) detail years of steady premium increases and benefit reductions.

Faced with a huge number of requests for premium increases, many for more than 100 percent, the Commission’s Bureau of Insurance will direct selected insurers to prepare for a scheduled May 21 hearing. Information on how to file a public comment can be found on the original news release, which prompted some coverage in the media. This story in the Daily Press is typical.

This is not a new topic for Bacon’s Rebellion, founded by Mr. Boomergeddon himself, who wrote about his own LTC policy three years ago.

His discussion of the industry’s challenges then lends a quality of “déjà vu all over again” going into this new SCC query. Same problems, only worse.

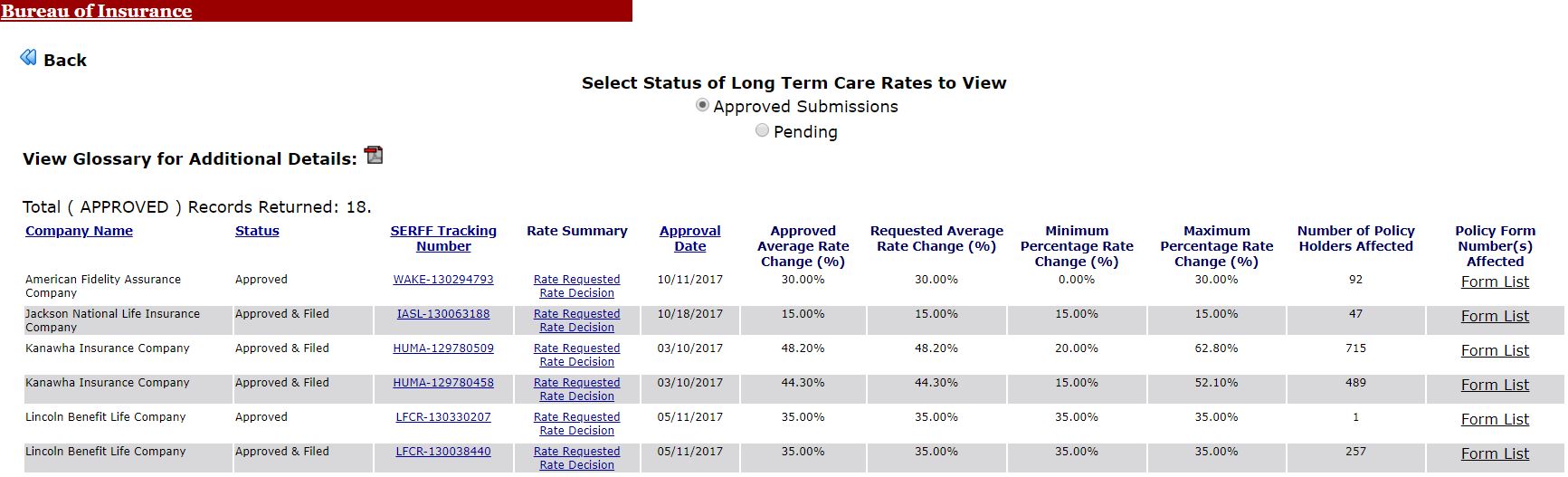

The SCC included in the release a link to its internal database (here) of granted or pending premium requests, showing the average, minimum and maximum premium increase for each insurer, and the number of Virginia policy holders for those policies. You can toggle between approved and pending applications at the top of the page.

The companies selected from that list to make full presentations will be asked for:

- an overview of past premium rate increases

- an explanation of the reasons for any pending premium rate increase requests

- options that are available to policyholders to reduce coverage or lower premiums

- any actions that have been taken to either eliminate or reduce premium rate increases; and

- the outlook for future premium rate increases.

The real question: Does this business model have any chance of surviving at all?

The form you find from each insurer on that application database often offers some comments on the reasons for the premium increases, and the bottom line usually is their initial actuarial projections of usage and cost were wrong.

Here’s John Hancock’s brief note on its modest (in comparison) increases of 11 to 36 percent on about 14,000 Virginia policies:

“Unfortunately, the most recent detailed review of our pricing assumptions confirms that the expected claims … are significantly higher today than they were expected to be when the premiums were originally determined. In general, we are seeing more, longer-lasting claims – claim incidence has increased, claim terminations have decreased, claim utilization has increased, and mortality have decreased.

“Our decision to increase premiums is solely related to the future claims anticipated on these policies and not to the recent recession, interest rate environment, or any other investment-related reason. As an alternative to paying higher premiums, we are offering several benefit reduction alternatives and, in most cases, at least one option that will enable the policyholder to keep their premiums at or close to the same level as what is being paid before the rate increase.”

Allstate blames its 90 percent rate request on fewer enrollees dropping out than expected and added: “From this analysis, we determined the maximum justifiable rate increase on this block is over 500%. The company

decided a 90% rate increase is appropriate, which balances the needs of all stakeholders involved, including the company and the policyholders involved.”

The largest insurer of the American market, Genworth Financial, is based in Richmond and its proposed acquisition by a privately-held Chinese company continues, pending continued regulatory reviews. The Virginia SCC has signed off on the deal. Genworth reportedly just announced its long-term care products will no longer be sold through agents, but only direct-to-consumer. The Investment News story on that adds several details about the struggles of the industry (but read it the first time – the paywall hits after one view.)

An industry snapshot of the longest and largest claims paid – $2 million plus, approaching two decades of payout – is quite telling. More than $10 billion was paid out in 2018, that source reports. At the same time, the number of covered individuals and underwriters is dropping.

A line from Econ 101 comes to mind, something about how when you subsidize something, you get more of it. Medicare and Medicaid are being challenged by the same market forces, as more people make it to a ripe old age and then consume more and more health care services to stay there. Long-term care insurance – not (yet) propped up by taxpayers – may be the canary in the Boomergeddon coal mine.

Leave a Reply

You must be logged in to post a comment.